|

IN THIS ISSUE:

- RONA begins its Lowe’s rebrand with 10 stores in southern Ontario

- Vendors are waiting to get product in—and out—because of B.C. port strike

- Independents’ market share plateaued post-Covid: Hardlines Retail Report

- Nova Scotia dealers cope with floods that have taken at least three lives

PLUS: Canac is on a roll, Loblaw’s profits pass half a billion dollars, Lowe’s worker fired for pursuing theft suspect is reinstated, Home Hardware dealer in Fergus celebrates 100 years, RDTS partners with Liteline, Walmart stores turn down the volume, new Ontario GM at Wolseley, retail sales slip, and more!

|

|

|

|

|

|

| RONA begins its Lowe’s rebrand with 10 stores in southwestern Ontario

The Lowe’s banner in Canada will soon be a thing of the past. On July 27, new RONA+ banners went up at 10 Lowe’s stores in southern and southwestern Ontario. The former Lowe’s stores which have converted are located in Ancaster, Brantford, Cambridge, Hamilton, Kitchener, Niagara Falls, Sarnia, Waterloo, and the two stores in Windsor.

RONA inc. developed its RONA+ banner after Lowe’s Cos. sold its Canadian banners to Sycamore Partners, a New York City-based private equity firm, earlier this year. Among the stores they acquired were 61 Lowe’s stores in this country, all of which will eventually be converted to RONA+.

Lowe’s products will continue to be available—and gift cards and warranties will continue to be honoured—in the new-look RONA+ stores.

The 10 stores had grand reopening deals on July 29 and 30 that included “seasonal and stylish home décor essentials and building materials,” according to RONA marketing. The celebrations included food, activities for kids, prizes of RONA gift cards, and music.

RONA inc. has called the conversions “the first step in a wider plan aimed at redefining how Canadians shop for home improvement, creating new opportunities to improve how we serve them.”

Christian Nelson (shown here) is the store manager at the Niagara Falls store. He’s excited by the new look and stresses that all 160 associates at this location have been heavily involved in the conversion. He is quick to point out that the changes are more than simply cosmetic.

“The ‘plus’ in RONA+ means lower prices on thousands of articles in the store. It means a stylish assortment—more stylish than our competitors. It means brands that people know and love, flexible payment options, and our price match plus 10 percent guarantee.”

RONA inc. has also announced the next 15 Lowe’s store that will be converted to the new RONA+ banner in Ontario. They are in Barrie, Belleville, East Gwillimbury, Kanata, Kingston, London North West, London South West, Maple, Nepean, Orleans, Oshawa, Ottawa Gloucester, Pickering, Sudbury, and Whitby. The stores will remain open during the conversion.

The timetable for the conversion or disposition of the remaining 36 Lowe’s stores in Canada has not been revealed.

Including its remaining Lowe’s stores, RONA inc. operates or supplies some 425 corporate and affiliated (independent) home improvement stores under the RONA, RONA+, Réno-Dépôt, and Dick’s Lumber banners.

|

|

|

Vendors are waiting to get product in—and out—because of B.C. port strike

The strike by workers at ports in British Columbia has been dragging on, and off, for almost four weeks. The work stoppage ties in with the approaching busy shipping times for many vendors, especially those trying to get product to their retail customers in time for the Christmas selling season.

Richelieu Hardware, the country’s largest cabinet hardware and fastener company, is feeling the effects of the strike as far east as Montreal, where it has its headquarters. According to Eric Daigneault, general manager of divisions at Richelieu, the strike has had an impact on many levels, “mainly on new product launches and restocking on a few existing products.”

However, Daigneault admits that the disruption will cause big delays, which Richelieu has tried to mitigate. “We believe the strike will have caused delays of three to four days for each day the strike has lasted. This forced us to use some airfreight and rerouting to other ports in our supply chain.”

Erin Wizenberg is the general manager of Holland Imports, a major hardware supplier based in Surrey, B.C. “The strike has definitely affected us,” she says, adding that it poses a two-fold problem—getting ships in to port and getting product out.

