| |

SUMMER PUBLISHING SCHEDULE: Please note that Hardlines is on our reduced summer publishing schedule. The next issue will come out September 7, when we resume our regular schedule. The remote Hardlines offices remain open during this time, however!

IN THIS ISSUE:

News

- New head of TORBSA will focus on member growth, strengthening purchases

- Consolidation continues as big retailers absorb market share, says new report

- Walmart goes after vendors for price breaks

Trends

- Shortages continue as dealers and wholesalers scramble for product

- Business is strong for most dealers. How long can it last?

- Staying safe means non-confrontation. So how can rules be enforced?

Summer Insights

- Canadian Tire second quarter reveals surge in online sales

- FROM THE ARCHIVES: Cashway relocates, Turkstra expands, Home Depot goes West

PLUS: Walmart Canada breaks ground on new DC, Lowe’s Canada donates to charitable organizations, Home Depot to open DCs in Georgia, Walmart Canada mandates masks, Intertape Polymer Q2 results, ACCEO will hold its first virtual user event, Home Depot donates to kids, WRLA to hold recruitment webinar, CanWel reports Q2, Hamilton Beach’s quarterly revenue and more! |

|

| |

| |

|

|

| New head of TORBSA will focus on member growth, strengthening purchases

BOLTON, Ont. — TORBSA announced the appointment earlier this month of Paul Williams as its new president. He replaces General Manager Bob Holmes, who will retire after 26 years at the helm of the group. In an exclusive interview with Hardlines, Williams shares his vision to grow the Ontario-based buying group’s ranks and reinforce relations with suppliers.

Bringing with him a strong background on the supplier side, Williams spent the last nine years in senior sales positions at Owens Corning and then CGC.

TORBSA works to combine purchases for two dozen member dealers (Williams stresses that the dealers are TORBSA shareholders) who represent about 45 stores. Most of those stores are in Ontario. Crown Building Supplies is in Surrey, B.C., and the newest member-shareholder, Matériaux de Construction Létourneau, with two locations in Sherbrooke, Que., joined just last month.

Total sales for all members totalled $576 million in 2019 (source: the latest Hardlines Retail Report—Editor). Despite the group’s relatively small size compared to other buying groups, such as Castle or TIMBER MART, Williams says he respects the way the business is run. “It’s a unique model, one that maintains a very lean team of just four people at head office. And Bob will stay on to the end of the year, as part of the transition,” he says.

TORBSA remains a low-cost operation, Williams says, because it operates without the kinds of supports provided by other groups. These can include marketing, branding and even distribution. “There’s an inherent value in that approach,” he says, “especially for dealers with a DIY focus or those that cater to walk-in business. But we’re not strictly targeting those types of dealers.”

In fact, the majority of members are focused on commercial sales, with sales teams on the road selling to all facets of the construction industry. For those kinds of dealers, Williams sees a fit with the group. “I think there’s an opportunity for the prospective dealer to come over to TORBSA.”

He also notes that this streamlined model ensures full transparency to dealers so they can truly understand the costs of each vendor agreement. “Every single percentage of each sale goes back to the dealer. They’re not paying for extra costs at head office.”

Adding members will be one of his priorities, especially as the group has lost some members in recent years. “So moving forward, there will be a major emphasis on solidifying our core of shareholders and building our purchases with our vendor partners. I’ve been given carte blanche to spread the TORBSA message and talk to prospective members.”

|

|

| Consolidation continues as big retailers absorb market share, says new report

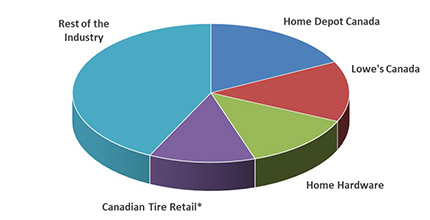

TORONTO — Just four retailers account for almost six out of every 10 dollars spent on hardware and home improvement products in Canada. According to the 2020 Hardlines Retail Report, Home Depot Canada, Lowe’s Canada, Home Hardware Stores and hardware-related volumes through Canadian Tire Retail generated almost $29 billion in sales in 2019, representing well over half of the industry.

