|

IN THIS ISSUE:

- Nicholson and Cates is being bought out by its management team

- Home Depot adds new features to its contractor loyalty program in U.S.

- Product returns remain a huge part of shrinkage, says U.S. association

- No strong recovery expected for Canada’s housing markets in 2023

PLUS: Eric Palmer promoted to president at Sexton Group, Princess Auto’s new video game, Home Depot’s new app for employees, Castle’s latest commercial member, Ace Hardware’s top franchise spot, Bed Bath & Beyond in talks with Lowe’s Canada’s new owner, Murray Finkbiner’s new role at Gillfor, Jason Hamburger returns to Home Hardware, Alexandria Moulding’s distribution centre in Calgary, building construction’s decline, and more!

|

|

|

|

|

|

|

Nicholson and Cates is being bought out by its management team

Nicholson and Cates Ltd. of Burlington, Ont., has entered a management buyout agreement. The deal, which was struck on Dec. 1, will involve transition of the leadership of the organization to an employee shareholder group consisting of Morgan Wellens, Brian Roger, and Bill Best.

Founded in 1930, N&C was taken over in the late 1960s by the Livermore family, who have owned and operated it ever since. Today, the firm distributes a range of building products including Trex, James Hardie, Fraser Wood Siding, and CertainTeed PVC. Along with its DC, the company has three lumber milling facilities in central and eastern Canada.

The company distributes commodity products throughout North America and indeed the world. It also has an industrial panel division focused mainly on the Ontario market, but which also ships to the U.S. N&C also operates remanufacturing facilities in Ontario and the Atlantic provinces.

The buyout deal comes as Jim Livermore, CEO and president of N&C, was considering retirement. He wanted to ensure “that all employees, customers, and suppliers continue to be supported and cared for,” the company said in a release.

Wellens, currently sales and marketing manager of N&C’s trading division, will transition to president. He is leading the management buyout team. Brian Roger is director of sales and marketing. Bill Best is chief financial officer.

The management transition will take place over the next few years and allow N&C to maintain its current branding and autonomy. All divisions and operating units, the company says, will continue in their same structure and locations.

|

|

|

Home Depot adds new features to its contractor loyalty program in U.S.

The Home Depot has expanded its Pro Xtra loyalty program south of the border. Pro Xtra is a proprietary points program that provides benefits for professional contractors and builders in both Canada and the U.S.

The enhanced platform is aimed at attracting and serving contractors and builders, who are an important—and growing—part of Home Depot’s business. For example, the U.S. pro business now accounts for about 10 percent of its customer base, but approximately half of its sales. The company says the pro market in the U.S. is worth $450 billion.

When customers enroll in Pro Xtra, they gain access to specialized perks, including business tools and exclusive sales both in stores and online. The program now offers three tiers, Member, Elite, and VIP, to reward pro customers with additional benefits according to their spend.

Every dollar spent counts toward earning rewards while allowing members to unlock the next level of benefits. As new tiers are unlocked, pros access additional perks such as assistance for business needs, VIP experiences, account management services with personalized purchase support from Home Depot experts, and preferred pricing. Additional benefits for members of all tiers will be released throughout the year.

The app, says Hector Padilla, executive vice president of outside sales and service, “is about removing friction through a variety of products and capabilities—whether they visit a Home Depot store for a last-minute need on the way to a job or plan a larger purchase in advance to be delivered to the job site.”

The company has introduced a range of other new products and services, including job-lot quantities, digital tools, and priority delivery options.

|

|

|

Product returns remain a huge part of shrinkage, says U.S. retail association

Standing in line at the post office in the middle of the Covid pandemic, this editor waited patiently for the line of eight people ahead of him to shrink. At the counter, commenting on the long queue, the Canada Post worker said, “Yeah, I’d say these days half of these packages are product returns.”

Fast-forward two years and the phenomenon remains widespread for both online and in-store sales. According to a study released before Christmas by the National Retail Federation in the U.S. along with Appriss Retail, consumers there were expected to return a total of more than $816 billion worth of retail merchandise that had been purchased in 2022 (all figures in this article in USD).

The NRF tracked an ongoing rise in retail sales growth, noting that the average rate of product returns was 16.5 percent last year, virtually flat with 16.6 percent in 2021.

According to the survey, for every $1 billion in sales, the average retailer incurs $165 million in merchandise returns. Additionally, the study found that for every $100 in returned merchandise accepted, retailers lose $10.40 to return fraud.

The returns of online product purchases were consistent with the overall rate of returns, with online return rates decreasing from 20.8 percent in 2021 to 16.5 percent in 2022. Online sales will account for approximately $1.29 trillion of total U.S. retail sales in 2022.

Online purchases should amount to about $212 billion in 2022. But slightly more than 10 percent of those returns will be deemed fraudulent. Of the types of return fraud retailers say they experienced in the past year, half cited returns of used, non-defective merchandise, a phenomenon known as “wardrobing.” Another 41.4 percent cited the return of shoplifted or stolen merchandise. One-fifth attributed return fraud to organized retail crime.

