| |

IN THIS ISSUE:

- Ace Canada adds private-label paint line in partnership with Cloverdale

- LBMAO president Dave Campbell takes aim at Premier Doug Ford's remarks

- Castle ramps up presence in Toronto area with latest members

- Global industry sales shrank in the pandemic, but e-commerce grew rapidly

PLUS: TIMBER MART signs member in Quebec, IKEA Canada partners to launch refugee skills employment program, Australian big box retailer introduces interactive maps instore, JRTech expands agreement with Metro stores, Cologne Hardware Fair gets strong support from exhibitor pre-bookings, housing trends, retail sales, and more! |

|

| |

| |

|

|

| Ace Canada adds private-label paint line in partnership with Cloverdale

Peavey Industries has struck a deal with Surrey, B.C.-based Cloverdale Paint to provide a private-label coatings line for Peavey’s Ace Canada dealers.

Cloverdale is making the paint for both of Ace’s paint lines, Royal and the premium Clark + Kensington brand. The paint fills an important gap in the Ace assortment in this country, as Ace’s paint provider in the U.S. would not ship to Canada. Finding a homegrown source was a natural solution, says Derek Smith, vice president of the Ace Canada division at Peavey. “It just makes sense to be buying in Canadian dollars and supporting a good Canadian company.”

Smith points out another benefit of the new partnership. “Cloverdale is also taking care of the training for the Ace staff and dealers. It’s not something Ace Canada had to worry about and provides good support for the Ace dealers.”

The background to the shuffle started almost a decade ago when Ace sold its paint manufacturing operation to Valspar in 2012. At that time it started carrying Valspar along with its house brands. But five years later, Valspar was bought by Sherwin-Williams. But Sherwin-Williams had made a deal a year earlier with Lowe’s Cos. to supply that retailer’s paint.

Ace then turned to Benjamin Moore, a Berkshire Hathaway company, to make the dealer-owned co-op’s high-end line, Clark + Kensington, and eventually expanded production to handle all of Ace’s paint supply later in 2019.

Smith summed up what the latest development of the Ace paint line represents. “We are focused on building Ace brand products for Canadian dealers.”

|

|

|

LBMAO president Dave Campbell takes aim at Premier Doug Ford's remarks

The Lumber and Building Materials Association of Ontario (LBMAO) has hit back at comments about the industry by Premier Doug Ford. During a press conference last week, the premier mused that “those lumber companies who are jacking up prices need to be held accountable.”

In an open letter, LBMAO president Dave Campbell rejected any suggestion that “our sector is ‘ripping the public off.’” Campbell sent the letter to the premier’s office. Lumber pricing, he explained in the letter, has been impacted from multiple directions.

Supply chain pressures and heightened demand followed both the pandemic and extreme weather in the U.S. At the same time, he said some of the increase in pricing had been “artificially orchestrated by provincial government policies to mitigate the impact of the COVID-19 pandemic,” adding that the LBMAO had “fully endorsed” those measures.

In an interview with Hardlines, Campbell expressed his outrage. “I thought it was just a stupid comment that did not address what the market represents.”

Commenting further on the letter, Campbell pointed out that these market pressures are out of the hands of dealers. “We have no control over prices. It’s dictated by the mills. Add to that product shortages, which are widespread and not just limited to lumber. And I didn’t even mention the devastation that’s been caused by the mountain pine beetles in B.C. forests.”

Campbell says the response from the industry has been very supportive. Dealers and suppliers alike let him know they agreed that Ford’s comments needed to be addressed. “The products we sell are commodities and pricing is dictated by the free market. The prices are already starting to go down. Whether they will go down to where they were two years ago, you never know. But they will level off.”

As of press time, Campbell had yet to receive a response from Premier Ford or his office and lumber prices have already begun to tumble.

|

|

| Castle ramps up presence in Toronto area with latest members A building centre in Scarborough, Ont., is the latest dealer to join Castle Building Centres. But it’s not the first dealer in the Greater Toronto Area to sign with the buying group so far this year. And it’s part of a significant expansion of Castle’s presence in a major urban market.

Global Building Supplies is a full-service lumber, building materials, and hardware retailer in a suburb on the east side of Toronto. The business was founded in 2020 by Min Lin, who has worked in the industry for close to a decade.

