|

IN THIS ISSUE:

- Cologne Hardware Fair postponed due to coronavirus threat

- Home Depot turns in solid year end, forecasts stronger growth in 2020

- Lowe’s reports higher year-end profits despite U.S. online sales challenges

- Retail market share by province: who are the top players regionally?

PLUS: Lowe’s Canada hires for spring, Giant Tiger extends loyalty program, Taiga reports year end, Acceo acquires Informatique Côté Coulombe, Cam White remembered, AQMAT will hold gala, Armstrong reports Q4 profits, retail sales up, U.S. retail and more!

|

|

|

|

| Cologne Hardware Fair postponed due to coronavirus threat

COLOGNE, Germany ― The International Hardware Fair planned in Cologne from March 1 to 4, 2020 has been postponed. Koelnmesse, the show’s organizer, is responding to the increasingly acute global situation around the recent occurrence of the coronavirus.

The show, ordinarily held every two years, drew 47,000 visitors in 2018 from 143 countries to visit 2,770 vendors. Show organizers are planning to remount the event from February 21 to 24, 2021 in addition to holding the show already scheduled for 2022.

As the virus spreads across Europe, travel there is becoming increasingly problematic. The concern began impacting specific companies, which started to withdraw from the show over the previous week. These include some German firms such as power tool maker Metabo, fastener company Fischer and packaging company Rose Plastic, which all cited concerns for their staff due to higher exposure risks.

German abrasives manufacturer Klingspor pulled out, saying, in a press release, “The reason for this decision is the potentially considerable health risks for employees and business partners in connection with the coronavirus SARS-CoV-2, which has been appearing worldwide since the beginning of the year, especially in view of the fact that the fair is expected to attract numerous exhibitors and visitors from regions affected by the virus.”

Considering these current developments and the high share of Asian exhibitors at the show itself, the management team at Koelnmesse were forced to reassess the situation.

|

|

|

Home Depot turns in solid year end, forecasts stronger growth in 2020

ATLANTA ― The world’s largest home improvement retailer saw sales dip slightly in the fourth quarter, but net sales for the year showed improvement over 2018.

Sales for the fourth quarter of fiscal 2019 were $25.8 billion, down 2.7 percent, due in part to an extra week of operations in the previous year compared to fiscal 2019. The extra week added about $1.7 billion of sales to the fourth quarter of fiscal 2018. Net earnings showed a healthy gain, however, reaching $2.5 billion, up 5.8 percent over Q4 2018.

Comparable sales for the fourth quarter increased 5.2 percent, with U.S. comps up 5.3 percent. The Canadian business reported positive comps in the quarter as well. Sales of “big-ticket items,” defined as products and services over $1,000, represent about 20 percent of Home Depot’s U.S. volume and those sales were up by double digits in the quarter. Big-ticket categories include appliances, vinyl plank flooring and Home Depot’s installation services business.

Online sales continued to be strong for the retailer. Excluding the extra week last year, online sales grew 20.8 percent in the quarter, and 21.4 percent for the year, all part of Home Depot’s interconnected retail strategy.

Sales for fiscal 2019 were $110.2 billion, up 1.9 percent over fiscal 2018. Net earnings reached $11.2 billion, up 1.1 percent. Comparable sales for fiscal 2019 increased 3.5 percent, and comps in the U.S. increased 3.8 percent.

Home Depot is now two years into a multi-year investment program, One Home Depot, during which time the retailer says it has grown sales by more $9 billion.

For 2020, the company anticipates total sales growth of 3.5 to four percent, with comp sales growth of between 3.5 and four percent. Home Depot also expects to open six new stores in fiscal 2020.

|

|

|

Lowe’s reports higher year-end profits despite U.S. online sales challenges

MOORESVILLE, N.C. — Lowe’s Cos. has reported net earnings of $509 million for the fourth quarter ended January 31. The results included pre-tax operating costs and charges of $185 million and represent a swing from the net loss of $824 million in the fourth quarter of 2018.

Those charges were from the company’s previously disclosed strategic review of its Canadian operations and closure of its Mexico business. The result of some closures in Canada and the complete exit from Mexico, where Lowe’s had 13 stores, resulted in charges related to inventory liquidation, accelerated depreciation and amortization, severance and other costs.

Sales for the fourth quarter reached $16 billion, up 2.4 percent from $15.6 billion in Q4 2018, and comparable sales increased 2.5 percent. Comp sales for the U.S. business increased 2.6 percent in the quarter. The business in Canada posted comp sales that were “slightly negative in local currency,” said Marvin Ellison, Lowe’s president and CEO, a call to analysts.

During the quarter, Lowe’s closed 28 stores in Canada, with another six due for closure by the end of February.

