July 9, 2018 Volume xxiv, #27

"Summer afternoon, summer afternoon; to me those have always been the two most beautiful words in the English language”

?Henry James (American author, 1843-1916)

IN THIS ISSUE:

-

Terry Davis’s pending retirement points to more changes at Home Hardware

-

Industry growing stronger than expected, says newest report from Hardlines

- Lowe’s continues updating its RONA building centres with new format

-

Taiga expands wood treatment operations with acquisition of U.S. company

PLUS: Kott Group joins Sexton Group, Coop Unicoop to close, Canadian Tire completes Helly Hansen purchase, Home Depot adds lockers, Taiga partners with Huber, Glen Dimplex Americas expands partnership with Celca Marketing Atlantic, U.S. construction spending, and more!

Terry Davis’s pending retirement points to more changes at Home Hardware

Terry Davis’s pending retirement points to more changes at Home Hardware

ST. JACOBS, Ont. — The news that the head of Home Hardware Stores Ltd. will retire at the end of 2018 is very much in keeping with the rate of change the co-op has been undergoing in recent years.

Terry Davis announced last week his desire to retire later this year after nearly 50 years with the company, following the naming of a new CEO and a transition period as that replacement steps in.

He’s only the third CEO in more than half a century. Co-founder Walter Hachborn held that title for more than a quarter-century, until he was succeeded by Paul Straus in 1988. Straus turned over the CEO title to Davis four years ago, maintaining the president’s role until just two months ago.

Davis, 67, is a 48-year veteran of the company. He started in the warehouse in St. Jacobs, Ont., which to this day is the head office and distribution centre for the co-op retailer and the 1,000-plus dealers it serves. In 2010, he was appointed executive vice-president and COO, before becoming CEO in 2014.

He said from the start of his tenure at the helm that he was leading the company on a short-term basis, as Home Hardware positions itself for the future. Part of that realignment has included the appointment in 2016 of an outsider to a senior executive position, Rick McNabb. As VP marketing and sales, McNabb has been instrumental, under Davis’s direction, in a range of changes at the company. Now, as Home Hardware sits poised to embrace the digital future of retail, Davis is prepared to step aside.

“It has always been my plan since taking over as CEO in 2014, that I would help prepare Home Hardware for a new generation of leadership—one that can ensure our continued success in the decades ahead,” Davis said in a letter to vendors that went out July 4.

Davis and the board of Home Hardware have been working for some time on succession planning and have recently engaged an executive search firm to assist with identifying the right person for the job. In the letter, he stated he doesn’t expect the pending change to be disruptive. “I wish to assure you that throughout this transition it will be business as usual.”

|

|

Industry growing stronger than expected, says newest report from Hardlines

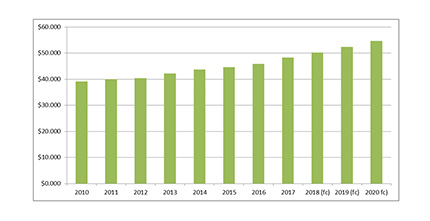

WORLD HEADQUARTERS, TORONTO — Canada’s retail home improvement industry grew at a healthier rate than anticipated in 2017 and business is expected to keep pace for most of 2018.

According to the 2018-2019 Hardlines Retail Report, sales by hardware stores, building centres and big boxes, Canadian Tire, and related sales by Walmart and Costco, were up 5.1% year over year in 2017. And while growth is forecast to moderate somewhat in 2018, the industry is expected to remain strong for the next two years.

This Report examines:

- why the big boxes have seen their share of the market slip in 2017;

- how building centres continue to maintain—and grow—their share of the business;

- which provinces and regions enjoyed growth, and which ones slipped;

- where Home Hardware is gaining market share—and at who’s expense;

- what Canadian Tire is doing to combat online threats like Amazon;

- where BMR is staking its growth in 2018 and beyond.

Offering a complete breakdown and analysis of Canada’s retail home improvement industry, the Hardlines Retail Report features in-depth analysis of the industry's top players, including the market shares of the top 20 players, and sales and forecasts for Home Depot, Canadian Tire and Lowe’s Canada.

Carefully researched by the Editors of Hardlines, the 2018-2019 Hardlines Retail Report features in-depth analysis of the sales trends by region and by store format (big box, hardware store, building centre and Canadian Tire). This year’s Report also digs deep with important forecasts of sales growth by province and store format, as well as anticipated sales performance of the Top Four players.

Available in either PDF or handy PowerPoint format, the Report has 200 slides, dozens of charts and graphs, and more photos than ever before. (Click here for details and to order your Hardlines Retail Report now!)

|

|

Lowe’s continues updating its RONA building centres with new format

ETOBICOKE, Ont. — The RONA store in the West end of Toronto has been converted to RONA’s new building centre model. The location, at 1170 Martin Grove Road, is actually the former head office and anchor store for the Lansing Buildall chain, which was an early—and major—acquisition by RONA as it expanded into Ontario and beyond in 2001.

Now, the store has undergone a major transformation, at a cost of more than $3 million. It’s the second RONA location in Ontario to be converted. Parent company Lowe’s Canada expects up to eight more stores to be refurbished by year’s end.

“The customer was at the centre of our thought process when developing the new RONA building centre model, which was designed with three goals in mind: better meet current needs and trends in home improvement, become a true one-stop-shop for our customers’ home improvement projects and enhance our offering for contractors and pros,” says Patrick Lapointe, divisional vice-president, RONA operations.

He points out that the store format is aimed at both DIYers and contractors, and “plays a key role in Lowe’s Canada’s growth strategy,” one that the company intends to keep investing heavily in as part of its growth strategy.