Castle has made a series of wins within the GTA since the beginning of 2021. In March, it signed Peel Hardware & Supply, a family-owned business in Caledon, a community on the west side of Toronto. Owner Bill Hewson founded the business in 2013; his daughter Jennifer Hewson manages it now.

Less than a month later, the buying group announced another Toronto member, ML Lumber & Building Supplies. Owners Connie Vieira and her son Rene Silva Jr. have operated in Toronto since 1974. Soon after that, Castle continued its expansion in the region with the addition of BDC Lighting and All Trade Supply in Brampton.

The next business to join Castle added to the ranks of the group’s commercial division, CBS. RGS Rascom Greenbuild Services in Concord, Ont., under the owner and managing director Rick Stacey, has been there for a dozen years, providing contractors with building envelope products.

The latest recruits bring Castle’s representation in the GTA to a dozen stores. The group has almost 300 member stores in total, with sales from all stores totalling an estimated $2.3 billion in 2020 (source: Hardlines Retail Report). However, the majority of its stores are in smaller centres across Canada. While it has three stores each in Calgary and Edmonton, for example, there are none in the Montreal area or the Lower Mainland of British Columbia, according to the Castle website. The increase in numbers in the GTA marks a notable expansion into an urban market.

Castle would not comment on whether the recent wins were part of a larger plan or merely a coincidence, as the geographically related dealers came on board around the same time.

|

|

|

Global industry sales shrank in the pandemic, but e-commerce grew rapidly

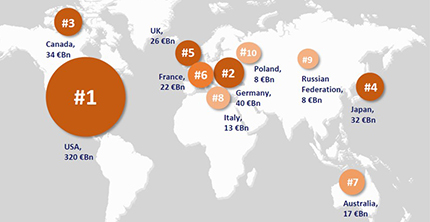

The global home improvement retail market shrank in 2020. Worldwide, sales fell by 2.2 percent to a value of $279.28 billion (all sales in USD). This figure was given by Miles Agbanrin, a consultant at Euromonitor International, in a recent presentation to the Global DIY Network.

Although the growth rate of e-commerce in the global home improvement trade doubled from 23 percent in 2019 to 47 percent in 2020, the overall decline in market volume could not be averted. Sales in home improvement and garden stores, whose market share is put at 70 percent by Euromonitor International, were down by one percent, while sales in other distribution channels fell by nine percent to 22 percent. The market share of e-commerce increased from three to eight percent between 2015 and 2020.

However, the overall decline was not realized in the Western industrialized nations, many of which saw record increases. The slowdowns occurred in the so-called developing markets, Agbanrin explained. He cited India, Taiwan, and China as examples.

Sales of wooden flooring in the Asia-Pacific Region, for example, fell by $1.89 billion, decorative paint sales declined by $2.13 billion, and sales of floor tiles were down by $3.16 billion.

On the other hand, “light DIY” was in demand in America and Europe. In North America, retail sales in the decorative paint category rose by $1.05 billion and in the hardware category by $950 million. In Western Europe, decorative paint added $647 million in sales.

Euromonitor International expects the global market volume to increase again in 2021 to $291.25 billion. By 2025 it should rise to $315.08 billion.

|

| |

|

| |

|

|

|

|

DID YOU KNOW...? ... that the annual Hardlines Retail Report is available soon? This powerful set of research is a marketer’s dream. If you want to know the sales growth and market shares of all the hardware and home improvement groups in Canada, and the strategic analysis of the top players, this is the report for you. It features more than 185 slides and dozens of photographs and tables. For more info and to pre-order, click here! |

|

| RETAILER NEWS

TIMBER MART has signed Centre de peinture Picasso as its fourth new member in Quebec to join this year. Located in Val-d’Or, the store has served as a destination for paint, plaster, tile, and siding in the Abitibi region for more than 35 years. The retailer wants to build out the business beyond paint and accessories, says co-owner Julie Bergeron.

IKEA Canada has partnered with ACCES Employment to launch a national Refugee Skills for Employment program. Supports include virtual customer service training, paid work placements, one-on-one culture and language coaching, job search strategies, and mentorship from IKEA Canada leaders. The program aims to hire 150 refugees within three years and is part of a broader commitment from IKEA globally to reach 2,500 refugees with meaningful employment by 2022.

