| |

IN THIS ISSUE:

- Big box stores gain record market share, says new report from Hardlines

- Product shortages plague dealers across Canada as demand stays high

- Home Depot accelerates investments in outdoor power, Lowe’s picks up Ego

- As project sales soar, can the new housing market pick up in 2020?

PLUS: U.S. retail chains impose mandatory mask rules, Walmart Canada will invest in customer experience, Amazon’s first Quebec fulfillment centre, Tractor Supply reports strong second quarter, Global DIY Summit postponed, retail sales rise, U.S. housing starts and more! |

|

| |

| |

|

|

| Big box stores gain record market share, says new report from Hardlines

TORONTO — The big just keep getting bigger. That includes the big box stores that comprise a significant portion of Canada’s retail home improvement industry.

According to the 2020 Hardlines Retail Report, sales by Canada’s big box home improvement retailers gained ground in 2019. In fact, the market share of this store format is at a record high, says the Report.

Big boxes are operated by only a handful of retailers, led by Home Depot Canada, which has 182 stores. Next is Lowe’s Canada, which operates stores under the Lowe’s, RONA Home & Garden/L’entrepôt and Reno-Depot names. Finally, Kent Building Supplies in Atlantic Canada has built a network of large-format stores over the past two decades that dominate in the East.

This year’s Hardlines Retail Report analyzes how much the industry grew last year and identifies how each retail format—hardware store, building centre, big box and Canadian Tire—fared. The Report also ranks the industry’s top retail groups, while giving the big players close scrutiny: Home Depot Canada, Lowe’s Canada, Canadian Tire and Home Hardware are all analyzed in depth, with forecasts for growth.

The Report also evaluates the strength of independents and their affiliations with the buying groups, including Castle Building Centres, TIMBER MART, BMR Group and Independent Lumber Dealers Co-operative (ILDC).

Designed to help retailers and suppliers alike develop their business plans for the year ahead, this year’s Hardlines Retail Report provides valuable forecasts for the industry for 2020 and 2021. Forecasts include estimated performance by the industry’s top home improvement retailers, plus growth forecasts for renovation and housing.

The 2020 Hardlines Retail Report fills almost 200 PowerPoint slides and is packed with dozens of charts, graphs and photographs. (For more information about the 2020 Hardlines Retail Report, please click here.)

|

|

| Product shortages plague dealers across Canada as demand stays high

NATIONAL REPORT — The issue of product shortages is being felt by dealers across the country. And the shortages cut across a range of categories.

On one hand, the availability of wood products has forced dealers to dig harder as a number of factors act against them. Mills cut back output early in the spring in anticipation of lower demand, based on the rise of the COVID-19 pandemic. Then, as demand increased, the ability of those mills to ramp up again has been hampered by the need to maintain safety measures onsite. Sanitizing practices can result in shorter shifts so that cleaning can be done before the next shift. And fewer people can be on the line, to maintain physical distancing.

On the other hand, the rise in demand took the industry by surprise. That started with paint and plumbing projects back in March, as people found themselves with extra time on their hands and extra discretionary income, unable to go on vacation, send their kids to camp or just sit in a restaurant and run up a tab.

Increased demand is coming from the contractor side, as well. As many projects enjoyed essential service status, infrastructure continued and to a lesser degree so did new housing, especially for condos and other multi-unit starts.

“The market just took off in June,” says Bob Holmes, general manager of TORBSA, a buying group whose members largely serve contractor and commercial accounts. As manufacturers ran out of capacity, they had to decide what to make, he says, restricting supply—and diversity of product.

He says his dealers in Ontario, where non-residential construction projects were reopened on May 4, are busy again, while one large TORBSA member in British Columbia’s Lower Mainland never really slowed down.

The demand among consumers runs to recreational and outdoor living products as well. As people were stuck in their homes, that is where they have been busy investing and developing ways to make their time there more interesting. As a result, dealers have run out of everything from patio furniture to outdoor playsets for kids, while seeds, especially for vegetables, are also in demand, as are large appliances. Following several days of record high temperatures, portable air conditioners are sold out in markets like Montreal and Toronto.

“We’ve seen a great party started in every backyard in North America,” says Dave McNeil, VP allied products and national accounts at Taiga Building Products. “People are spending money where they spend their time—near their homes.”

The Burnaby, B.C.-based wholesaler has seen the demand for products shift in May and June to more substantial projects around the house. That increase in demand, coupled with tighter supply, has driven up prices for lumber. Flooring, mouldings, decking and related products are being snapped up by both contractors and DIYers. Treated wood and composite decking are hard to find and harder to keep in stock.