This consolidation at the top has been a trend in the industry for decades, as smaller players have disappeared through new competition, as from the rise of Home Depot Canada over the past 25 years. It now owns close to 18 percent of the market here, according to the report.

Other companies were absorbed by competitors. RONA was a key agent of this trend over the past two decades until it, in turn, was acquired by Lowe’s. At the end of 2019, Lowe’s Canada generated more than 14 percent of the Canadian market’s sales.

Beyond these top four players, almost 90 percent of sales by Canadian home improvement retailers are generated by 20 retail groups. This ongoing consolidation of the industry is among the many findings and forecasts in the 2020 Hardlines Retail Report.

This year’s report analyzes how much the industry grew last year and identifies the best-performing provinces. The report also tracks the growth of the big box format in Canada, identifying that more than one-quarter of the market is represented by large-surface home improvement stores.

Designed to help retailers and suppliers alike to develop their business plans for the year ahead, this year’s report provides valuable industry forecasts for 2019 and 2020, including analysis of the strategies and performance of home improvement retailing’s top players—Home Depot Canada, Lowe’s Canada, Home Hardware Stores Limited and Canadian Tire Retail.

The 2020 Hardlines Retail Report fills 184 PowerPoint slides and is packed with dozens of charts, graphs and photographs. (For more information about the 2020 Hardlines Retail Report, please click here.)

|

|

|

Walmart goes after vendors for price breaks

MISSISSAUGA, Ont. — Walmart Canada says its $3.5 million investment in stores and e-retail will improve the customer experience and boost sales, but new fees aimed at recovering costs have outraged suppliers. In a letter earlier this month, Walmart explained to vendors that beginning September 14, it will be charging a new “infrastructure development fee” of 1.25 percent of the price of products, with an additional five percent for wares sold online. All of this is on top of existing fees set by arrangement with each vendor.

The retailer considers the fees a fair trade-off for suppliers, who it says will benefit from the investment plan in increased sales. But at Food and Consumer Products of Canada, CEO Michael Graydon calls the timing of the announcement “diabolical” and says his members who supply Walmart are “absolutely furious.”

Graydon is calling on federal and provincial governments to act in order to prevent other retailers from making similar moves. “When you look at five percent on e-comm sales—that’s your margin,” he told the Financial Post. “So you’re going to give it away.”

Sure enough, a group of Walmart Canada’s grocery competitors is following its lead in seeking savings from suppliers. United Grocers Inc., a buying group representing such banners as Metro, Longo’s and Couche-Tard, wrote to suppliers saying it will “expect to receive any cost reduction you may decide to offer any competitors.”

UGI President Michael Forgione did not specify how it would obtain the reductions but said the group would not set similar fees.

|

|

|

Shortages continue as dealers and wholesalers scramble for product

NATIONAL REPORT — In the midst of the COVID-19 pandemic, Osoyoos Home Hardware, in British Columbia’s Okanagan Valley, shortened its hours while maintaining full pay for staff. And even though store traffic has remained high, it has been slowed by the need for physical distancing and hygiene protocols. On top of that, product supply has been interrupted and deliveries to the store remain erratic. In spite of these challenges, Frances Sologuk says her store had its best July ever.

But if she could have maintained a steadier flow of products, she wonders just how much better the store might have performed. “I can’t imagine what sales would have been like without the out-of-stocks and back orders. It would have been mind-boggling,” Sologuk says.

Demand has risen sharply among DIYers. Stuck at home, they are looking to fix up their living spaces in lieu of expenditures on cottages and camps and in restaurants and bars. That’s put a pinch on supply for contractors, who are trying to get larger projects done.

Farther north, in Princeton, B.C., Susan Robinson of Princeton Home Building Centre reports a similar scenario. After watching sales plummet by 50 percent through February and part of March, business took off. She saw huge runs on personal protective equipment, sanitizers and toilet paper. “They are now available,” she notes. “We’re seeing lumber shortages now, primarily of treated woods.”

In Ontario, Rebecca Wichers-Schreur at Wood Works of Renfrew, a Castle dealer in Renfrew, about an hour west of Ottawa, is facing the same challenges. Business has been strong, marred only by product shortages. “Pressure treated is still very difficult to get, and a lot of suppliers for construction lumber and sheeting are either not taking orders for certain things or the orders they are taking are about two months out.”