Of the more than $3.66 trillion in expected in-store sales for 2022, $603 billion will be returned. Approximately $62.1 billion of those returns, or 10.3 percent, are expected to be fraudulent.

|

|

|

No strong recovery expected for Canada’s housing markets in 2023

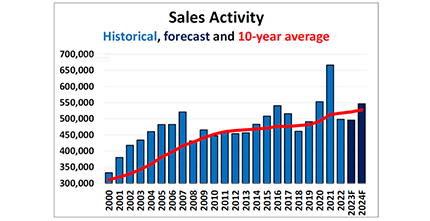

Sales of existing homes, which tend to drive renovation sales, along with projected new housing starts, are anticipated to limp along in the year ahead. Both the Canadian Real Estate Association and Statistics Canada offer cautious outlooks.

Last year ended on a slightly positive note, according to the latest report from CREA. Sales rose by 1.3 percent between November and December, which may sound like good news, but the actual (not seasonally adjusted) number of transactions in December came in 39.1 percent below a near-record for that month the previous year. Overall sales last year were down.

CREA also released its forecast for 2023. With characteristic optimism, the release says, “National home sales have been more or less stable since the summer, suggesting the downward adjustment to sales activity from rising interest rates and high uncertainty may be in the rear-view mirror.”

Indeed, some indicators are positive for the year ahead. This normalization will be good news from an affordability standpoint as the market makes small moves to correct itself. Hammered by rising interest rates and growing inflation, seasonally adjusted prices in December were down 7.5 percent, and down 12 percent in non-adjusted dollars.

That trend will continue, as the national average home price is forecast to decline 5.9 percent on an annual basis to $662,103 and sales activity overall is expected to dip by 0.5 percent.

Looking out further, things brighten up. CREA anticipates that home sales will rise by 10.2 percent to 546,625 units in 2024 as markets continue to return to normal.

The national average home price is forecast to recover by a moderate 3.5 percent from 2023 to 2024 to around $685,056, below 2022 but back on par with 2021.

All this would still fall short of 2020 and 2021 figures, but activity in the Covid years was anomalous, as it was for so many sectors.

Another view to future construction is building permit activity. The latest numbers from StatCan, from November, show that the total value of building permits in Canada jumped 14.1 percent to $11 billion. That increase marks a rebound after two consecutive monthly losses.

On a constant dollar basis, the total value of building permits went up 12.3 percent to $6.5 billion. Much of the action came from residential permits, which increased 13.7 percent to $7.1 billion nationally. Single-family starts were up a more modest 7.1 percent, and that’s after four consecutive monthly declines. Total permit value in the non-residential sector rose 14.9 percent to $3.9 billion in November.

More importantly, however, is the reality that permits year-over-year are down two percent compared to November 2021. This indicator alone reinforces the likelihood of a slow or flat year for new housing. This will follow 2022’s rate of actual urban housing starts, which, at 240,590 units, is down one percent from 2021 levels.

|

|

|

Eric Palmer has been promoted to the position of president at Sexton Group Ltd. He was previous VP and GM of the buying group for three years, leading a development team that has been active in recruiting new members throughout Canada. “He also led a purchasing team that ably supported our members' product procurement needs during a time of acute shortages,” Sexton said in a release.

Murray Finkbiner has started a new position at Gillfor Distribution as senior advisor. He was previously a managing partner at AFA Forest Products. Gillfor acquired AFA, an LBM distributor headquartered in Bolton, Ont., in April 2022.

Jason Hamburger has been named dealer development manager at Home Hardware Stores Ltd. Hamburger was previously at Home Hardware for 15 years, until he left in 2017. His last post before rejoining Home was as a business development manager at BMR Group.

Marcus Jablonka has been appointed president & CEO of Dörken Systems Inc., a company based in Beamsville, Ont., that produces moisture barriers for commercial and residential construction sold under the Delta brand. For the past six years Jablonka was VP, operations and marketing, focused on developing and implementing production technologies throughout Dörken Systems’ North American operations.

|

|

|

|

DID YOU KNOW...?

... that the latest edition of Hardlines Dealer News hit inboxes last week? In this issue, we look at using tool rentals to drive sales, the growing importance of loyalty plans, and a start-up that’s helping dealers by linking contractors and homeowners. Hardlines Dealer News is monthly and it’s free. (Click here to subscribe now!) |

|

|

| RETAILER NEWS

Princess Auto has come up with a video game to attract a younger demographic to its stores. The Winnipeg-based hardware and automotive retailer recruited a local video game developer, ZenFri, to develop a retail-related AR (Augmented Reality) location-based game. The game is called Powerfist Defence Force and it has something to do with aliens invading Princess Auto stores to steal tools to fix their spaceships, conquer humans, and … well, you get the idea. Powerfist is a private-label brand of Princess Auto.

