April 16, 2018 Volume xxiv, #15

“Love is a canvas furnished by nature and embroidered by imagination.”

—Voltaire (French writer, essayist, and philosopher, 1694-1778)

IN THIS ISSUE:

-

Acquisition of Titan by U.S. gypsum dealer could pave the way for further takeovers

-

BMR supports Maritime expansion with online initiatives

-

Richelieuís Richard Lord talks about the importance of design, growth

-

Housing update: Toronto cools off as Western markets heat up

PLUS: Richelieu reports strong Q1, Canadian Tire improves loyalty program, Amar Doman buys more CanWel shares, Bunnings struggles in U.K., RONA store switches in Leduc, UFA loves paper flyers, ServRite and JBMD unite, RDTS wins European prize, hires at Jeld-Wen, housing starts, Home Depot invests in cannabis accessories, and more!

Acquisition of Titan by U.S. gypsum dealer could pave the way for further takeovers

Acquisition of Titan by U.S. gypsum dealer could pave the way for further takeovers

TUCKER, Ga. — A U.S. gypsum supply dealer is buying up this country’s largest GSD network, and it’s not likely to stop there. GMS Inc., a distributor of wallboard and suspended ceilings systems based in Georgia, has announced its intention to acquire 100% of WSB Titan. The deal is worth about US$627 million ($800 million).

Titan, which is headquartered in Vaughan, Ont., just north of Toronto, serves the residential, commercial, and institutional markets with wallboard, insulation, lumber, roofing, steel framing, and other complementary building products. It originally represented a partnership of Watson Building Supplies in Vaughan, Shoemaker Drywall Supplies, based in Alberta, and Le Groupe Beauchesne in Quebec.

Beauchesne itself is not to be part of this deal. It remains a shareholder in Titan, but is not part of the sale to GMS. It will, however, remain part of Titan and that group’s negotiations with vendors going forwards.

Titan grew further in 2015 with its first foray into the retail side, through the acquisition of Slegg Building Materials, a family-run building supply dealer with a dozen stores on Vancouver Island. Not counting the five Groupe Beauchesne locations, it now has 33 outlets across the country, which includes B.C. Ceiling Systems, a ceiling products distribution business with two sites in British Columbia. Titan’s sales in 2017 were $585 million in 2017, not including Beauchesne.

Under the terms of the agreement, GMS will acquire 100% of the equity interests of Titan for approximately $US627 million ($800 million) from Titan’s current management and private equity firm TorQuest Partners. The existing Titan management will roll over $35 million of their current ownership position into GMS stock. GMS head Mike Callahan will continue to serve as president and CEO of the combined company. Titan President Doug Skrepnek will become president of GMS Canada, reporting to Callahan.

Callahan expects the Titan acquisition to expand the company’s footprint into Canada and establish it as a truly North American operator. He also foresees the opportunity for further acquisitions and greenfields expansion north of the border, which he calls a “highly fragmented market”. And he expects to pick up some of the best practices within Titan to share with the rest of the company.

With the Titan takeover, GMS will have 240 locations across 42 U.S. states and five Canadian provinces, representing $3 billion in sales.

|

|

BMR supports Maritime expansion with online initiatives

BOUCHERVILLE, Que. ó Groupe BMR has invested $10 million over the past two years on upgrading its e-commerce capabilities. According to Pascal Houle, CEO of BMR, the retail group is getting ready to launch a next-generation platform in the coming weeks that will be completely transactional.

The move is part of an overall initiative to support growth for the buying group and wholesale distributor outside its home province of Quebec. The company has been especially active in the Maritimes, where it has most recently signed Matériaux Parent, a dealer with two building centres, in Saint-Quentin and Kedgwick, N.B. Effective April 19, they will join the BMR network, bringing the number of BMR stores in New Brunswick to 11.

Pierre Parent, second-generation owner of the family business, decided to make the change after operating under a competing banner for 18 years.

Driving the expansion efforts is Pierre Nolet, a former dealer himself, who has, since June 2017, held the title of vice-president of business development at BMR. “Our entire team is pleased to be able to count on a dealer like Matériaux Parent,” says Nolet.

A third store in New Brunswick is also in the works, this one in Caraquet. Owner Michel Chiasson’s operation will be a BMR Express hardware store, with a grand opening scheduled for May.

Nolet says BMR is paying close attention to combining bricks and mortar with a more expanded online presence. The ability of shoppers to buy online will be a huge step forward for BMR and an important support for its dealers. Those stores, in turn, can serve as pickup points for online purchases.

|

|

Richelieuís Richard Lord talks about the importance of design, growth

MONTREAL — Over the past 50 years of Richelieu Hardware’s existence, the company has seen growth from new product innovation that has helped elevate the level of sophistication of products as simple as kitchen cabinet knobs and drawer pulls.