She is also seeing shortages in other categories. “Some hardware items have also been difficult to find—decking accessories in particular like joist hangers and fencing materials.”

Supply chain disrupted

The problem of disrupted supply chain is a consistent one across the country. Denis Melanson, president of the Atlantic Building Supply Dealers Association, says his dealers have rebounded. “They’re doing absolutely fantastic and it’s turned into a stimulus for our industry in general.”

But those same dealers are also expressing concerns about supply. “I’ve talked to a lot of dealers—and some of the vendors—and they’ve never seen anything like it.”

In mid-July, Kent Building Supplies made news for being out of stock on wood products, particularly plywood and pressure treated lumber, in its stores across Atlantic Canada. The retailer even sent an email to its sales associates advising them of the situation. “The huge sales increase has completely stripped the supply chain,” it read in part. “There is no supply left in Atlantic Canada. Replacement from Western Canada is five to six weeks away ... Costs are through the roof.”

Melanson at ABSDA sums up the issue when he says, “That’s the new challenge—getting products on the shelves.”

Amanda Fancy at Gow’s Home Hardware and Home Furniture in Bridgewater, N.S., reports that sales are up over last year. But she too has found that her biggest challenge is getting product. The Home Hardware truck would typically come each Tuesday and Friday. Now, when a shipment comes, it can take a week, and sometimes everything comes at once—in two 53-foot trailers.

Retail teams deal with disruption

Disrupted supply affects more than just sales. It can disrupt the rhythm of a store’s operations. For Sologuk in Osoyoos, the once-regular truck has been turned into a hit-and-miss affair. “We’re not even getting a truck a week,” she says. “And when it does come, it’s not always convenient.” She recalls the arrival of a truck on a Saturday over a recent long weekend. “Thank goodness some of my team came in to unload, even though it was their day off.”

Back on the West Coast, other suppliers are scrambling to keep up. Ross Power is president of PowerHouse Building Solutions in Surrey, B.C. The company sells building materials to dealers in the Lower Mainland and beyond.

Despite being slower than usual for this time of year, “things are overall pretty healthy,” he says. His company has been able to maintain stock levels and products he was having difficulty getting have returned to normal.

Brad McCluskie, general manager of Coast Distributors, based in Nanaimo, B.C., says some regions, like the northern part of British Columbia, “are setting records each month.” But product shortages have taken their toll. He’s had to manage the orders, as some independent dealers have tried to buy up all his stock in lines like lawn and garden.

As shortages ease in some categories, the overall supply chain remains unsettled. Distributors scramble to get materials and keep production lines moving, all the while wondering how long the boom times will last.

“We’ll just have to see what happens,” says McCluskie. “We’re all just guessing now.”

|

|

|

Business is strong for most dealers. How long can it last?

WINDSOR, Ont. — Like most dealers across the country, Charlie Hotham watched business flip on its ear in March. But fortunately for him, his business managed to keep busy with the infrastructure and construction jobs that remained essential services in Ontario as the COVID-19 pandemic grew.

Hotham Building Materials is in the southwestern Ontario city of Windsor. And more good news came last week as his region entered phase three, lagging behind the rest of the province due to COVID-19 outbreaks at farming facilities in the area.

Hotham’s store doesn’t carry lumber, focusing instead on masonry, concrete insulation and waterproofing. But despite the focus on contractors and commercial, Hotham Building Materials also enjoys good traffic from walk-in customers. He does a brisk business with pool installers. They are telling him they’re not even giving quotes anymore. “They’re done for this year.”

His big concern is another one shared across the country: shortage of supply. “We’ve experienced some difficulty with the supply chain,” Hotham says. “But as far as people coming in the door, we’re very, very busy.”

He expects the trend to continue right through until winter, when things typically slow down for him. But he’s not confident that things will pick up in the spring the way they typically do. “It might be short-lived, but at this time I see zero signs of a slowdown.”

|

|

| Staying safe means non-confrontation. So how can rules be enforced?