Keeping in mind the way homes are being designed and furnished—including open floor plans, bright lighting and plush outdoor spaces, the store reflects those changes in both its layout and product selection. The result is a brighter, less compartmentalized store, with entirely redesigned racking that has been lowered, except on the perimeter of the store, to allow customers a 360-degree view of the store at a glance. In addition, seasonal products have been moved up near the entrance and household appliances now have a prime location near the kitchen project section.

The new-look store is also designed to accommodate project sales, anything from a kitchen or bathroom remodel or roof repair to replacing doors and windows. Project sales are supported by services such as design consulting, 3D renderings and installation services.

Eventually, all RONA building centres will feature a kitchen section, which will be bigger or smaller depending on the size of the store.

Drawing on the store’s historical use as a distribution centre for the former Lansing Buildall stores across the Greater Toronto Area, the store will use its 130,000-square-foot warehousing area and a five-acre paved lumber yard as a central delivery hub for the 26 RONA stores in the GTA. It can house large quantities of products in key contractor categories such as roofing, drywall and insulation. This gives all 26 GTA RONA stores access to an overall wider product assortment and increased availability, therefore improving the level of service provided to all customers. This is especially effective for, and appreciated by, pro customers who must meet tight timelines when completing their projects. In peak season, the hub has over 30 delivery vehicles.

|

|

Taiga expands wood treatment operations with acquisition of U.S. company

BURNABY, B.C. — Taiga Building Products Ltd., through a wholly owned subsidiary, has entered into a share purchase agreement with a U.S. treated-wood producer, Exterior Wood, Inc. Taiga will acquire all common shares of Exterior Wood for US$42 million ($55.2 million).

Exterior Wood has been operating a wood treatment facility and distribution centre in Washougal, Wash., since 1977, and services retail building supply centres throughout the western United States and Canada with a wide array of pressure treated products. The acquisition will expand Taiga’s existing wood treatment operations at three facilities in Canada, with additional penetration into the U.S. market.

“The acquisition of Exterior Wood and the expansion of our wood treatment business represents a significant step forward in our corporate strategy of pursuing value enhancing opportunities,” said Trent Balog, president and CEO of Taiga. He expects the new addition to integrate well with Taiga’s existing treated wood operations and expand its distribution reach.

The deal, which is expected to close by the end of this month, is subject to certain adjustments at closing of the acquisition in respect of working capital, cash and certain outstanding indebtedness. The acquisition has been structured to close on a cash-free, debt-free basis.

|

DID YOU KNOW...?

that you can now find out the market share, sales and forecasts for Home Depot, Canadian Tire, Lowe’s Canada? Yup, the 2018 Hardlines Retail Report is now available, with in-depth analysis of the country’s top hardware and home improvement players and breakdowns of the Top 20 retail groups. With 200 PowerPoint slides, it has more trends analysis and more forecasts than ever. Click here for details and to order your Hardlines Retail Report now!

|

|

RETAILER NEWS

WINNIPEG — Kott Group is the latest dealer to join the Winnipeg-based Sexton Group. A family-owned and operated business founded in 1974, Kott has locations in Toronto, Ottawa and Cobourg, Ont. Specializing in lumber and framing materials, factory-built building envelope components, home exterior products and custom stair and railing systems, Kott services a large part of the Ontario market in residential and commercial new construction, as well as the renovation market.

BELLECHASSE, Que. — The local Coop Unicoop, a member of BMR’s Agrizone banner, will close July 27, according to its management, with its farm business being relocated to the Unimat in nearby Saint-Gervais. “It was a considered business decision,” said Coop President Richard Dion. “We have a strong conviction that this change will benefit our clientele in Bellechasse since they can find [in Saint-Gervais] a wide range of products and services under one roof.” The Unicoop group of co-ops is set to merge with several others into the new Coop Avantis, which will bring together hundreds of BMR and Unimat employees when it launches on October 28.

TORONTO — Canadian Tire Corp. has completed the previously announced acquisition of Norwegian sportswear and workwear company Helly Hansen. The line will be added to Canadian Tire’s growing stable of owned brands.

ATLANTA — Home Depot has added in-store pickup options for online orders to a range of its stores in the U.S. Customers who make online purchases from Home Depot can come to participating locations, unlock one of the pickup lockers and retrieve their merchandise without interacting with an employee. Home Depot says that 45% of its online orders are picked up in-store.

SUPPLIER NEWS

BURNABY, B.C. — Taiga has partnered with Huber Engineered Woods LLC to carry its lines of OSB product. Taiga will now be marketing AdvanTech flooring, Zip panels and Zip-R panels, along with related accessories.

CAMBRIDGE, Ont. — Glen Dimplex Americas has announced it is expanding its partnership with Celca Marketing Atlantic. The agency will now represent Dimplex- and Cadet-branded heating products to all home improvement retailers across the Atlantic provinces. Glen Dimplex also announced a partnership with King Marketing, which will represent its product portfolio to dealers in Ontario and Western Canada. As of July 1, King Marketing represents Dimplex and Cadet by providing local account management, training, event marketing and in-store merchandising services for the organization. The company says it intends to expand its current product portfolio with the addition of new brands.

OVERHEARD...

“We recognize that each and every one of our suppliers and business partners play an important role in our success. I have every confidence that Home Hardware has its best days ahead. We remain competitive, our brand is strong and relevant and the credit is also to be shared by each of you.”

—Terry Davis, CEO of Home Hardware Stores Limited, on last week’s announcement that he would retire later this year.