| |

IN THIS ISSUE:

-

Ace Canada and Sexton Group form strategic alliance

- Canadian Tire’s online soars under COVID, strong holiday sales expected

- Dealers drive growth for Home Hardware in Quebec

- FROM THE ARCHIVES: Beaver forges supply deal with Ace, Walmart expands

PLUS: BMR launches click-and-collect pilot, Canadian Tire sees growth in private label, Canac raises funds for kids with cancer, Home Improvement eRetailer Summit a go for next March, IPG’s Q3, win for Regal Ideas, Western Forest’s solid third quarter and more! |

|

| |

| |

|

|

|

Ace Canada and Sexton Group form strategic alliance

RED DEER, Alta. & WINNIPEG — Ace Canada, a division of Peavey Industries LP, has established a formal business arrangement with Winnipeg-based buying group Sexton Group Ltd. Under the joint supply agreement, Ace dealers, who now get their hardware supplied through Peavey, will have access to the LBM offerings of Sexton’s programs. Sexton members will likewise have access to the hardware products and programs of Ace Canada.

According to the release, “This agreement provides the opportunity for all Ace dealers and Sexton Group members to benefit from expanded and improved product selection, distribution and other services that only two innovative and exceptional leaders in their own areas of expertise could bring to the table.”

“When we purchased the Ace Canada licence from Ace International in March of this year, and at the same time acquired existing dealer agreements from RONA, we knew a long-term plan was needed for LBM support and supply to our dealers going forward,” said Doug Anderson, president and CEO of Peavey Industries.

Noting that the stores represented by both companies are strongly rooted in the communities they serve, Anderson said, the "new strategic alliance reinforces both of our companies’ growth objectives while providing us with the opportunity to bring our strengths together as parallel supports for our LBM dealers.”

And the deal is designed to help Sexton dealers with the front end of their businesses. “Current Sexton Group members will also have a guided opportunity to become Ace dealers if they wish, and we welcome that too!” Anderson added.

The joint supply agreement has been signed, with the collaborative terms taking effect January 1 for all Canadian regions, aside from Quebec, although stores in that province will be also be included. “We have allotted additional time to ensure our LBM program will effectively support our Quebec dealers,” says the release.

“This is not expected to be a lengthy process as our LBM portal, a major element already in place, has been bilingual since its inception. The target date for Quebec dealer activation within the agreement is between the second and third quarter of 2021.”

(Click here to read the full press release from Ace Canada and Sexton Group.)

|

|

|

Canadian Tire’s online soars under COVID, strong holiday sales expected

TORONTO — Canadian Tire saw sales both in-store and online spike through the summer, driving strong results for the company during the COVID-19 pandemic. “Our e-commerce channel year-to-date has now surpassed $1 billion in sales, up 211 percent from 2019,” said President and CEO Greg Hicks in a call to analysts following the release of Canadian Tire’s third-quarter results.

“Both digitally and in-store, our existing Triangle [online loyalty] members were key contributors to increases in store transactions and basket size, and the Triangle program acquired approximately 400,000 new members in the quarter,” Hicks noted.

The Canadian Tire Retail stores saw a big jump in sales, likewise thanks in large part to online sales. “CTR experienced continued growth in our e-commerce channel, up 178 percent in the quarter. E-commerce penetration is now double where it was a year ago.”

Store traffic remained strong as well for Canadian Tire stores. Revenue for that business was up 28 percent, while comparable sales grew by 25.1 percent. Growth came from more than 90 percent of CTR's 200 categories, with 80 percent of those categories achieving double-digit growth. The top-selling products in Q3 were in kitchenwares, as people stayed home and spent more time and money on food preparation.

CTR enjoyed big growth in home improvement categories that typified sales across the industry. These included lawn and garden, tools, paint and hardware. The stores also capitalized on the surge in popularity of backyard living, camping and road trips, which drove sales across all seasonal categories. Hicks admitted that those sales could have been even stronger, especially in outdoor living and barbecues, if not for scarcity of product. “We will certainly need to replenish store inventory and that's the big question for the teams—how we forecast consumer demand heading into next year.”

Hicks said the trend has given the stores the opportunity to attract new customers. He noted that “the average paint customer is much more lucrative than the average CTR shopper. Not only do they spend three times more than non-paint customers, they visit the store more frequently.”

Although e-commerce sales, especially for bulky items, stabilized at the end of the third quarter, Hicks expects them to pick up again for the holidays, which he says represents Canadian Tire’s busiest season. And the arrival of snow in some Western markets has already helped ignite seasonal sales. But he also anticipates continued demand for amenities to brighten up the home, with big increases in customer searches for game rooms, ping pong tables, pool tables and winter cycling.