SPECIAL REPORT — Lowe’s Cos. took heat from customers who signed a petition in North Carolina, demanding that the retailer enforce rules that their customers wear masks. Yet from the start, CEO Marvin Ellison had told workers to lead by example and avoid confrontation that could result in an unpleasant or downright violent outcome.

Closer to home, where many stores reserved the first hour of opening for seniors who are at greater risk of getting seriously ill from COVID-19 than the younger population, those rules were not enforced. Retailers weren’t keen to ask an hourly worker, often very young themselves, to confront a customer and risk an incident.

Yet informal conversations with store managers and employees from a range of sectors reveals that customers do not consistently follow rules. While entering a store without a mask may just be a case of neglect or forgetfulness, it can be indicative of a bigger issue. Many people have embraced the notion, in spite of medical evidence to the contrary, that masks are not only useless in preventing or minimizing the risk of contagion, but that they’re downright harmful.

Walmart Canada began requiring staff and customers to wear masks in all of its stores last week. Walmart stores in the U.S. have instructed customers to wear masks since last month, but are not refusing service to those who decline so that employees do not put themselves at risk by attempting to enforce the rule.

These contrasting attitudes are creating tensions anywhere that people gather, including inside a store. That puts pressure on sales staff to monitor protocols—and the anxieties and even anger of customers.

The pressure can become even greater for independent dealers in communities where they know many of their customers by name. Confronting them over mask wearing or proper distancing procedures can be very touchy—and leave lasting impressions that can affect one’s relationship with customers long term.

Altercations can also go viral. In the case of the Lowe’s store in Atlanta, when the store manager was chastised for not confronting unmasked customers, he produced a letter from CEO Ellison that actually advised staff not to take action. The customer was so upset by this response that they started a petition online to urge Lowe’s to be more proactive. Within two weeks, the petition had racked up 114,000 names.

|

|

| Canadian Tire second quarter reveals surge in online sales

TORONTO — Canadian Tire Corp. posted a net loss of $20 million in its second quarter, compared to earnings of $177.4 million a year ago. Strong sales online and under the Canadian Tire banner made for an overall retail sales gain of 1.7 percent to nearly $4.4 billion but weren't enough to offset losses.

Public health measures obliged the company to shutter its Mark’s, Helly Hansen and SportChek stores, while Canadian Tire stores in Ontario, making up 40 percent of CTC’s store network, were limited to curbside pickup and delivery for most of April. Revenues fell by 14.2 percent to some $3.2 billion as franchisees cut orders amid the uncertainty of the pandemic. Yet the company underscored that revenues have been on the rise since stores reopened, climbing by 24 percent in June after the specialty banners were permitted to reopen their stores.

“E-commerce demand exploded in April and May, and in June, we saw new heightened levels relative to pre-COVID-19 activity,” CEO and President Greg Hicks told analysts on a conference call. “In the quarter, our consolidated e-commerce business reached over $600 million in sales, up $500 million or 400 percent, with CTR, SportChek and Mark’s up 500 percent, 300 percent and 350 percent, respectively.”

Early in the quarter, demand even caused the CTR website to crash for some users. Once back on track, however, the online channel proved to be a strong driver, along with the Canadian Tire banner, to the company’s retail sales growth for the quarter.

In particular, e-commerce was a draw for young adults and “active families,” as Canadian Tire refers to them. “As they engaged with us through their e-commerce adoption, we saw very strong spend per customer increases of over 30 percent,” said Hicks. “Triangle Rewards enables us to know exactly how our customers are engaging with us in a time like this.”

|

|

| FROM THE ARCHIVES: Cashway relocates, Turkstra expands, Home Depot goes West

NATIONAL REPORT — Looking back through a quarter century of history in the retail home improvement industry uncovers news from companies that are themselves lost to history.

In Hardlines 25 years ago this week, Cashway Building Centres, a chain of 57 stores in Ontario, was busy reorganizing its ownership under Chairman Craig Graham and moving its head office from the west end of Toronto to Port Hope, a community about an hour east. Around the same time, Glen French came over from Home Depot to head up merchandising for the company. Cashway would be bought by RONA in 1999.