Holland Imports carries a wide range of products through five divisions, and Christmas is a big one for them. But those products need to ship as soon as possible.

In-bound containers of goods that are on their way in to port or just came in are not moving. “So we’re looking at a five-day delay, even for ships that are in port. However product that needs to be picked and packed is still sitting on the water. We have 15 containers that are delayed and in the past five days only two of them have been retrieved.” Holland Imports has another 20 to 30 containers still sitting in China, most of them filled with Christmas products.

But ships are like airlines. If there aren’t enough “passengers,” they can cancel a stop, bypass a port, or cancel a ship altogether. This practice is called blank sailing, something companies like Holland Imports must contend with at the best of times.

“Christmas goods should be loaded now—and with blank sailings, that’s being pushed out 20 days. So it will be too late to pick and pack and get it out to our retailers before the end of September, otherwise my customers won’t take that product.”

Wizenberg says the delays aren’t affecting the cost of products directly, but holding costs for products that are stuck keep rising. Even ships that are heading to Vancouver are slowing their arrival times, she notes. “Because of the delays in port, even ships that are out on the water are slowing down, to save gas and decrease the amount of time sitting in port.”

Daigneault at Richelieu agrees that prices haven’t been affected. “Not so far, but it means headaches with our retailers and for our supply chain staff trying to find alternatives."

|

|

|

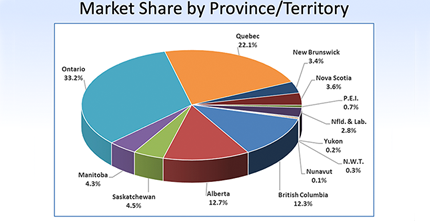

Independents’ market share plateaued post-Covid: Hardlines Retail Report

Canada’s retail home improvement industry returned to something like normality in 2022 after seeing exceptional growth in 2020 and 2021 due to the effects of the pandemic, the 2023 Hardlines Retail Report has found.

It’s not only that high borrowing costs have curtailed the appeal of homebuying, leading to fewer reno projects. Household spending has also become more diffuse since the end of pandemic lockdown restrictions opened up more options.

When people were more or less limited to their homes, money that might otherwise have been budgeted for travel or dining out got redirected to improving the home as a multi-purpose space. Now those options are all back on the table.

For many dealers, this slowdown may come with some relief. The boom in sales activity during 2020 and 2021 came at the price of staffing headaches and uncertainties around supply chains.

The 2023 Hardlines Retail Report looks at how all these trends have translated into sales numbers, including breakdowns by banner, province, and store type. Sales at big box stores, for example, remained strong in 2022 even as they dipped slightly from the previous year.

During 2022, the Top Four retail groups further solidified their market dominance. While independent dealers saw sales rise in absolute terms, their growth failed to keep pace with the industry average of growth—after the temporary advantage they gained during Covid restrictions on large retailers.

Our exclusive and proprietary research offers insights on hot trends from private labels and e-commerce penetration to rewards programs and the challenges of consolidation. The Report also presents Hardlines’ calculations of RONA’s and Home Depot’s omnichannel growth, and forecasts for their growth in 2023 and 2024.

(The Hardlines Retail Report is now available for purchase. As a Premium Member-Subscriber, you save more than 20 percent on your order, and more than 30 percent when you buy the Retail Report bundled with its companion, the annual Hardlines Market Share Report. Click here to order!)

|

|

| Nova Scotia dealers cope with floods that have taken at least three lives

In what some dealers are calling the worst storm they’ve seen in their lives, certain parts of Nova Scotia got hit by up to 250 mm of rainfall last week. Roads and bridges in some counties got washed out—and the main rail line through the province was cut. Two children were swept to their deaths by the flooding and a 52-year-old man also lost his life. The province declared a State of Emergency.

Hardlines reached out to dealers in the affected areas for comment. “Bedford, Sackville, and Metro Halifax were hard hit,” said Andrew Payzant, president and CEO of Payzant Building Products Ltd., which has a group of Home Hardware Building Centres in Nova Scotia and New Brunswick.