To help speed up the length of in-store visits, Australian big box home improvement retailer Bunnings has introduced interactive maps. It’s a new feature on the retailer’s product finder app, available across most of its stores. The new feature allows customers to view the location of a product and access the fastest route to get to it. Customers can also locate different services within the stores. |

|

SUPPLIER NEWS

JRTech Solutions, the Montreal-based supplier of electronic shelf labels (ESL), has signed an agreement with Metro, one of Canada’s largest food retailers, for its Pricer ESL system. The deal builds on an initial agreement between JRTech Solutions and Metro that was signed in 2018. This latest update includes the deployment of Pricer Plaza’s cloud platform, which leverages electronic shelf labels to automatically locate a product in a store.

Pre-bookings by vendors for next year's giant hardware fair in Cologne, Germany, indicates strong support for a return to face-to-face business. Eisenwarenmesse, the International Hardware Fair already has almost 2,500 registrations through its early-bird booking. The booking was also a success internationally, say the organizers, as exhibitors from over 40 countries have registered so far. The show will be held from Feb. 21 to 24, 2022. |

|

ECONOMIC INDICATORS

Current housing trends and the outlook for housing market fundamentals suggest activity will remain strong through 2021. This is expected to result in a record number of sales this year, despite a slowdown that began in April. However, over time activity is forecast to continue returning toward more typical levels. As a result, 2022 is expected to see significantly fewer home sales than in 2021. (Canadian Real Estate Association)

Retail sales were down 5.7 percent to $54.8 billion in April. The decline coincided with the third wave of the COVID-19 pandemic and was the largest decline in retail sales since April 2020, during the first wave of the pandemic. Sales at building material and garden equipment and supplies dealers were down 10.4 percent, the first decline in nine months. Despite the decline, sales remained above levels reached in February 2021. (StatCanada)

Sales in the U.S. of new single‐family houses in May were at a seasonally adjusted annual rate of 769,000. This is 5.9 percent below the April rate but is 9.2 percent above the same month a year ago. (U.S. Census Bureau) |

|

|

NOTED

Ace Hardware Corporation says it’s hiring 30,000 employees this summer through the U.S., adding to the ranks of its retail stores and distribution centres. This comes amidst a record first-quarter earnings report and Ace Hardware earning J.D. Power's highest ranking for customer service among home improvement stores. |

|

|

|

|

|

|

|

|

|

| |

Classified Ads

|

Key Account Manager

Masco Canada is looking for a new Retail Sales member with strong analytical skills to complete its team

- Develop strategies to grow with Regional and Independent Customers.

- Support activities on selected National Accounts.

For more information: https://masco.wd1.myworkdayjobs.com/en-US/MascoCanada/job/CA---Ontario---Mississauga/Key-Account-Manager_REQ31308

Wolf Gugler Executive Search has two new career opportunities that we’ve been retained to search out talent for:

Director of Marketing, undisputed category leader in the hardware space. NE Toronto, great company, and compensation package.

Director of National Accounts focused on mass retailers such as Walmart, Target, Kohl’s, BBB and office and club retail. US based, remote position. Excellent compensation package and a place on the US leadership team awaits you.

You can apply online at www.wolfgugler.com or call Wolf Gugler @ 888-848-3006 for a confidential chat. Referrals are welcome and appreciated.

Senior Director, Business Development – Eastern Canada

We are looking for a new member to join our team at BMR Group in the context of a remote job (mainly on the road). This person will work under the Vice President, Strategy and Network Development and will have as main responsibilities:

- Design and create the development strategy for the dealer network in Quebec, Ontario and the Maritimes.

- Research and identify new business opportunities across Canada.

Competitive salary and benefits!

For more information about this opportunity and to apply: https://www.bmr.ca/en/jobs/a20210506-02

|

Looking to post a classified ad? Email Michelle for a free quote. |

| |

|

|

Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Christina Manocchio — Editor— christina@hardlines.ca

Geoff McLarney — Assistant Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internalrouting from this end!

1-3 Subscribers: $495

4 -6 Subscribers: $660

7

-10 Subscribers: $795

11-20 Subscribers $1,110

21-30 Subscribers $1,425

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

| |

|

|