Also around that time 25 years ago, Turkstra Lumber was wrapping up some vigorous expansion. The Hamilton, Ont.-based chain added its ninth store, while a new distribution centre was being readied for operation. Still going strong, Turkstra, which to this day is a member of ILDC, has 11 stores throughout southwestern Ontario.

Home Depot Canada made news as it continued its aggressive expansion. The retailer opened a buying office in Western Canada, solidifying its presence as a true national player. At the time, President Stephen Bebis said the move would mean quicker lead times for its Western stores “and will let us be more sensitive to the nuances of product demands in the West.” Hardlines revealed the company’s plans to open new stores in both Ontario and British Columbia in the coming months. Home Depot Canada would have 24 stores by the following year, 1996. |

| |

|

Barrie Brooks, owner of Opeongo Sales Ltd., has retired after 50 years working in the retail hardware business. Brooks got his start at Sears Canada working as a buyer and marketing manager from 1969 to 1990. He then became president of Grant Brothers Sales in its Hardware Division for the better part of a decade, before serving as Director of Sales Coleman Powermate at Sunbeam Canada in 2000. He spent two years there before heading out on his own to form his own agency, Opeongo Sales Ltd., in 2002.

|

|

|

| DID YOU KNOW...? ... that the 2020 Hardlines Retail Report, your definitive guide to the state of the industry, is now available? The report includes valuable proprietary information you won’t find anywhere else, including in-depth analysis of the industry’s key players, breakdowns by province and store format and forecasts for 2021. Hardlines subscribers save more than 20 percent on pricing, so be sure and take advantage of this! Click here now to learn more and order yours! |

|

| RETAILER NEWS

MISSISSAUGA, Ont. — Walmart Canada, together with Condor Properties, has broken ground on a new distribution centre in Vaughan, Ont. When the facility is operational in 2024, it will handle ambient general merchandise and food products in the highest volume of any Walmart facility in the country. The project is expected to create hundreds of construction jobs in Vaughan. The Vaughan project joins the construction of a 300,000-square-foot DC currently underway in Surrey, B.C., and the renovation of an existing warehouse in Cornwall, Ont.

BOUCHERVILLE, Que. — Lowe’s Canada’s corporate store network has made $245,000 worth of donations over the past few months to more than 75 food banks, hospital foundations and other charitable organizations in the communities that it serves. “With the pandemic causing new problems to emerge and exacerbating existing issues, we felt it was important to express our solidarity by supporting community organizations that are facing higher demand and declining resources,” said Lowe’s Canada’s Jean-Sébastien Lamoureux, senior VP, public affairs, asset protection and sustainable development.

ATLANTA — The Home Depot will open three new distribution centres in Georgia over the next 18 months to support a growing demand for flexible delivery and pick-up options. The expansion is projected to bring approximately 1,000 additional jobs to the Atlanta area. In 2017, Home Depot announced a $1.2 billion investment to expand its distribution network with approximately 150 new supply chain facilities across the U.S., with the goal of expanding the company’s same-day and next-day delivery options to 90 percent of the country’s population.

MISSISSAUGA, Ont. — Walmart Canada began requiring staff and customers to wear masks inside all stores last week, even where local and provincial regulations do not call for such measures. Felicia Feder, corporate affairs manager, told CBC News that 60 percent of Walmart Canada’s stores are in jurisdictions with a mandatory mask rule, and that the company’s move is meant to “help bring more consistency across our store network.”

ATLANTA — With its Kids Workshop classes on hiatus in stores, The Home Depot has donated 500,000 Kids Workshop kits over the past four months to more than 100 non-profit organizations and schools across the U.S., including Boys & Girls Club of America, ToolBank and the YMCA. The company will continue to donate kits until workshops resume in person. |

|

SUPPLIER NEWS

MONTREAL — Intertape Polymer Group reported that its Q2 net income rose by $8.3 million to $14.8 million ($0.25 per share), due in part to lower travel expenses and an adjustment to contingent consideration in its acquisition of Nortech Packaging. Adjusted net earnings fell by $1.4 million to $13.2 million ($0.22 per share) as gross profits declined. Revenue decreased by 9.4 percent to $267.8 million, primarily due to lower selling prices and a pandemic-related decline in volume/mix.