In fact, growth in the quarter came directly from the company’s domestic stores. “Our sales growth was driven almost entirely by our U.S. bricks-and-mortar stores, supported by our investments in technology, store environment and the pro business,” said Ellison.

For the year, Lowe’s saw net sales increase to $72.15 billion, up 1.2 percent from $71.31 billion in the prior year, and net income of $4.28 billion, up 85 percent from $2.31 billion.

Lowe’s guidance for 2020 includes total sales growth of 2.5 to three percent and comp sales growth of three to 3.5 percent.

|

|

|

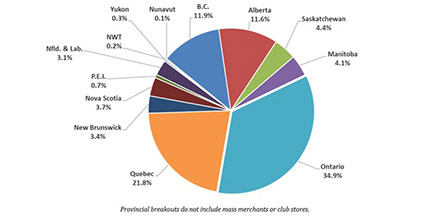

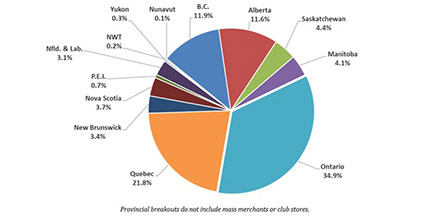

Retail market share by province: who are the top players regionally?

SPECIAL REPORT ― Home improvement banners can vary in their market dominance according to the provinces they are in. And even the national brands can face different levels of market penetration and acceptance, based on their region.

In British Columbia, which itself makes up almost 12 percent of retail sales in this industry, Home Depot Canada is the market leader. It represents 22.4 percent of the B.C. market, followed by Lowe’s Canada through its various banners at 13.3 percent. Home Hardware and Canadian Tire are close behind with 12 percent each.

Alberta follows close behind British Columbia in terms of market share, also just shy of 12 percent. In this province, the leader is again Home Depot, with 22.4 percent of retail sales, followed by Lowe’s Canada with 16 percent. In Saskatchewan, the independents hold sway. The Sexton Group has 15.1 percent of the market, while Federated Co-operatives, based in Saskatoon, represents 14.8 percent. Home Hardware comes in third with 13.3 percent.

Manitoba sees a mix of corporate and independent stores battling for supremacy. Home Depot has 14.5 percent of the market, with Home Hardware at 13.8 percent. These are followed by Lowe’s Canada, which represents 11.1 percent of the market, while TIMBER MART is close behind with almost 10 percent.

Ontario is Canada’s largest market, representing more than one-third of all hardware and home improvement sales in the country. Home Depot has dominance there, as this province is its home base in Canada and the scene of the greatest expansion in its early years in this country. Canadian Tire and Home Hardware trail behind, both with slightly more than 16 percent of the market.

Quebec is an important market that accounts for more than one-fifth of home improvement sales in Canada. Lowe’s, through its acquisition of RONA, is the clear leader there. With 26 percent of the market, that’s well ahead of the volume of the next dealers, Canadian Tire and BMR Group, with 16 and 12 percent, respectively.

Things shift as we move east. Home Hardware holds dominance in New Brunswick with more than a quarter of the market, followed closely by Kent Building Supplies with almost 23 percent. Canadian Tire has 15 percent of the market and Castle is next with 10 percent. Home Hardware is well ahead in Nova Scotia, accounting for almost 30 percent of the market there. They’re followed by Canadian Tire with 16.3 percent and Kent with a little more than 13 percent. In Prince Edward Island, Kent has the lead with 31 percent, followed by Home Hardware with 24.2 percent, Home Depot with almost 14 percent and Castle with 11 percent.

Newfoundland and Labrador is another region dominated by independents: Home Hardware has 28.3 percent of the market there, followed by Castle with more than 22 percent.

(Source: the 2019 Hardlines Market Share Report, which breaks out the market shares for all retail banners in the industry by province. The full report is available here!)

|

|

|

At BMR Group, John Longo has been appointed manager, business development, for Ontario and the Atlantic provinces. Longo brings more than 25 years of experience in the construction and renovation industry, including more than two decades with RONA. Under the direction of Pierre Nolet, VP, business development, Longo’s main duty will be to recruit dealers and to identify new business opportunities in Atlantic Canada’s English-speaking markets and in Ontario, where he will work alongside Jason Hamburger, business development manager for Ontario.

|

|

IN MEMORIAM

Thomas Campbell “Cam” White died at his Calgary home on February 21 at the age of 73. A founding member of Taiga Building Products in 1973, he served as CEO and president from 2010 to 2015, continuing thereafter on the board of directors. The WRLA honoured White with its Industry Achievement Award in 2002. He is survived by his wife Janet and their children, Warren and Cheryl White and Wendy and Jody Nelson, along with his brother Lynn (Marie) and five grandchildren.

|

| DID YOU KNOW...