“Many roads and infrastructure are still closed, and many people have badly damaged homes. Personally, all our nine stores are okay except for our Sackville [Nova Scotia] store. There, we have major flooding of the retail store as well as a warehouse and yard (pictured).

“A huge shoutout to our team that worked overtime to get open again the next morning, ready to serve the community.” Payzant also acknowledged the support from Home Hardware corporate, which opened up its Atlantic distribution centre in Debert, N.S., “so we could send a truck and bring in hundreds of badly-needed sump pumps and dehumidifiers to serve the community.”

Curtis Saulnier, manager of Nova Scotia Building Supplies in Blockhouse, N.S., said that his firm’s sister store in Chester, N.S. (both stores are on the south shore of Nova Scotia) got flooded. “Probably a $100,000 loss. Anything in a box—doors, windows—it acts as our warehouse.” Saulnier said the management hoped to have the losses cover by insurance. “The water shot right up through the floor drains.”

Saulnier said it was his day off on July 22, during the peak of the storm, but he phoned in to say he was coming to help at the Blockhouse store. He made it 15 minutes down the road before he was turned back by authorities. Lunenburg County, home to both stores, got hit really hard. He said the store has provided a large supply of sump pumps for residents. Fortunately, getting more supply was not a problem because the storm was so localized.

|

|

|

|

At Wolseley Canada, Alex Nahvi has been named general manager for Ontario. A 21-year veteran with the company, he assumes responsibility for various aspects of its operations in the province, including organizational planning, budgeting, cost control, and sales. Most recently Nahvi spent five years as the director of residential trade and counter in the Upper Midwest region, followed by three years as the director of branch management.

Rick Mather has been appointed vice-president of retail operations at Peninsula Co-op. Mather has spent over 30 years in retail management that included leadership roles at Woolco/Walmart Canada, where he held the position of store manager in Whitehorse and later in Victoria. Most recently, he served as the VP of retail operations at a start-up retail company.

|

|

|

|

DID YOU KNOW...?

… that anyone trying to decide whether to go to the International Hardware Fair in Cologne, Germany, next spring now has even more reasons to do it? We already told you about the incredible Rhine Cruise we are adding to this event. Now, we’ve found a new cruise partner that will let you stay on board during the entire show. That means you don’t have to book a separate hotel to stay while attending the show. The Hardware Fair runs March 3 to 6, 2024. The cruise leaves Cologne March 6 and arrives in Amsterdam March 12. It’s going to be an amazing event. Click here for more info!

|

|

|

|

RETAILER NEWS

A Home Hardware Building Centre on Tecumseh Road West in Windsor, Ont., sustained $100,000 in damage because of a fire July 21, according to the Windsor Fire Service. There were no injuries and the store reopened for business the next day after the 11 pm fire. Store management told CTV News that they believe the fire started outside the building in a garbage can. Most of the damage is outside the store at the front, with the exterior cladding and signage charred. There was also water damage inside the store.

Canac has a new store in the works in Salaberry-de-Valleyfield, Que. “We already have openings planned in 2024 in Sorel as well as Rivière-du-Loup, which would give us reason to believe we’ll be in a position, if all goes according to plan, to serve the people of Valleyfield in the middle of 2025,” marketing director Patrick Delisle told Le Journal Saint-François. Like most Canac outlets, the store will occupy some 40,000 square feet and employ between 100 and 125 staff.

Loblaw Cos. Ltd. reported Q2 net earnings that reached $508 million, from $387 million a year earlier. The company attributed the 31 percent gain largely to a $111 million tax charge that bit into its Q2 earnings in 2022. Revenues for the quarter rose 6.9 percent to $13.7 billion, while grocery same-store sales were up by 6.1 percent.

|

|

|

|

|

Dixon Home Hardware Building Centre in Fergus, Ont., celebrated its 100th anniversary last week. The store has been family-run since 1923. Current dealer-owners Jeff and Jason Dixon joined the business with their father in the 1990s. In 2004, the Dixons brought the store under the Home Hardware banner.