Nor is one region better off than another. “All of North America is in the same boat,” says McNeil.

|

|

|

Home Depot accelerates investments in outdoor power, Lowe’s picks up Ego

ATLANTA & MOORESVILLE, N.C. — The Home Depot says it’s accelerating its investments in resets of its outdoor power categories. It’s part of a process to refine and simplify its primary brands across this category.

“We have been extremely pleased by the customer response to our premiere outdoor power brands, as we improved the shopping experience with a simplified presentation,” said Ted Decker, executive vice president, merchandising. “Similar to prior resets in our power tool business, outdoor power equipment is being reset and positioned by brand, and we will complete this rollout to approximately 1,300 U.S. stores by year’s end.”

The enhanced assortment will include The Home Depot’s top brands of cordless outdoor power—Ryobi, Makita, DeWalt and Milwaukee—as well as its lines of gas-powered products under the Toro, Echo, John Deere, Cub Cadet, Honda and Troy-Bilt names.

As part of this merchandise reset, the company will discontinue the Ego line of outdoor power equipment. However, Lowe’s Cos. quickly announced it had picked up the Ego brand. Beginning in December 2020, Lowe’s will be the exclusive U.S.-wide home improvement retailer to offer Ego’s battery-powered mowers, blowers, trimmers, chainsaws and snowblowers. Products will be available online and in select stores in fall 2020 and will roll out to all U.S. stores nationwide by February 2021.

In addition, Lowe’s will begin offering select Skil battery-powered outdoor power equipment in late 2020, including push and self-propelled mowers, leaf blowers, string and hedge trimmers. Both Skil and Ego are brands owned by Chervon, a global power tool and outdoor power equipment maker.

Home Depot’s efforts to refresh the presentation of the outdoor power category began earlier in the year. According to the company, four brands—Ryobi, DeWalt, Milwaukee and Makita—provide common battery platforms across their power tool and outdoor power equipment products.

|

|

| As project sales soar, can the new housing market pick up in 2020?

OTTAWA — While retail is trending higher in May and remains poised to realize continued gains in June and July as home improvement dealers remain busy, one question mark affecting the outlook for the industry for the rest of the year is the buoyancy of the new housing market.

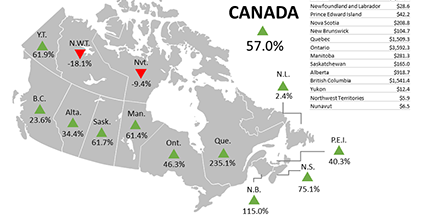

Total investment in building construction increased 60.1 percent to $13.4 billion in May, StatCan reports, partially rebounding from large declines in April. Investment in residential construction rose 57 percent to $8.4 billion. Spending on single-unit construction bounced back 71.7 percent to $4.1 billion, exceeding multi-unit growth, which increased 45.2 percent to $4.3 billion.

Although Ontario and Quebec reported the largest provincial gains for the month, all provinces bounced back somewhat from sharp declines in April. Despite these strong gains, residential investment remained 22.7 percent lower than February, before COVID-19-related restrictions were put in place. And it remains well below spending in May 2019, when investment in single starts reached $4.97 million compared with $4.12 million in May 2020. Investment in multiple starts slipped as well, to $4.3 million from $5.5 million a year earlier.

At the end of May, CMHC released its Spring Housing Market Outlook, which anticipated continued softening of the housing market as the COVID-19 pandemic leads the country into a recession. Following declines in 2020, says the report, “housing starts, sales and prices are expected to start to recover by mid-2021 as the pandemic recedes.”

While Canada’s housing markets could start to rebound by the end of the first half of 2021, CMHC expects sales and prices to remain below their pre-COVID-19 levels right through to the end of 2022. But it concedes that “the precise timing and duration of the recovery is highly uncertain because the virus’s future path is not yet known.”

Dealers in this industry have been buoyed by the unexpected demand for home products, but for dealers selling into the new housing market, the future remains cloudier. |

| |

|

At TORBSA, the Bolton, Ont.-based buying group, Steve Guglietti of Pro Con Building Supplies Ltd. in Brampton, Ont., has been elected as the chairman of its board for the year 2020. Previously, he served as the board’s secretary for 2019. In addition to Guglietti, the 2020 board is composed of Past Chairman Greg Drouillard of Target Building Materials Limited (Windsor, Ont.), Vice-Chairman Dante DiGiovanni of Blair Building Materials Inc. (Maple, Ont.), Vice-Chairman of Operations Gary Sangha of Crown Building Supplies (Surrey, B.C.), Secretary Mike Burkart of Bernardi Building Supply Ltd. (Weston, Ont.) and Treasurer Len Hewson of Hewson Brothers Supply Limited (Brantford, Ont.).

