|

IN THIS ISSUE:

- Buying groups showed solid growth in 2021, says latest Retail Report

- Home Hardware’s DCs can now help dealers fulfil their e-commerce orders

- TOOLBX online ordering platform connects dealers with contractors

- U.S. flooring sales will flatten this year, says U.S. research firm

PLUS: Peavey’s Doug Anderson named Prairie region Entrepreneur of the Year, Lowe’s Canada recycles 23,000 tons of waste, Peavey’s Ace show heads to Toronto, Richelieu reports Q2 revenues, Oldcastle acquires Barrette Outdoor Living, Goodfellow names Darren Miller as Saskatoon manager, West Four Group makes acquisition, housing starts decline, existing homes sales fall, and more!

|

|

|

|

|

|

|

Buying groups showed solid growth in 2021, says latest Retail Report

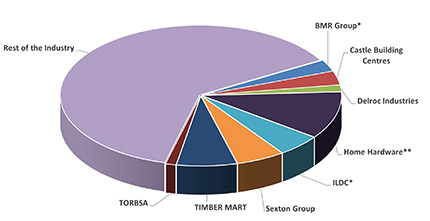

The majority of independent dealers in Canada operate as part of a larger buying group. These organizations gather independent building supply dealers to combine their sales volumes, mainly for commodity purchases.

According to the 2022 Hardlines Retail Report, these LBM buying groups collectively had strong sales performance last year, even though those sales fell slightly below the 11.3 percent growth of the industry overall. These numbers reflect the durability of the independent dealers that make up the buying groups.

A buying group can be dealer-owned, such as TIMBER MART and Castle, or privately owned, as in the case of Sexton Group and Delroc. But regardless of their structure, their central aim is a common one: to provide more leverage for independents to get the best price for their products, especially commodities. Together, they represent almost 2,600 dealers nationwide and represented more than one-third of the market in 2022, says the report.

The latest Hardlines Retail Report analyzes the growth of the industry and establishes the size of the retail home improvement industry by sales, store numbers, and province. It also examines the industry’s top 20 retail players, with an in-depth examination of four key retailers: The Home Depot Canada, Home Hardware Canada, Lowe’s Canada, and Canadian Tire Retail.

It's available in handy PowerPoint format, with more than 180 slides and more pictures and graphs than we can count!

(The 2022 Hardlines Retail Report will be available in a few days. To order you own copy of this exclusive report, click here now.)

|

|

|

Home Hardware’s DCs can now help dealers fulfil their e-commerce orders

Home Hardware has spent the past decade upgrading its distribution centres to better handle the huge flow of product that has to get out on a weekly basis to its 1,100-plus dealers nationally.

Its new warehouse management system, now in place in all three DCs—in Debert, N.S., Wetaskiwin, Alta., and St. Jacobs, Ont.—can also handle the growing demand for online orders.

It’s the latest update of a continuous systems improvement that began a decade ago. In 2012, the company began the process of migrating off its Oracle-based warehouse management system, which had been in place since 1990. Home Hardware is now using the Manhattan WMS, along with Dematic material handling equipment. Together, these systems run the distribution centre operations.

This new warehouse management system increases the level of automation to optimize inbound orders and outbound deliveries while providing efficiencies in overall inventory management. It allows the warehouse team to increase product velocity, enhance order accuracy, and implement efficiencies within the supply chain.

Whether online orders are to be sent to Home Hardware stores for pickup there, or sent directly to the customer’s home, the new WMS is equipped to fulfill those orders. John Dyksterhuis, VP logistics for Home Hardware, explains that the St. Jacobs DC has the capacity to sort, pick, and process e-commerce orders.

The ship-to-home capability is a relatively new initiative. It went live in July 2021, with a phased rollout to the other two DCs that was launched earlier this year.

|

|

|

TOOLBX online ordering platform connects dealers with contractors

The level of online sales among independent dealers is very low, Hardlines’ research shows. But many dealers are trying to figure it out—to their credit. For some that means paying Google for online ads. But even if a shopper gets directed to a dealer’s site from a Google ad, they may not have the ability to actually buy something there.

That’s where companies like TOOLBX come in.

TOOLBX was founded as an online buying platform for contractors by a trio of entrepreneurs in 2018. And now it’s part of Lowe’s Canada’s—among other stores’—strategies for reaching those pros online.

