|

July 11, 2016 Volume

xxii, #28

“Every noble work is at first impossible.”

—Thomas Carlyle (Scottish writer and historian, 1767-1830)

______________________________________________________________________

SUMMER PUBLISHING SCHEDULE: Please note there will be no weekly edition of HARDLINES on August 8, 21, or 29. The World Headquarters will remain open, however, during this time. The regular weekly schedule will resume September 5.

(Click here to receive FREE Daily News updates all the time!)

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

Addition of BMR makes ILDC Canada’s biggest buying group

BOUCHERVILLE, Que. — Groupe BMR has joined the Independent Lumber Dealers Co-operative (ILDC). Already one of the country’s largest buying groups, the addition of BMR will give ILDC combined sales of about $4.3 billion through just 22 members and put it firmly in place as Canada’s largest home improvement buying group.

“We are happy to welcome a major Canadian player such as BMR in our group,” said Paul Bonhomme, president of ILDC and head of Les Enterprises P. Bonhomme, a 10-store chain in the Ottawa-Gatineau region. “This new partnership strengthens our position in the home improvement industry in Canada, which benefits our current and future members.”

Other members include some of the country’s largest independent or closely-held retail chains, including Kent Building Supplies, Patrick Morin, Copp Buildall, McMunn & Yates, and Central Supply. BMR brings another 325 outlets and about $1.7 billion in retail sales to ILDC.

La Coop had been a member itself up until February 2015, when it completed the acquisition of BMR. That group, considered a direct competitor to many existing ILDC members, forced La Coop to exit the group. However, the retail landscape in Quebec has changed dramatically since then, with the takeover of RONA by Lowe’s, the aggressive geographic expansion by Canac, and the consolidation of La Coop and BMR.

“The great purchasing power of ILDC, combined with our own, and their business model that allows us to preserve our independence, were important factors in our decision to join the group,” said Pascal Houle, CEO of Groupe BMR. He added that he looks forward to sharing experiences and best practices with the other ILDC members.

back to top

______________________________________________________________________

______________________________________________________________________

Medline’s ouster from Canadian Tire raises eyebrows

TORONTO — Last week’s announced departure of Michael Medline from Canadian Tire Corp., where he served as president and CEO, came suddenly and without explanation. Medline was replaced by Stephen Wetmore, who had been deputy chair of Canadian Tire.

For Wetmore, this marks a return to the role he held before Medline took over, and Medline had in fact worked under him previously. Wetmore was CEO from January 2009 to December 2014. Medline became president in 2013 and CEO in 2014.

“The board has taken a unanimous decision to change the leadership of the company at a time of unprecedented change in the retail industry,” said Maureen Sabia, chair of Canadian Tire. “While our short-term priorities are delivering results, the board’s responsibility is the long-term success of Canadian Tire.”

If there are any clues as to why Medline was ousted, they may lie in Sabia’s next statement, which suggest the move was planned and that Wetmore was not simply parachuted in: “Stephen transformed our company during his previous tenure and laid the foundation for our current performance. We believe he is uniquely qualified to lead the company through the increasing complexities of the new world of retail. His appointment as president and CEO is neither an interim, nor a short term, appointment.”

One source HARDLINES spoke with indicated Wetmore had been actively working with Canadian Tire’s executive team on a daily basis for the past several months, which would further suggest that this latest shakeup was a planned one.

Medline, who had held the top job at Canadian Tire since December 2014, distinguished himself early on. And prior to that, his background had included a number of “fix-it” roles for Canadian Tire, including turning around the automotive business from 2009 to 2011. After that, when Canadian Tire—under Wetmore as CEO—purchased Forzani Group to expand its presence in sporting goods, Medline was put in charge of that business for three years.

His next post was as president of Canadian Tire Corp., and within a year he had added the CEO title, as Wetmore moved into the role of deputy chairman, a non-executive role.

Despite gains on the retail side, Medline’s reign was marred by the company’s inability to build its online business effectively. A pilot online buying program in Nova Scotia dragged on for almost a year longer than expected before a wider rollout was implemented. And more recently, a hard-copy catalogue, called the “Wow” Guide, reportedly fell short of igniting the kind of digital sales that it was intended to deliver.

Canadian Tire’s common shares are currently trading at an 18-month low, having slipped 22% since December 2015. Despite Medline’s internal fixes and focus on the retail side of the business, Canadian Tire’s board may find comfort in Wetmore’s more corporate approach to ensure a successful long-term strategy.

back to top

_________________________________________________________________

Private label versus national brands: the battle continues

SPECIAL REPORT — Ten years ago, most retailers were scrambling to increase their investment in house brands, or private-label products. In recent years, that trend has eased, or at very least, been transformed, as retailers begin to support more national brands again, while at the same time developing more and more proprietary brands of their own.

Private label is just one of the trends examined in depth in the newly-released Hardlines Retail Report.

Most retailers source their private-label products through their own sourcing or buying offices in Asia. Canadian Tire, Home Depot, Lowe’s and other major retailers all have their own buying offices in Shanghai, Hong Kong, and/or Singapore.