The reason for the change? Design has played a big role, says Richelieu President and CEO Richard Lord. The nature of product design has gotten more sophisticated, and consumers’ expectations have risen, through the years. But this is another area, he points out, where Richelieu has an edge. Its designers and product managers are constantly searching for the latest in product innovation and design trends. “We have huge financial resources to buy the best products from here and from around the world.”

The company has been actively making acquisitions and in recent years most of them have been manufacturing facilities that feed into Richelieu’s commercial side. But it still dominates on the retail side, through the Richelieu brand, as well as Onward Hardware and Reliable Fasteners. “We have the most outstanding decorative hardware program in the world,” says Lord.

His ambition was to see those programs sold in every hardware, building supply, and big box store in the country. He’s confident that at least 95% of them now do, driven by Richelieu’s own sales force, rather than outside sales agencies.

Finally, Lord explains why Richelieu remains a distinctly Canadian company. “The share price is strong, currently at about 20 times EBITDA, so it would be hard to acquire,” he notes. “And we never gave the market any indication that we want to sell. Our interest for the time being is not to sell, but to grow.”

(Part one of our interview with Richard Lord appeared in last week’s edition. —Editor)

|

|

Housing update: Toronto cools off as Western markets heat up

TORONTO & KELOWNA, B.C. ó One-quarter of Canadian homebuyers say they feel pinched by changes to Canada’s mortgage lending rules, which includes a “stress test” to ensure that first-time homebuyers could withstand increases to mortgage interest rates. However, projections for the spring market show optimism, with most markets expected to remain stable or improve.

These are just some of the findings of a new survey conducted by Leger on behalf of real estate organization Re/Max.

House prices in the Greater Toronto Area have actually fallen almost 10% from the first two months of 2017, and prices are expected to continue softening throughout the year. At the same time, the average residential sale price in Western Canada continues to increase, apparently less impacted by the stress test rules than in Eastern Canada. Greater Vancouver saw prices increase almost 11% in January and February to $1,051,513, up from $950,184 during the same period in 2017. Victoria has also seen an increase in average residential sale price, which was $831,000 in January and February this year compared to $761,000 during the same period in 2017.

In Alberta, first-time homebuyers looking for affordability in Calgary and Edmonton continue to drive the market, with single millennials and young couples gravitating toward the condominium market, which the Re/Max report says is relatively stable. The average residential sale price increased 1.4% in Calgary to $481,775 in January and February of this year, up from $475,288 in 2017. In Edmonton, by comparison, more housing inventory has resulted in a small increase in activity and more stable year-over-year prices going in to 2018.

Activity in Atlantic Canada experienced increased demand from first-time homebuyers, many of whom are young couples and families. At the same time, the condo market is being driven by retirees who are looking to downsize. Prices continue to rise across most Atlantic markets, especially in Saint John where the average residential sale price in January and February this year was $201,328, compared to $168,956 during the same period in 2017.

|

DID YOU KNOW…?

... that our friends at Presidents Council are hosting a series of buyer meetings with South American hardware big box retailer Sodimac? The event takes place May 22 in Santiago, Chile. Participating vendors are guaranteed exclusive 30-minute face-to-face meetings with Sodimac product import decision makers. Interested in building your business in South America? Register here to secure your product pitch with Sodimac’s senior-level merchandise personnel.

|

|

RETAILER NEWS

TORONTO — Canadian Tire is making changes to its loyalty program, rolling out the new Triangle Rewards card in the first major shakeup of the program since it first introduced a loyalty card in 2014 to enhance—and ultimately supplant—the retailer’s own Canadian Tire money. With Triangle Rewards, the company will for the first time extend its loyalty program to Sport Chek and Mark’s. With the digital rewards app, the card complements the familiar Canadian Tire money notes.

RED DEER, Alta. — UFA re-introduced paper flyers at the beginning of 2017 for the first time in many years and has been pleased with the results. The flyers were part of a new series of promotional and marketing efforts for the farm and hardware co-op’s 36 retail outlets. Twelve marketing flyers were printed over the year, which were delivered as an insert in the Alberta Farmer Express newspaper and made available in UFA Farm & Ranch Supply stores, petroleum agencies, and online. Based on positive feedback from customers and stores, UFA plans to expand the distribution of the flyers in 2018.

BOUCHERVILLE, Que. — The RONA store in Leduc, Alta., is the first in that province to transition to the new RONA building centre model, Lowe’s Canada has announced. The move is part of Lowe’s strategy to strengthen RONA’s position in proximity stores. Ten stores will have made the switch by year’s end.

LONDON — The Australian company Wesfarmers has been running into difficulties in the U.K. following an acquisition there. It purchased Homebase, a chain of 231 stores, in 2016 and has been converting them to its own big box Bunnings banner. While Bunnings is wildly popular in Australia, where its “sausage sizzles” are a folk icon (and where it successfully repelled an attempt by Lowe’s to enter that market with its own Masters Hardware banner), Wesfarmers acknowledged in February that it bungled its foray into the new market.