To meet the demand, the company will maintain services including home delivery, curbside pickup and click-and-collect processes that will see more automated pickup lockers across the CTR network.

|

|

Dealers drive growth for Home Hardware in Quebec

ST. JACOBS, Ont. — Home Hardware Stores Ltd. is expanding its base in Quebec, and Home Hardware dealers themselves are driving some of the expansion.

In just one week, the company announced a couple of deals in that province that saw existing dealers in their respective regions buy out another dealer. First, three of its dealers partnered to purchase a Home Hardware Building Centre location in Saint-Lin-Laurentides. Louis Turcotte, Daniel Gervais and David Blair own and operate multiple Home Hardware and Home Hardware Building Centre stores across Quebec and Ontario. They have purchased the Saint-Lin-Laurentides from retiring dealers Yves and Gilles Morels.

The Saint-Lin-Laurentides store has been family-owned for its more than a century in existence, and under the Home Hardware banner for the past 20 years.

Just a few days after this deal made the news, Home Hardware announced that the dealer-owners of another group of Quebec stores had purchased Centre de Rénovation Pine Hill Inc. in Brownsburg-Chatham.

Hugues Nepveu and Isabelle Patry own and operate three Home Hardware Building Centre locations in Sainte-Marthe-sur-le-Lac, L’Épiphanie and Fabreville. They took over Pine Hill from former dealer-owners Serge and Ghislaine Séguin. Looking to retire after 30 years in operation, they wanted to see the business kept under the Home Hardware banner.

Home Hardware already picked up two new dealers through the summer. L'Acadien Bricoleur Gentilly, located in Becancour, opened August, was followed a month later by Materiaux Marquette in Baie-Comeau. |

|

|

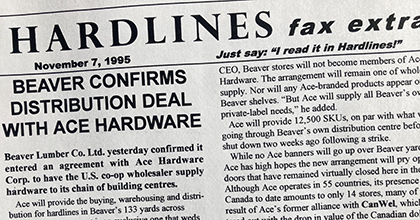

FROM THE ARCHIVES: Beaver forges supply deal with Ace, Walmart expands

SPECIAL REPORT — While the industry eyes Amazon with trepidation today, 25 years ago the company that kept every retailer awake at night was Walmart. This week in 1995, Hardlines reported on expansion plans by Walmart Canada. Those plans involved five new stores in the year ahead, adding to the five that had already opened in 1995. In conjunction with that growth, the giant retailer began another wave of price reductions, putting further pressure on vendors.

This news came just a week after Hardlines broke some big news for the home improvement industry. The first-ever Hardlines “Fax Extra” (since replaced by our online Breaking News—your historically minded Editor) announced that Beaver Lumber had confirmed a supply deal for hardware from Ace Hardware. The deal provided Ace with a solid footing in Canada, but at the expense of Canadian suppliers. By choosing Ace, Beaver, under President and CEO Ralph Trott, effectively thumbed its nose at D.H. Howden & Co., at the time the major hardware wholesaler for independents nationally.

This deal marked Ace’s second attempt to get established in Canada. Previously, it had teamed up with LBM wholesaler CanWel, under Tom Longworth. He tried bringing Ace products up for cross-docking at one of CanWel’s warehouses in the Vancouver area. The arrangement became unworkable when the Canadian dollar took a big tumble.

Where are they now? Beaver got sold to Home Hardware five years later. Ace had to scramble, continuing to recruit dealers one at a time. The Ace business would eventually get taken over by Howden. That wholesaler, in turn, after many sales and mergers, got buried somewhere in Orgill’s acquisition of Chalifour Hardware 20 years later. Tom Longworth went on to join the board of the Port of Vancouver.

(Ralph Trott met up with me for a coffee at the National Hardware Show in Chicago a few months after the Beaver sell-off. He shared with me his idea of launching a big-box retailer that would focus on storage and storage products. Trott was already ahead of the curve. Sure enough, in just a few more years, that category would explode. —Your nostalgic Editor) |

| |

|

|

|

|

| DID YOU KNOW...? ... that subscriptions for the weekly Hardlines Newsletter are going up on December 1? Any subscriptions set for renewal after December 1 will be invoiced for the updated prices. If your subscription is set to auto-renew by credit card, you will automatically be billed the updated price. To check your renewal date, update your credit card information, or change your current sub-users, please follow the instructions here. If you have any questions, please don't hesitate to email Michelle. And thank you for your ongoing support! |

|

| RETAILER NEWS

BOUCHERVILLE, Que. — BMR Group has launched a pilot program for a click-and-collect system in its corporate stores. The platform, from Tecsys, provides omnichannel retail order management software (OMS) to help retailers fulfil orders across channels. It’s been identified as a way to support some of the BMR stores during the pandemic by offering in-store pickup.