... that dealers can now enter this year’s Outstanding Retailer Awards? Meanwhile, check out the party we had last year with this brief video featuring last year’s winners, just posted on Hardlines TV! We look forward to celebrating the country’s top hardware and home improvement dealers at the 25th annual Hardlines Conference on October 27 at the Queen’s Landing in Niagara-on-the-Lake, Ont. The nomination forms are available online.

|

|

|

RETAILER NEWS

BOUCHERVILLE, Que. — Lowe’s Canada is looking to fill more than 4,700 full-time and part-time seasonal positions and 700 regular positions in its network of corporate stores ahead of the industry’s busiest season. The company is holding its National Hiring Day on March 14 in all its Lowe’s, RONA and Reno-Depot corporate stores in Canada. Applicants are invited to visit their local store and meet the management teams.

OTTAWA — Giant Tiger is extending its GT VIP loyalty program to the Atlantic and Quebec markets. The program was rolled out to the Atlantic provinces on February 18 and went live in Quebec last week.

|

|

|

SUPPLIER NEWS

BURNABY, B.C. ― Taiga Building Products reported consolidated net sales for the fourth quarter ended December 31 of $298.1 million, compared to $303.9 million a year earlier. The two percent decrease was largely due to lower commodity prices. Net earnings for the quarter were $5.8 million, up 3.8 percent from $1.5 million. For the year, the company reported sales of $1.3 billion, down from $1.45 billion in 2018. Net earnings were up, however, rising 24 percent to $35.91 million, from $28.97 million in the previous year.

MONTREAL — Acceo Solutions has acquired Informatique Côté Coulombe Inc., a developer of high-end enterprise resource planning software for the construction, distribution, retail and printing sectors. ICC Technologies’ customers will be added to a base of more than 40,000 Acceo customers and more than 60,000 North American customers of Acceo’s parent, N. Harris Computer Corp.

LONGUEUIL — AQMAT will hold its 8th Gala Reconnaissance on Saturday, March 7 at Montreal’s Fairmont Le Reine Elizabeth. Awards will be presented to retailers in eight categories and suppliers in seven, along with a prize for product innovation. With comedian Jeff Boudreault as master of ceremonies, the entertainment will include the musical group 1945. (To review the lists of finalists and to purchase tickets, click here.)

|

|

|

|

ECONOMIC INDICATORS

Retail sales were virtually unchanged at $51.6 billion in December, after growing 1.1 percent in November. Building materials and garden equipment and supplies dealers enjoyed an increase, however, as sales were up 3.8 percent—the largest increase for the sub-sector since June. For the fourth quarter, retail sales decreased 0.2 percent after increasing 0.3 percent in the third quarter. Quarterly sales totalled $615 billion, up 1.6 percent from 2018. (StatCan)

U.S. retail sales rose by 0.3 percent in January, the fourth consecutive monthly gain. Unusually mild temperatures during the month boosted sales of building materials, while lower gas prices stimulated sales at the pump. (U.S. Commerce Dept.)

|

|

|

NOTED

Consumers spent $601.75 billion online with U.S. merchants in 2019, up 14.9 percent from $523.64 billion the prior year, according to the latest figures from the U.S. Department of Commerce.

|

|

|

|

OVERHEARD...

“As we outlined on our third-quarter earnings call, we’re making foundational changes to improve execution and deliver long-term improved profitability in Canada.”—Marvin Ellison, president and CEO of Lowe’s Cos., on his company’s commitment to the Canadian market. He was speaking to analysts following the release of Lowe’s fourth-quarter results.

|

|

|

|

Classified Ads

|

|

Alexandria West

Position Outside Sales Representative – British Columbia

Job Summary:

Sell products to new and current customers, prospect and generate new business, cold call on new accounts to generate sales, build relationships and educate customers on new products and product lines. The hours and level of responsibility may vary by geographical location or product line. This position will report to the Sales Manager

Responsibilities and Essential Functions:

- Complete prospecting activities to establish first and follow up appointments with customer decision makers through cold calls, lead generation, referrals, networking.

- Must maintain a current customer base.

- Prepare and deliver sales proposals/presentations and follow up with key decision makers.

- Educate current customers on new products and product lines.

- Determine new customer needs and propose appropriate level of product sales.

- Interact with existing and new customers to increase sales of product.

- Identify and resolve any customer issues and problems.

- Travel to customers and trade shows to present products.

- May assist Corporate Accounting with collection of payment.

- Responsible for company vehicle maintenance and maintaining a professional presentation.

- Other duties, as assigned and requested by Management.

Required Cognitive and Psychological Characteristics:

- Must be self-motivated and able to work independently to meet or exceed goals.

- Ability to learn skills quickly with a mature and service-oriented attitude.