TOOLBX started as an online construction materials delivery platform and procurement tool focused on builders, trades, general contractors, and dealers. It offers very fast search and checkout. Products, sourced from home improvement store partners, are delivered in the company’s fleet of vehicles, which can handle up to 3,000 pounds of building materials.

The economics of such online delivery services are widely understood. It’s expensive for tradespeople to lay down their tools and go pick up more materials at the local building centre. Since the pandemic, TOOLBX has launched a brand-new platform to become a full-service digital enablement tech company.

This latest innovation, says company co-founder and CEO Erik Bornstein, “can set up a building supply dealer on a single platform that empowers them to sell, deliver, and process payments online through their own e-commerce store.”

Bornstein says his firm could be the starting point for thousands of building supply dealers in Canada who do minimal sales online. “Phase one is to get the dealers online to process orders. We don’t believe the dealers need to spend billions of dollars to provide a seamless online customer experience. Getting online should not require a dealer to lose themselves in the minutiae of tech. We know that dealers have full-time jobs running their businesses.”

|

|

|

U.S. flooring sales will flatten this year, says U.S. research firm

Anticipating product trends can certainly be tricky, but the Home Improvement Research Institute has been doing this kind of research for decades, so when HIRI suggests that flooring sales in the U.S. will drop in coming months, it’s worth paying attention.

While U.S. trends may vary from Canadian spending intentions, the overall trends warrant scrutiny. Based on recent estimates, there will be a drop in floor sales for renovation and remodels compared to 2021. This is one of the few categories HIRI anticipates will take a dip this year, alongside kitchen and bathroom cabinets.

However, the drop in flooring will follow a year of strong growth in 2021 that reached nearly 24 percent. Even with the drop off this year, the total U.S. spend on flooring products from 2020 through 2022 would equate to a three percent annual growth rate.

Inflation stemming from material shortages, high demand, and shipping delays continually act as headwinds on the sale of flooring products. In fact, the latest numbers out of the U.S. put inflation at 9.1 percent. But why does this hit the flooring category so hard?

Because of its durability, flooring has a life expectancy that is longer than most other components of a home. The massive influx of renovation spending on flooring in 2021 caused a pull-forward effect on many flooring projects, with many people trying to beat expected price increases by redoing flooring this year instead of one, three, or five years out.

HIRI identifies 2022 as a blip in the market for flooring or a slight correction to more historical growth patterns following a year of immense growth.

|

|

|

Peavey Industries CEO Doug Anderson has been named a 2022 EY Entrepreneur of the Year for the Prairie region. EY (Ernst & Young) has been honouring “unstoppable” Canadian entrepreneurs for some 30 years. This year’s national winner will be announced in November.

Goodfellow has appointed Darren Miller as manager of its Saskatoon branch. Miller has been a territory manager for Goodfellow in Saskatchewan for the past three years. He has more than 20 years of experience in the retail building supply business as GM for Nelson Lumber in Lloydminster, Sask.

Jonathan Gendreau has joined grocery giant Metro Inc. as senior director, online grocery and digital platforms. Gendreau previously spent five years with BMR Group, most recently as VP for business development, marketing, customer experience. He has nearly 20 years of experience in e-commerce and digital marketing.

Chris Allinotte has joined the Western Retail Lumber Association as director of marketing and communications. Allinotte was marketing lead for Balmoral Hall, a girls’ boarding school in Winnipeg, for the past nine years. He began his communications career with Carquest Auto Parts in Toronto.

|

|

|

|

DID YOU KNOW...?

... that you can now buy tickets for the next Hardlines Conference? That’s right, registration is now available online for the 26th annual Conference, being held Oct. 18 and 19 at the Queen’s Landing Hotel in Niagara-on-the-Lake, Ont. Sign up now as tickets are limited for this year’s event. |

|

|

| RETAILER NEWS

Lowe’s Canada has published a summary of highlights of its corporate responsibility milestones for 2021. Among other accomplishments, Lowe’s Canada points to its recycling nearly 23,000 tons of waste, putting it more than halfway towards its 2025 target.

Peavey Industries will host its next Ace dealer buying show in Toronto Sept. 20 to 22. It will be a combined show and market, bringing together both independent Ace dealers and managers for the Peavey Mart stores, which are corporately owned.