TORONTO — Canadian Tire saw strong growth in its private-label products in its third quarter. Its so-called “owned brands” accounted for an incredible 36 percent of its retail sales in the quarter, delivering impressive 23 percent growth over last year. At CTR, owned brands grew 28 percent, thanks to big names, such as Mastercraft, MotoMaster, NOMA, Woods and Canvas, as well as the more recent addition of Vermont Castings.

QUEBEC CITY — For the eighth year in a row, Canac has partnered with Leucan to raise funds for the agency, which helps children with cancer. Over the Thanksgiving weekend, a record $36,500 was raised. A. Since 2013, Canac has generated a total of $161,668 for Leucan.

|

|

SUPPLIER NEWS

CHICAGO — The fifth Home Improvement eRetailer Summit is scheduled to take place March 7 to 9 at the Aloft Chicago Downtown River North hotel. It aims to provide insight into future market conditions and tools to help dealers plan for and respond to those conditions proactively. This unique forum provides insights and access to growing online sales for vendors and buyers alike. Attendance is capped at 100 participants. For more information and to request an invitation, visit the Summit website.

DELTA, B.C. — Regal ideas Inc. has been recognized with a Davey Award for its DeckStars integrated marketing campaign. The Davey Awards honour the best in web, design, marketing and social media worldwide. Regal ideas tapped industry veteran Joe Jacklin to lead the program in 2019.

VANCOUVER — Western Forest Products reported solid third-quarter results, with net income of $11.5 million, reversing a net loss of $18.7 million for the third quarter of 2019 and net income of $8.5 million from the second quarter of 2020. The company says strong demand from the repair and renovation and new home building sectors, combined with constrained supply, managed to drive record pricing for logs and lumber in the quarter.

MONTREAL — Intertape Polymer Group said its Q3 revenues increased by 10 percent to $323 million, primarily due to increased demand in products with significant e-commerce end market exposure. That included water-activated tape and protective packaging. Net earnings increased $14.2 million to $26.7 million. |

|

ECONOMIC INDICATORS

Total investment in building construction decreased 1.7 percent to $15.2 billion in September, after reaching a record high in August. This can be attributed to decreases in the non-residential sector, which was down 8.5 percent. The drop was partially offset by increases in residential sector investment, which was up 1.6 percent. (StatCanada) |

|

NOTED

Retail Council of Canada’s annual national Holiday Shopping Survey shows that Canadians will be spending less in some categories, but they are eager to support local retailers. Product categories that help make people's experience at home better, improve their wellness and promote getting outdoors are seeing increases this year. The dramatic shift toward online shopping will continue over the holidays as fewer Canadians plan to shop in stores this season. Only 58 percent of respondents said they would shop in stores this Christmas, compared to 72 percent in 2019. |

|

|

|

|

| |

Classified Ads

|

|

Sales Representative

BMF is looking for a Sales Representative for our Display and Retail Division. Candidate must be a personable, self-motivated, customer centric professional who excels in building relationships and sales. BMF is the Home Improvement Industry’s preferred supplier in custom displays and big box resets. We also support retailers in other hardline categories including sporting goods, pet supplies, and footwear.

Responsibilities:

- Service existing relationships with Vendors in the Home Improvement Industry to support Merchandising Programs, Display needs and Big Box Resets

- Build relationships with new customers to expand current accounts

- Work with Buying Groups in the sporting goods sector to support store planning and renovation opportunities.

- Collaborate with customers and BMF’s cross functional teams

- Set sales targets and expand customer base

Requirements:

- Min 3-5 years of industry sales experience

- Highly organized and able to prioritize multiple responsibilities

- Experience with store fixtures and custom displays

- Excellent Customer Service and Presentation skills

- Proficient in Microsoft Office Suite

What Do We Do?

We provide retainer-based talent recruitment services for hardware and housewares retailers and their suppliers throughout North America and the Caribbean. We also provide individual, tailored outplacement services for displaced employees.

Career Opportunities Available!

Looking to kick start your career? Check out these excellent positions with both notable and entrepreneurial employers on the Jobs page of our web site, www.wolfgugler.com.

- Director, National Accounts – US (remote)

- Key Accounts Manager – Ontario

- Inventory Analyst (Chicagoland)

Recently completed searches:

- Technical Sales Representative

- Director, Marketing

- Senior Director, Operations

For a confidential exchange of information, call Wolf at 888-848-3006 or email him at wolf@wolfgugler.com. Wolf Gugler Executive Search, offices in Canada and the US.

(All applicants are considered for employment without attention to race, colour, religion, sex, sexual orientation, gender identity, national origin, veteran or disability status)

|

Looking to post a classified ad? Email Michelle for a free quote. |

| |

|

|

Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Geoff McLarney — Assistant Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internalrouting from this end!

1-3 Subscribers: $455

4-6 Subscribers: $615

7-10: Subscribers: $750

After initial 10 subscribers, blocks of 10 are $285.

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

| |

|

|