Donna Hansbrough, 68, got her job back as a Lowe’s associate in Rincon, Ga., after she had been fired a month earlier. Attempting to stop three suspected shoplifters, she had grabbed onto a shopping cart in the parking lot and allegedly got punched in the face three times for her trouble. Lowe’s and other big retailers have strict policies that forbid associates from confronting shoplifters. Hansbrough’s case created a social media backlash—with many customers calling for a boycott of Lowe’s. The company reinstated her “after senior managers became aware of the incident,” Lowe’s told the media.

“Sensory-sensitive” shoppers will have their own time to shop at Walmart, as the stores’ physical environments will be toned down. The discount retailer announced a two-hour window, every Saturday from 8 a.m. to 10 a.m. through August, in which stores will dim their lights, radios will be turned off, and switch to static images on TV monitors. The accommodations, the company says, are an attempt to improve the shopping experience for autistic people and those with sensory processing disorders.

|

|

|

|

|

| SUPPLIER NEWS

U.S. hardware wholesaler Orgill is making investments to keep up with the unprecedented growth it has experienced over the past three years. It will expand its field sales team by as much as 10 percent, in addition to the more than 400 field service people it currently has working with its retailer customers in North America and around the world. Meanwhile, construction of an 800,000-square-foot distribution facility in Tifton, Ga., continues. The new DC will replace Orgill’s existing Tifton facility, which opened in 1995.

RDTS Canada has forged a partnership with Liteline, a company specializing in lighting fixtures for residential and commercial spaces. RDTS will support Liteline with merchandising to the Canadian market of Liteline’s Trenz-branded retail product lines.

|

|

|

|

|

|

| ECONOMIC INDICATORS

Retail sales slid by 0.2 percent to $66 billion in May. Sales increased in five of nine subsectors and were led by hikes at motor vehicle and parts dealers, up 0.8 percent, and food and beverage retailers, which rose by one percent. In LBM and garden categories, sales were down 1.5 percent from April and 8.6 percent from the previous May. (StatCan)

Sales of existing U.S. homes fell by 3.3 percent in June to an annual rate of 4.16 million units. It was the lowest level of sales in five months. On a year-over-year basis, home resales tumbled by 18.9 percent. (National Association of Realtors)

U.S. housing starts declined by eight percent in June after a spike in May. The multi-family segment was hardest hit, but single-family projects were down by seven percent. The value of building permits issued in June was down 3.7 percent. (U.S. Census Bureau)

|

|

|

| NOTED

The latest instalment of the Hardlines podcast series, What’s In Store, has gone live. This episode features a lively discussion about the importance of e-commerce and why getting started needn’t be daunting for independent dealers. You’ll hear Hardlines editor Steve Payne in conversation with tech guru Romain Mercier, partner and co-founder at Vancouver-based PS&Co Data Lab. Sign up now for free and get updates about our latest podcasts in your inbox! |

|

|

|

|

|

|

|

|

Looking to post a classified ad? Email Jillian for a free quote. |

|

| Privacy Policy | HARDLINES.ca

The Hardlines Weekly Report is part of the Hardlines Premium Membership

Hardlines Weekly Report is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2023 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President — mike@hardlines.ca

Steve Payne — Editor — steve@hardlines.ca

Geoff McLarney — Associate Editor — geoff@hardlines.ca

David Chestnut — VP & Publisher — david@hardlines.ca

Michelle Porter — Marketing & Events Manager — michelle@hardlines.ca

Jillian Macleod — Administrative Assistant — jillian@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES "Fair Play" Policy. Forwarding or reproduction of Hardlines content is a violation of your terms of service as a valued subscriber. Please respect our copyright! However, we DO want to reach as many people as possible at your firm or banner, so please DO enquire about our really low "extra subscriber(s)" rates. Contact jillian@hardlines.ca to get your colleagues added!

1-3 Subscribers: $495

4 -6 Subscribers: $660

7

-10 Subscribers: $795

11-20 Subscribers $1,110

21-30 Subscribers $1,425

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

|

|

|