Home Depot has started out the year with the rollout of an app developed to help U.S. store associates prioritize tasks more effectively. Dubbed Sidekick, the app is a new addition to existing “hdPhones,” mobile devices by Zebra Technologies. Sidekick uses an algorithm to determine which tasks to focus on, identifies out-of-stock products, and can locate products in the stores. The rollout was completed in all Home Depot’s U.S. stores at the end of 2022.

Castle Building Centres Group has added a new member to its commercial building supply division. Urban Insulation Supply of Casselman, Ont., was founded in 2019 by Gaétan and Pierrette Dazé, serving eastern Ontario and western Quebec. Under Castle, Urban Insulation will continue to serve as the area’s building envelope specialist.

|

|

|

|

Ace Hardware has garnered a spot in the Top 10 list of franchise business opportunities in the world for 2023, according to Entrepreneur Magazine’s Franchise 500. Ace earned the top spot based on its retailer support, yearly sales growth, and strong brand recognition. The retail group ranked number 12 in 2022, then climbed the list in 2023 to the seventh position out of 500 ranked franchise businesses. Both years, it took the number-one spot in the retail category.

Home products retailer Bed Bath & Beyond is in talks to sell some assets to Sycamore Partners of New York City in order to relieve financial pressures. The New Jersey-based retailer counted 953 stores in North America last year, including 65 outlets in Canada. Last November, Sycamore agreed to buy the assets of Lowe’s Canada, including RONA and Réno-Dépôt, for $400 million plus a performance consideration. That deal is expected to close in the first quarter of this year.

|

|

|

|

IN MEMORIAM:

Peter Miller has died at the age of 67. A fixture in the home improvement industry for more than 40 years, he retired almost a decade ago after working for a range of companies on both the retail and supplier sides of the business. His CV included stints at CanWel, Kaycan, Home Hardware Stores, All Weather Windows, and Westman Steel. In 2014, he received the Industry Achievement Award from the Lumber and Building Materials Association of Ontario.

John Schaefer died on Dec. 27. As an LBM Procurement Manager for TIMBER MART, he was instrumental in the development of the TIMBER MART distribution business in Langley, B.C., during the last decade. Prior to his tenure at TIMBER MART, he worked for IRLY Building Centres and Hollyburn Lumber. A celebration of life will be held on Feb. 11 at 1:00 p.m. PST at Boal Chapel in North Vancouver.

|

|

|

|

SUPPLIER NEWS

Alexandria Moulding is building a distribution centre in Calgary to serve its western customers. The facility, which will be about 200,000 square feet in size when completed, is slated to open this summer. Alexandria Moulding, based in Alexandria, Ont., is a North American moulding manufacturer and distributor of wood and wood composite mouldings.

|

|

|

ECONOMIC INDICATORS

Investment in building construction declined 1.4 percent to $20.4 billion in November. Spending on residential building construction was down two percent to $14.9 billion, the third consecutive decline in that sector. Investment in single-family homes fell for the fourth consecutive month, down 3.9 percent to $7.8 billion in November, with all provinces reporting declines. (StatCan)

|

|

|

|

|

NOTED

The latest episode of the Hardlines Podcast Series What’s In Store is now available. In this episode, Home Hardware dealer Frances Sologuk shares the story of how her family’s hardware store in Osoyoos, B.C., was “un-renovated” to reveal its historic building materials (including a jailhouse door!), reclaimed from a nearby mining camp. It’s a master class in customer service and community relations—with a heritage twist. (Sign up now to get updates about the latest podcasts in your inbox!)

|

|

|

OVERHEARD...

“In 2022, we saw one of the biggest single-year shifts on record in Canadian housing activity, from record highs last winter to just below the 10-year average to end the year. That said, the market’s adjustment to higher rates may be mostly in the rear-view mirror at this point. That could start to bring buyers back off the sidelines this spring.”

—Jill Oudil, chair of the Canadian Real Estate Association, commenting on the end of a year marked by a softening house sale market.

|

|

|

|

|

| Classified Ads

|

|

Position: Key Account Executive

Responsibilities: Sales to Retailers in the Canadian Market

Product: Primarily Seasonal and Hardware Categories

Location: Toronto / Working Remote

Compensation: Base + Commission

The Company: Vertex Sales

About Vertex:

Vertex Sales is a sales agency representing non-competing manufacturers’ product categories spanning the Hardware, Housewares, Electrical, and Seasonal product categories. Vertex provides sales solutions for consumer products marketers / companies.

Contact: info@vertexbrands.com

|

|

Looking to post a classified ad? Email Michelle for a free quote. |

|

|

|

| Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2023 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Steve Payne — Editor— steve@hardlines.ca

Geoff McLarney — Associate Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internal routing from this end!

1-3 Subscribers: $495

4 -6 Subscribers: $660

7

-10 Subscribers: $795

11-20 Subscribers $1,110

21-30 Subscribers $1,425

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

|

|

|