SUPPLIER NEWS

PARIS — RDTS, the Montreal-based merchandising and in-store services company, has garnered an award for one of its retail customers in Europe. At a recent awards ceremony of POPAI, the point-of-purchase association, POPAI created a new category. The first-ever Concept Merchandising Deployment Award went to CPM France, RDTS’s partner in Europe, for the deployment of the Imagine program at Bricomarché, the French home improvement chain. The program included 410 stores, 27 product categories, three point-of-sale formats, and dozens of different merchandising plans. RDTS delivered the Imagine program to RONA’s big box stores from 2009 to 2016. It is currently working with Pharmacie Uniprix, as well, for 200 items.

VANCOUVER — CEO and Chairman Amar Doman upped his stake in CanWel Building Materials during March, purchasing thousands of shares in three separate transactions. On March 23, Doman purchased 35,000 shares in the company, paying an average price of $6.73 per share, for a total value of $235,550. On the 21st, he invested $68,300 in 10,000 shares at an average price of $6.83, and a week earlier, Doman purchased 30,000 shares for an average of $6.88, totalling $206,400. Last summer, the Globe & Mail reported that Doman had spent more than $2 million over the preceding two years buying company stock. CanWel is slated to report its latest earnings on May 8.

MONTREAL — Richelieu Hardware’s Q1 sales rose by 13.3% to $222 million. Internal growth accounted for 6.2% and acquisitions for 7.1%. Canadian sales amounted to $143.7 million, an increase of $18.1 million or 14.4% from the same period last year. Profits were up 5.9% to $12.7 million. In February, the company acquired Fort Myers, Fla.-based distributor Cabinet and Top Supply Inc.

BURNABY, B.C. — ServRite and JBMD, formerly JB Merchandising Design, are merging to become “a fully rounded service provider”. B.C.-based ServRite, founded in 2001, specializes in store assembly, surveys, resets, product launches, mystery shops, and planogram verification. JBMD, located in Midland, Ont., has been in store construction and maintenance for more than two decades. The merged entity will now have a combined staff of some 300 employees. Its services will include construction of new stores and handling merchandising and fixture installation, including asset surveys.

PEOPLE ON THE MOVE

At Jeld-Wen Inc., Brian Glen has been promoted to the role of national account manager – buying groups, reporting to Adrienne Burgess, VP sales – Canada. Brian joined Jeld-Wen in 2016 and has more than a decade of industry sales experience across Canada, including 14 years with Alexandria Mouldings. He brings to the role a knowledge of windows, doors, and mouldings, combined with an understanding of Canadian buying groups and their dealers. (bglen@jeldwen.com)

Also at Jeld-Wen, Candace Kane has been appointed national sales manager for Lowe’s and RONA. She brings more than a decade of sales experience in the home improvement industry, including stints at Stanley Black & Decker, CGC, and National Concrete Accessories, and also reports to Burgess. (ckane@jeldwen.com)

ECONOMIC INDICATORS

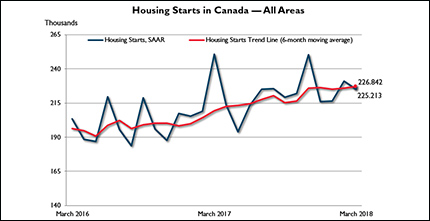

The seasonally adjusted annual rate of housing starts was 225,213 units in March, down from 231,026 units in February. The SAAR of urban starts decreased by 2.8% to 208,237 units. Multiple urban starts decreased by 7.3% to 144,578 units, while single-detached urban starts increased by 9.5% to 63,659 units. Rural starts were estimated at a SAAR of 16,976 units. (CMHC)

Canadian municipalities issued $8.2 billion in building permits in February, a decline of 2.6% following a 5.2% gain in January. Single-family homes as well as the commercial and institutional components saw lower levels of construction intentions in February. The value of permits for single-family dwellings decreased by 1.6% or $41.3 million, largely due to Ontario where intentions fell 6.9% compared with January. Toronto and Oshawa posted the largest declines. (StatCan)

NOTED

The Home Depot, Walmart, and Amazon have all agreed to grow individual relationships with a company that has its roots firmly planted in the cannabis industry. Both of the big box retailers and the e-commerce giant have begun selling products from the American Cannabis Co. (ACC) online. The products available include SoHum Living Soils potting mix and Dr. Marijane Root Probiotic.

OVERHEARD…

“I believe we have the best team, because BMR has changed with the vision that Pascal Houle has, along with the strength that La Coop brings us.”

—Pierre Nolet, VP Business Development for Groupe BMR, on the expansion initiatives of the company under the direction of CEO Pascal Houle, supported by BMR’s affiliation with parent company La Coop fédérée.