Ace Hardware has dismissed The Grommet co-founders Jules Pieri and Joanne Domeniconi, along with VP of Operations Jason McCarthy, almost three years after acquiring a majority stake in the e-commerce site. Rooted in the artisanal, DIY-based “Maker movement,” The Grommet is a platform for the sale and marketing of products developed by independent entrepreneurs. Ace retained Pieri and Domeniconi when it acquired a stake in The Grommet in 2017.

|

|

|

| DID YOU KNOW...? ... that the 2020 Hardlines Retail Report, your definitive guide to the state of the industry, is now available for pre-order? The report includes valuable proprietary information you won’t find anywhere else, including in-depth analysis of the industry’s key players, breakdowns by province and store format and forecasts for 2021. Hardlines subscribers save more than 20 percent on pricing, so be sure and take advantage of this! Click here now to learn more and pre-order yours! |

|

| RETAILER NEWS

MISSISSAUGA, Ont. — Walmart Canada will invest $3.5 billion over the next five years to improve the customer experience in stores and online. The investment will include measures to speed up e-commerce transactions and the construction of two new distribution centres. Reinvented stores will feature expanded electronic shelf labels and scanners and a new checkout process to reduce touchpoints.

MONTREAL — Amazon’s first Quebec fulfillment centre is now operational in the Montreal borough of Lachine. The e-retail behemoth’s 13th warehouse in Canada will employ 300 full-time workers to pack and ship items. Amazon, which has taken heat for its work conditions, said in a statement that full-time employees will receive “comprehensive pay ($16 and up)” and “industry-leading benefits, including medical, vision and dental coverage.”

BRENTWOOD, Tenn — Tractor Supply Co. reported that Q2 net sales rose by 35 percent to $3.18 billion, compared to $2.35 billion in the same quarter last year. Comp sales were up 30.5 percent. Gross profit increased by 41 percent to $1.16 billion, from $820.7 million in 2019. Net income of $338.7 million was up 54.5 percent from $219.2 million, and diluted earnings per share soared by 61.1 percent, rising from $1.80 to $2.90. |

|

SUPPLIER NEWS

COLOGNE, Germany — The eighth Global DIY Summit is being postponed by one year. The new dates for Europe’s leading conference for executives in the retail home improvement industry are June 9 to 11, 2021 in Copenhagen, Denmark. This congress is jointly organized by the European DIY-Retail Association (EDRA), Home Improvement Manufacturers Association (HIMA) and Global Home Improvement Network (GHIN). |

|

ECONOMIC INDICATORS

Retail sales rose by 18.7 percent in May to $41.8 billion. Motor vehicle and parts dealers led the growth, followed by an increase in sales in every other sub-sector except food and beverage sales. Sales of LBM and garden equipment and supplies amounted to $2.9 billion for the month, up 5.5 percent from April, but 7.6 percent below last May’s sales. Although sales increased across all provinces in May, retail sales remain 20 percent below February levels. (StatCan)

Retail sales in the U.S. climbed by 7.5 percent in June as businesses resumed activity. The gains followed on an 18.2 percent upwardly revised leap in May, the largest since the government began collecting the data in 1992. (U.S. Commerce Dept.)

U.S. housing starts soared by 17.3 percent in June to a seasonally adjusted annual rate of 1.186 million units. Building permits for the same period increased by 2.1 percent. (U.S. Census Bureau)

Sales of existing U.S. homes in May declined by 9.7 percent to a seasonally adjusted annual rate of 3.91 million units. That was the lowest rate of home resales since October 2010. On a yearly basis, existing home sales fell 26.6 percent, the largest annual decline since 1982. (National Association of Realtors) |

|

NOTED

Several U.S. retail chains are imposing mandatory mask rules in their stores, regardless of local regulations. Walmart, Target, Best Buy and Costco are among those that have adopted the rule across their banners. In Canada, Quebec has required masks in public indoor places since earlier this month, while several Ontario municipalities have made similar moves. |

|

OVERHEARD...

“Joanne and I are sad to abandon our Citizen Commerce mission and not see Grommet through to becoming a household name. But we feel nothing but a great deal of pride when we reflect on the hundreds of careers we shaped, the more than 3,000 small businesses we accelerated, and the thousands of jobs we created.”

—Jules Pieri, co-founder of internet site The Grommet, who, along with her partner Joanne Domeniconi, was ousted from Ace Hardware three years after that company acquired The Grommet. |

|

|

| |

Classified Ads

|

|

Director of North American Sales

BMF is looking for an experienced Director of Sales to lead our Home Improvement Division. Must be personable, self-motivated and professional with proven track record in strategic planning and meeting targets.