MONTREAL — IT firm ACCEO’s Home, Garden and Building Supply division will hold its first virtual user event in the fall. Open to all ACCEO customers in the LBM and hardware sector, it will feature training and networking opportunities. Over two days, October 21 and 22, participants will be offered product launches and demos, software training and industry discussions. The event will be offered in two installments: one English and one French. Click here for information and registration.

WINNIPEG — The Western Retail Lumber Association will hold a webinar on recruitment and personnel matters on August 18 at 11:30 MT. Glow Leadership’s Diane Taylor will cover best practices to help managers ease their people’s challenges and move towards aligning staff with business objectives. Also on the agenda: dealing with post-COVID-19 challenges and how to effectively navigate a successful return to work. Click here for more details and free registration.

VANCOUVER — CanWel Building Materials saw Q2 revenues increase by 7.1 percent to $412.9 million, from $385.7 million during the same period in 2019. Despite the pandemic’s economic impact, sales for the distribution segment rose by $31.3 million, or 8.4 percent. The year-over-year sales increase was attributed to improvements in both sales volumes and pricing. Net income for the quarter increased 62.8 percent to $12.7 million.

OTTAWA — The Canada Revenue Agency has a new tool to help employers estimate what kind of assistance they can expect from the Canada Emergency Wage Subsidy. Employers can punch in business information into an online calculator and receive an instant estimate. The agency said that companies, armed with this info, will be able to make informed HR decisions. It will hold a series of information sessions over the coming weeks.

GLEN ALLEN, Va. — Hamilton Beach reported its Q2 revenue rose by 5.5 percent compared to Q2 2019, due to strong demand in the U.S. and Canada consumer markets. Operating profit increased more than threefold on higher revenue, a benefit of $1.6 million from tariff relief and lower expenses. Consolidated net income was $7.8 million, or $0.57 per diluted share, compared to a net loss of $0.6 million, or $0.04 per diluted share, a year ago. |

|

ECONOMIC INDICATORS

The seasonally adjusted annual rate of housing starts was 245,604 units in July, an increase of 15.8 percent from 212,095 units in June. The SAAR of urban starts rose by 17.4 percent in July to 231,995 units. Multiple urban starts increased by 18.8 percent to 184,431 units in July while single-detached urban starts increased by 12.3 percent to 47,564 units. Rural starts were estimated at a seasonally adjusted annual rate of 13,609 units. (CMHC) |

|

NOTED

CHHMA is moving ahead with the golf tournament portion of its Industry Day event on September 9th with a few modifications to comply with COVID-19 safety guidelines. This year’s event includes a power cart that has social distancing dividers, breakfast on the cart, lunch and ice cream on the course, plus two drink tickets per golfer and a charitable donation. There will be no cocktail hour or dinner. (Click here for more information and to register.) |

|

OVERHEARD...

“I’ve been to British Columbia. It’s not very British—or Columbian. Vancouver was like a rainy Seattle.”

“Ontario and Quebec. Those are like the two brothers that run the family business after the parents died. But they had different mothers.”

—Jim Gaffigan, an American comic, who enjoys taking gentle pokes at Canada. (With thanks to our friend Roy Prevost, retail consultant and business coach, for sending us this one.) |

|

|

| |

Classified Ads

|

|

Director of North American Sales

FCL is hiring a Category Manager – Hardware on a permanent basis at our Home Office in Saskatoon, Saskatchewan.

Who you are:

You are looking for a career in Sales & Marketing and:

- You have a Bachelor’s Degree in Commerce or Business Administration

- You have a minimum of 6-9 years of relevant progressively responsible experience in consumer wholesale/retail, with preference for marketing, buying, or customer service as it relates to home and building solution products.

- You’re familiar with Home and building solutions.

If this opportunity speaks to you, please visit www.fcl.crs for more details and apply by August 25, 2020

|

Looking to post a classified ad? Email Michelle for a free quote. |

| |

|

|

Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Sigrid Forberg — Editor— sigrid@hardlines.ca

Geoff McLarney — Assistant Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internalrouting from this end!

1-3 Subscribers: $455

4-6 Subscribers: $615

7-10: Subscribers: $750

After initial 10 subscribers, blocks of 10 are $285.

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

| |

|

|