This procurement model ties in well with the model of effective proprietary brands and private labels that can offer a value price point for consumers—and a margin advantage for dealers.

Reducing emphasis on private labels and proprietary brands has become a worldwide trend in recent years. However, private labels are continually being developed that will complement strong national brands, and even wholesalers such as Orgill, Ace, and Home Hardware continue to develop their own private brands.

Canadian Tire exemplifies a focus on strong in-house brands that have the trappings of a national brand. These include Canvas, Woods, and Maximum. For example, the Canvas brand, which was introduced during Christmas 2013, was expanded considerably for this spring. It now includes outdoor furniture for yards and smaller items designed for condo living. The brand is expanding further with the addition of accessories such as rugs, lighting, and cushions.

Canadian Tire is just one of the retail companies analyzed in the 2016-2017 Hardlines Retail Report. Private label products represent one of a number of trends examined in depth. With almost 200 PowerPoint slides, dozens of charts and graphs, and analysis available only from HARDLINES, this is a marketer’s dream tool. (Click here for more info and to order this amazing research document now!)

back to top

______________________________________________________________________

____________________________________________________________________

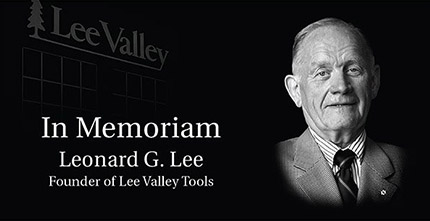

Leonard Lee, Lee Valley Tools: our hats off to a true entrepreneur

OTTAWA — The recent passing of Leonard Lee, founder of Lee Valley Tools, marks the end of a long career of a true retail pioneer. Lee, who died on July 7 at the age of 77, was born in Wadena, Sask. A former civil servant, his career included a stint with the Canadian Foreign Service, as well as the Canadian Consumer Council and the National Dairy Council.

Raised in a log cabin with dirt floors and neither electricity nor indoor plumbing, Lee studied civil engineering at the Royal Military College, ultimately graduating with a degree in economics from Queen’s University. He started Lee Valley Tools in 1978 as a mail-order catalogue business for specialty wood-working tools.

Lee had a special connection with Hardlines. He spoke at our annual conference twice, and is remembered by many delegates as one of our best speakers ever. He talked about the fearless choices he made to build his company, and shared the fair and open way he treated his employees. Combined with his stories of being wooed by big retailers like Zellers and Home Depot Canada, his presentations literally made us laugh and cry.

In addition to Lee Valley, Lee was also the founder of medical tools developer Canica Design and Algrove Publishing, which specializes in reprints of out-of-print technical books. Appointed to the Order of Canada with the rank of Member in 2003, Lee was suffering from vascular dementia in his final years and, according to Robin Lee, his son and president of Lee Valley Tools, his condition had begun to deteriorate rapidly in the past months.

back to top

_____________________________________________________________________

Groupe BMR has announced the appointment of Mélanie Gore as director—Flyers and Business Intelligence. Under the supervision of Alain John Pinard, her duties will include managing the flyer program, the loyalty programs, and BMR’s customer databases. Gore brings with her 10 years of experience in the marketing department at RONA, as well as time most recently as loyalty marketing director for Groupe Atis.

back to top

_____________________________________________________________________

CLASSIFIED ADS

Product Manager, Building Products–Mitten Building Products

Product Manager, Building Products–Mitten Building Products

As one of North America's largest building products manufacturers, Ply Gem makes it possible for every homeowner to enjoy a beautiful, custom-looking home exterior that's also energy efficient and low maintenance. The Mitten Building Products division is growing their marketing department and has retained Wolf Gugler Executive Search to identify a star building products marketer in search of their next career opportunity.

Reporting to the VP Marketing, you’ll enjoy category leadership for assigned product lines managing a significant product portfolio including:

- Managing the Stage Gage process, situation analysis including industry trends, field and customer input, gap analysis to identify and capitalize on opportunities

- Sku rationalization/evaluation with margin contribution in mind at all times

- Define marketing communications strategy to support product, channel and brand strategies

- Liaise with engineering and manufacturing on long term product planning

- Be an information conduit with internal and external customers including company branches, retailers, sales and customer service

- Work closely with Purchasing to negotiate programs and distribution agreements

Qualifications:

- Five years’ plus product marketing expertise in the building products field

- Demonstrated analytic, problem solving and planning skills

- A proven presenter in order to educate and influence others both internally and externally

- Stage Gage knowledge or similar product development road mapping experience

This position is based in Brantford, ON. Very competitive salary, bonus and benefits package offered in addition to advancement within the company.

We’ve had the privilege of working with the company on previous occasions and have known the VP, Marketing for many years. He’s a dynamic building products subject matter expert and both a good leader and delegator with no ego. What more can you ask for in your next career move?

You can expect complete discretion in exploring this great opportunity by contacting Wolf Gugler via email or phone at (888) 848-3006 for a confidential exchange of information. You may also apply online by clicking this link. We respond to all inquiries. This position is available immediately! |

Product Manager, Building Products–Mitten Building Products

Product Manager, Building Products–Mitten Building Products