Dave Kellam has joined AD as director, business development for the Building Supplies–Canada division. With over 16 years of industry experience, Kellam will contribute to member and supplier recruitment efforts, strategic partnerships, working to drive divisional results across the nation. Before joining AD, he held various sales and marketing roles at Elemex Architectural Facade Systems, Rockwool, Continental Gypsum, and Firestone Building Products.

Dave Kellam has joined AD as director, business development for the Building Supplies–Canada division. With over 16 years of industry experience, Kellam will contribute to member and supplier recruitment efforts, strategic partnerships, working to drive divisional results across the nation. Before joining AD, he held various sales and marketing roles at Elemex Architectural Facade Systems, Rockwool, Continental Gypsum, and Firestone Building Products.

Archives

Home Depot looking to sublet four huge warehouses in U.S.

Pierre Battah shares workplace strategies at Hardlines Conference

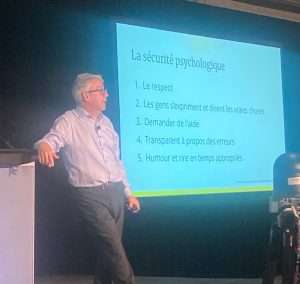

Hardlines’ 28th Annual Conference concluded last week, held at the Fairmont Le Manor Richelieu in the Charlevoix region of Quebec.

Hardlines’ 28th Annual Conference concluded last week, held at the Fairmont Le Manor Richelieu in the Charlevoix region of Quebec.

On day one, Pierre Battah, a workplace expert head and self-confessed “recovering head-hunter,” stepped up to the podium to kick off the conference. Battah talked about having purpose in leadership, balancing caring for employees and achieving results, the science-based evidence on positivity and feedback, and the importance of daily positivity and respect.

Rebecca Dumais

Kent rolls out appliance sales in more stores

Kent Building Supplies has added appliance showrooms in seven more of its stores throughout Atlantic Canada. The company first brought fridges and stoves into select stores in November 2023. The latest locations are in: Antigonish and New Minas, N.S.; Sussex, Bathurst, and Woodstock, N.B.; and Clarenville and Grand Falls-Windsor, N.L. Kent now sells heavy appliances in 21 of its 48 stores.

Kent Building Supplies has added appliance showrooms in seven more of its stores throughout Atlantic Canada. The company first brought fridges and stoves into select stores in November 2023. The latest locations are in: Antigonish and New Minas, N.S.; Sussex, Bathurst, and Woodstock, N.B.; and Clarenville and Grand Falls-Windsor, N.L. Kent now sells heavy appliances in 21 of its 48 stores.

Canfor reports third-quarter loss

Canfor Corporation is reporting a Q3 operating loss of $559.7 million, compared with an operating loss of $250.8 million in the second quarter of 2024.

Canfor Corporation is reporting a Q3 operating loss of $559.7 million, compared with an operating loss of $250.8 million in the second quarter of 2024.

“This was another extremely challenging quarter for our lumber business,” said Canfor president and chief executive officer, Don Kayne, adding that North American operations continued to face a persistently weak pricing environment. He said these conditions have resulted in unsustainable financial losses from the company’s British Columbia operations. The company recently announced the closing of its Plateau and Fort St. John operations in northern B.C. by the end of 2024.

Sarah McGoldrick

Hardlines Conference concludes with panel discussion

The 28th Hardlines Conference ended Wednesday afternoon with a panel discussion among some of the country’s top buyers. It was moderated by Sherri Amos (far left), director of dealer support at Home Hardware Stores Ltd.

She was joined (pictured from left to right) by Rabia Dhanani, merchandise manager for millwork at Home Hardware; Shawn Ettinger, national hardware procurement manager at TIMBER MART; Kelvin Johnston, senior buyer, commodity lumber and panels, Castle Building Centres; Natacha Laurin, RONA’s category director for home décor; and Alex Burcham, senior category manager for plumbing, electrical, heating, and cooling, Orgil.

The wide-ranging conversation touched on themes from the future of AI to the importance of private labels, as well as changing consumer behaviour and how to leverage loyalty programs.

RONA Lachine, Quebec, celebrates grand opening of new warehouse

RONA Lachine, an affiliate store, celebrated the completion of its major expansion and renovation project on Wednesday. The project on the west island of Montreal required an investment of $2 million, RONA said in a release.

RONA Lachine, an affiliate store, celebrated the completion of its major expansion and renovation project on Wednesday. The project on the west island of Montreal required an investment of $2 million, RONA said in a release.

“The main goal was to build a second warehouse for building materials, to improve the service offering for construction and home improvement professionals. The RONA Lachine store was expanded by 6,500 square feet and 75 items were added to the store’s product assortment. The new warehouse is accessible by vehicle and includes a service counter equipped with a racking system, electronic shelf labels, and lockers for online order pick up. The Chartier family also took the opportunity to add parking spaces, including two with electric charging stations, and a staff break room with a patio.”

Newfoundland Castle dealer wins small business award

The population of Fogo Island, which is off the northeast coast of Newfoundland and Labrador, was measured at only 2,244 in the 2016 census. That hasn’t stopped Castle dealer Ryan Holmes from running a successful home improvement store on the island. “Work hard. Your hard work will pay off,” Holmes said. “It’s not an easy journey, but it will be worth the struggle.” A press release from Castle’s head office yesterday said that the store had been awarded Fogo Island’s Small Business of the Week Award. (Pictured is Ryan Holmes, right, with Shayna Waterman, centre, who was awarded a store scholarship for $1,000 earlier this year.)

The population of Fogo Island, which is off the northeast coast of Newfoundland and Labrador, was measured at only 2,244 in the 2016 census. That hasn’t stopped Castle dealer Ryan Holmes from running a successful home improvement store on the island. “Work hard. Your hard work will pay off,” Holmes said. “It’s not an easy journey, but it will be worth the struggle.” A press release from Castle’s head office yesterday said that the store had been awarded Fogo Island’s Small Business of the Week Award. (Pictured is Ryan Holmes, right, with Shayna Waterman, centre, who was awarded a store scholarship for $1,000 earlier this year.)

Retail sales rise in August

Retail sales increased 0.4 percent to $66.6 billion in August, according to the latest StatCan data. Sales were up in four of nine subsectors, led by increases at motor vehicle and parts dealers. Sales in LBM and garden categories fell by 0.5 percent. Seven provinces saw sales rise in the month, with Ontario’s 0.9 percent gain clocking in as the largest. The largest decrease was in Alberta, largely due to lower food and beverage sales.

Strongman kicks off final day of Hardlines Conference

Hugo Girard, world champion strongman and wellness leader, was the first speaker of the 28th Hardlines Conference’s second day. Girard described his lifelong dream to be the world’s strongest man and what he has done to achieve his goals. He offered examples of how perseverance revolves around focus, training, initiative, dedication, determination, expressing that talent can only take you so far.

Hugo Girard, world champion strongman and wellness leader, was the first speaker of the 28th Hardlines Conference’s second day. Girard described his lifelong dream to be the world’s strongest man and what he has done to achieve his goals. He offered examples of how perseverance revolves around focus, training, initiative, dedication, determination, expressing that talent can only take you so far.

Rebecca Dumais