Your primary focus will be to generate sales growth through existing accounts and developing new strategic accounts both in Canada and the USA. You will be responsible for developing relationships at the Buying Group and Independent Dealer level where BMF can provide store renovations and new builds. In addition to being an excellent communicator, our ideal candidate will have a background in Management of Home Improvement Store Operations.

Responsibilities:

- Work closely with Home Improvement retailers and Buying Groups to help them compete more effectively

- Developing and executing strategic plan to achieve sales targets and expand our customer base

- Develop weekly, monthly, and quarterly action plans to meet growth objectives

- Responsible for initial contact and site visit with Dealers to sell our services working both at the macro and micro levels

- Work cross-functionally with Design, Operations, Project, and Installation teams

- Oversee project management and customer relations throughout projects

Requirements

- Min 10 years of Home Improvement Retail Experience

- In-depth knowledge and experience of store operations

- Strong organizational skills to prioritize multiple responsibilities

- Excellent negotiation and leadership skills

- Solid Understanding of Merchandising and Store Design

To apply, please send resume to: Careers@bmfonline.com

Store Planner

The Store Planner works closely with independent Home Improvement Dealers to design the layout and merchandising of their stores. As part of the design team, you will participate in developing new innovations to meet the needs of our expanding client base.

RESPONSIBILITIES

- Host discovery meetings with new clients to determine their goals and objectives

- Gather information needed to develop store layouts and conceptual plans

- Developing store layouts and conceptual plans

- Create detailed merchandise plans

- Build and quote detailed fixture take offs

- Work cross-functionally with Sales, Project and Installation teams

QUALIFICATIONS:

- Min 5 years of Home Improvement Retail Experience

- Min 5 years of Store Planning Experience

- Proficiency with MS Office and design software including AutoCad and or Solidworks

- Excellent communication and customer service skills

- Organized, analytical, detail-oriented

- Able to prioritize multiple responsibilities

To apply, please send resume to: Careers@bmfonline.com

WESTERN CANADA (BC)

FOREST PRODUCTS COMMODITY TRADER

(Softwood Lumber & Structural Panels)

HOURS: 8AM TO 4:30PM

GRADE: Salary

Duties and Responsibilities:

Reporting to the Merchandise Manager Forest Products, the Forest Products Commodity Trader is responsible for and on behalf of our network of independent Owner/Dealers:

- Purchase commodity forest products (lumber and panels) for the BC and other regions as required.

- Negotiate contracts with suppliers/mills ensuring quality products and competitive pricing.

- Develop new sources of supply with BC based sawmills, by educating suppliers on the size, scope and opportunity that Home Hardware has to offer.

- Maintain and nurture existing supplier relationships with BC based sawmills.

- Communicate daily with mills/wholesalers for pricing and market trends.

- Provide analysis and input to the Commodity Manager to aid in buying decisions.

- Organize and conduct regional spot and block buys.

- Build and maintain relationships with the Home Hardware Dealers to help grow their business.

- Maintain Supplier information database, to include contacts, product selection, availability, lead times etc.

- Assist stores with product issues including shipments, quality, claims etc.

- Maintain critical data and reporting, including purchase orders, commodity reports and supplier agreements.

Qualifications:

- Bachelor’s degree in Business or a combination of education/experience.

- Minimum five years of purchasing experience in the Forest Products industry.

- Proven negotiation skills.

- Excellent communication skills, both written and verbal.

- Ability to work in a team environment.

- Self-starter with a demonstrated capacity to work independently.

- Knowledge of softwood lumber and panel products including Western Canadian mill connections.

- Ability to analyze and make recommendations from economic reports, commodity reports and information received from various industry sources, including those generated internally.

- Highly motivated and able to problem solve.

- Excellent computer skills, including Microsoft Word and Excel.

- Ability to work varied hours as required to fulfill the responsibilities of the position.

- Seasonal travel may be required.

*We thank all applicants for their interest; however, only qualified candidates

will be contacted for interviews.

INTERESTED CANDIDATES, PLEASE VISIT www.homehardware.ca/careers

SUBMIT YOUR RESUME TO: Charmaine Mifsud, Human Resources Manager hrwetaskiwin@homehardware.ca

Deadline: Friday, August 14, 2020

We will accommodate the needs of qualified applicants under the Human Rights Code in all parts of the hiring process.

|

Looking to post a classified ad? Email Michelle for a free quote. |

| |

|

|

Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Sigrid Forberg — Editor— sigrid@hardlines.ca

Geoff McLarney — Assistant Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internalrouting from this end!

1-3 Subscribers: $455

4-6 Subscribers: $615

7-10: Subscribers: $750

After initial 10 subscribers, blocks of 10 are $285.

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

| |

|

|