CORRECTION: We ran a story last week about Peavey’s latest changes as it tweaks its business to serve Ace Canada dealers. We cited a consulting firm that has been providing guidance to Peavey. That company’s correct name is the Poirier Group.

|

|

|

|

SUPPLIER NEWS

Richelieu Hardware reported Q2 revenues of $487.9-million, up 31.4 percent. Net earnings rose by 27.7 percent to $77.9-million, or $0.83 per diluted share. Canadian sales grew 17.3 percent to $292.3-million. Sales to Canadian retailers reached $55-million, up $9.3-million or 20.4 percent from the comparable period of 2021.

Oldcastle APG, an outdoor living and building materials manufacturer based in Atlanta, has acquired Barrette Outdoor Living. Founded in 1975, Ohio-based Barrette has 14 locations in the U.S. Its fulfilment needs are served by a warehouse just outside Granby, Que., 45 minutes from the Vermont border. Oldcastle’s parent company is CRH plc, based out of Dublin, with operations in countries from Switzerland to the Philippines.

|

|

|

|

West Four Group of Companies said this week it has purchased WSI Doors, Dorland Doors, and More Than Doors, with ownership taking effect July 1. WSI and Dorland will continue to operate as before pending an operational review, with a view to an eventual seamless integration. From July 1, the distribution lines of Larson, Renin, Schlage, Allegion, and Assa Abloy will be available for sale through WSI.

Even as construction is booming, the supply of cement has been squeezed by a combination of factors, CBC News reports. They include higher demand, a shrinking labour pool, and inflation. “This is a good-weather summer, and people have put off building for a while, and the money has come from governments,” Michael Veall, an economics professor at McMaster University, explains. “And now everybody wants to do everything all at once.”

|

|

|

|

ECONOMIC INDICATORS

June saw Canada’s inflation rate spike to 8.1 percent, according to StatCan, its most rapid annual increase since 1983. With gasoline, the leading contributor, backed out of the equation, the rate would be 6.5 percent. In a Bloomberg survey, economists had projected an even more dire increase to 8.4 percent.

The seasonally adjusted annual rate of housing starts was 273,841 units in June. That figure represents a three-percent decline from May. The rate of total urban starts for the month fell by three percent to 257,438 units. Single-detached urban starts were down four percent to a rate of 60,416 units. Rural starts were estimated at an annualized pace of 16,403 units. (CMHC)

Sales of existing homes in Canada fell by 5.6 percent between May and June 2022. Although larger declines were recorded in April and May, monthly activity has dropped to slightly below average levels for the month of June. Sales were down in three-quarters of all local markets, led by some of Canada's biggest cities, including the Greater Toronto Area, Greater Vancouver, Calgary, Edmonton, Ottawa, and Hamilton-Burlington. The actual (not seasonally adjusted) number of transactions in June came in 23.9 percent below the record for that month set last year. (Canadian Real Estate Association)

Housing starts in the U.S. fell by two percent to an annualized rate of 1.56 million units in June. That was the slowest pace since last September. Building permits in June fell by 0.6 percent to a rate of 1.69 million units. (U.S. Commerce Dept.)

|

|

|

|

|

|

NOTED

The latest episode of Hardlines’ podcast series What’s In Store, goes live this week. In this instalment, we hear from Rebecca Gravelle, winner of the 2019 Outstanding Retailer Award for Young Retailer. She talks about the many hats she wears, including managing HR, as VP of operations for two Castle stores in eastern Ontario. Sign up now to get updates about the latest podcasts in your inbox!

|

|

|

|

OVERHEARD...

“For the last 60 years, the Barbie Dreamhouse has been a spectacular home that allows kids to immerse themselves in Barbie’s world and gives them the room to dream. The curated colours in this collection were created to continue inspiring imaginative play, beyond the Barbie Dreamhouse, in the homes of those who love Barbie.”

—Jennifer Gileno, head of licensing at Mattel Canada, on a new branding tie-in with Home Hardware’s BeautiTone paint to provide a new palette of bright colours for the home.

|

|

|

|

| Classified Ads

|

|

|

|

Looking to post a classified ad? Email Michelle for a free quote. |

|

|

|

| Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2022 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Steve Payne — Acting Editor— steve@hardlines.ca

Geoff McLarney — Associate Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internal routing from this end!

1-3 Subscribers: $495

4 -6 Subscribers: $660

7

-10 Subscribers: $795

11-20 Subscribers $1,110

21-30 Subscribers $1,425

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

|

|

|