- Must be computer literate, Microsoft Word, Excel, and Outlook.

- Attention to detail and ability to manage multiple tasks.

Required Credentials:

- Three to five years of outside sales (business-to-business) experience, with lumber and/or building supply industry preferred.

- A bachelor's degree or any similar combination of education and experience.

- Excellent communication skills including a service-oriented telephone manner.

- Must possess good business presentation, selling principles, negotiation and closing skills.

- Self-starter, pro-active, and the ability to take initiative.

- Must have basic math and analytical skills.

Please apply to: Jobs@alexmo.com

About Home Hardware Stores Limited

Home Hardware Stores Limited is Canada’s largest Dealer-owned cooperative with close to 1,100 Stores and annual retail sales of over $6 billion.

Located near Kitchener/Waterloo, Ontario, Home Hardware remains 100% Canadian owned and operated. Home hardware has received designations as one of the Best Managed Companies and Top Ten Most Trusted Brand’s in Canada and is committed to providing local communities with superior service and quality advice.

TWO POSITIONS

SENIOR DIRECTOR, RETAIL SALES AND OPERATIONS, QUEBEC AND ATLANTIC (#810QU)

Responsible to the Vice-President, Store Operations for developing, overseeing and implementing strategies and procedures for continuous improvements in sales, retail execution, customer experience and operational excellence in retail for Quebec and Atlantic Canada.

Create an empowered environment through leadership, coaching and communication ensuring the Retail Sales and Operations Team understand the goals and objectives of the business and have the resources and management support to be successful.

Provide leadership and direction to the Quebec and Atlantic Retail Sales and Operations teams in the management of all retail activation activities from sales campaigns, operational initiatives, store expansions and new Dealer growth and development.

Establish sales and operational goals and key performance indicators and monitor the effectiveness of the teams through measurable metrics and analytics.

Prepare annual operational and capital budgets working with Finance department to analyze costs of improvements and lead cost and productivity improvement initiatives.

Partner with other key stakeholders (Merchandise/Marketing) to drive sales by introducing new programs and sales initiatives. Evaluate and communicate the execution of these initiatives at retail level.

QUALIFICATIONS:

University degree in a business-related field or retail strategy, with minimum ten years’ progressive experience in a retail management capacity at a senior leadership level.

Solutions-oriented decision maker with proven ability to build, execute and measure data-driven retail programs and deliver on commitments.

Excellent written and verbal communication skills, with confidence to interact with all levels. Fluent in French and English is required.

Understanding of key KPI measures for retailing; knowledge and use of consumer insights tools and ROI metrics.

Solid understanding of digital marketing, social platforms, analytics, optimization and traditional marketing.

Willingness and flexibility to travel extensively and work varying hours to fulfil the requirements of the position.

DIRECTOR, RETAIL OPERATIONS, ONTARIO WEST (#811)

Responsible to the Senior Director, National Retail Operations for effectively leading the day-to-day activities of the Ontario West Retail Sales and Operations team and facilitating retail sales, store growth, profitability and operational excellence.

Coach the Ontario West Retail Sales and Operations team to achieve operational objectives and retail sales targets.

In conjunction with Dealer Development, assess and approve all prospect all Home Dealer applicants.

Work closely with existing Dealers through the application process who are looking to grow their business through consolidation, expansion or additional locations by submitting forecast requests, business plans and completion of the application outline.

Coach and add value to Dealers during special projects including, but not limited to financial focus, businesses for sale, expansion & relocation and overlapping objections.

QUALIFICATIONS:

Successful applicant must be willing to locate in close proximity of the Dealer Support Centre in St. Jacobs.

College/University diploma or degree in a business-related field or retail strategy.

Progressive store operation and retail industry experience, with five to ten years in a leadership level.

Thorough understanding of retail and business fundamentals and KPI’s. Knowledge of Account Management an asset.

Consumer insights and analytics exposure.

Willingness and flexibility to travel extensively and work varying hours to fulfil the requirements of the position.

Fluent in both French and English would be an asset.

Interested applicants, please submit resume to www.homehardware.ca/careers.

Phone: 519-664-2252 ext 6130

34 Henry St W, St. Jacobs, ON, N0B 2N0

*While we appreciate all applications received, only those to be interviewed will be contacted.

We will accommodate the needs of qualified applicants on request under the Human Rights Code in all parts of the hiring process

|

|

| Looking to post a classified ad? Email Michelle for a free quote.

|

| Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Sigrid Forberg — Editor— sigrid@hardlines.ca

Geoff McLarney — Staff Writer— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing

& Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internal routing from this end!

1-3 Subscribers: $460

4-6 Subscribers: $615

7-10: Subscribers: $750

After initial 10 subscribers, blocks of 10 are $285.

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES. |

|

|