|

IN THIS ISSUE:

- Home improvement industry scrambles to make sense of latest tariffs

- BMR targets pros in new marketing campaign

- Stock markets turn volatile in first week after Trump’s “Liberation Day”

- Home Depot unveils spring and summer lines at product preview

PLUS: B.C. billionaire to bid on HBC, RONA named sustainability leader, Rust-Oleum parent buys Pink Stuff, IKEA opens Plan and Order Point in Quebec, Canada needs more unskilled immigrants, Peak Group hires new VP marketing, and more!

|

|

|

|

|

|

Home improvement industry scrambles to make sense of latest tariffs

Many Canadian retailers are shying away from U.S.-made products as consumers look to buy Canadian. Jessica Hung, CEO of Parasol Co., a California-based manufacturer of diapers, told CTV News her company had been working since January with a distributor to expand its product presence in Canada.

In early March, however, the distributor stopped working on the project. “They were instructed by a retailer to pause any American brand launch,” said Hung. “They told us they would re-evaluate when market conditions allow. That’s the kind of disruption we would never expect.”

But the disruption goes well beyond diapers. The U.S. is gearing up to more than double the existing duties on Canadian softwood lumber. That means the rates—a combination of tariffs and ongoing anti-dumping duties—will rise to 34.45 percent from 14.54 percent. The U.S. Lumber Coalition and the office of B.C. premier David Eby both confirmed the move, which Eby denounced as “an attack on forest workers and British Columbians.”

Canada and Mexico, the United States’ largest trading partners, were omitted from the baseline 10 percent tariff imposed on April 5, exempted by the terms of the existing North American (CUSMA/USMCA) trade pact. Then another reprieve came last Wednesday, when U.S. President Donald Trump made the surprise announcement that he would “pause” his reciprocal tariffs against countries that impose counter-tariffs of their own against the U.S.

However, the current duties have already taken their toll, as companies like Canfor have been forced to close mills. Companies that rely on the movement of parts and materials, which includes manufacturers of everything from paint to plumbing products, are trying to figure out how many times even a smaller 10 percent tariff might be applied to materials as they move back and forth across the border.

|

|

BMR targets pros in new marketing campaign

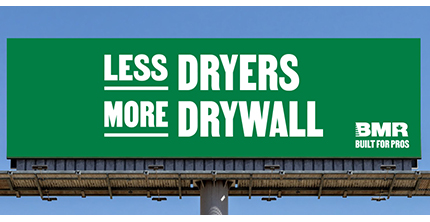

BMR Group has adopted new marketing, touting its stores as the destination for pros. Creative agency lg2 is delivering a multi-platform marketing campaign.

Earlier this month, BMR in collaboration with lg2, took its messaging to various media in Quebec, Ontario, and the Maritimes, including TV, radio, billboards, and digital media. The campaign includes a 15-second multi-platform marketing spot, plus billboards and social media posts, all featuring taglines that target the contractor customer: “Pour les vrais” (“For the real ones”), “Built for pros,” “The experts’ centre,” and “Less dryers, more drywall.”

“At its core, BMR is defined by exceptional customer service, a team of dedicated experts, a high-quality inventory, and a well-established network,” CEO Alexandre Lefebvre said in a release. “This new image reinforces our industry-recognized commitment to quality, while staying true to the core values that have made us successful.”

“We wanted to realign our focus on experts to evolve BMR’s brand positioning and image, to become the expert’s centre for professionals,” Marlène Hins, BMR’s VP of marketing and communications, told Hardlines. The marketing campaign, she explained, is “based on three key pillars: local, expertise, and products—the right product and quality.”

BMR, she adds, is “already a destination for the contractor clientele but we wanted to put the focus of our campaign on this very business segment, which is one of the pillars of our growth strategy.” At the same time, the company is also keeping a focus on a more skilled retail customer, “DIYers who aspire to be considered pro,” says Hin.

The new campaign encompasses all BMR brands. “Our brand positioning and marketing campaign include all our banners—BMR, BMR Express, BMR Pro, and Potvin & Bouchard—from smaller stores to larger locations, because they all serve, to a certain extent, the pro clientele.”

|

|

| Stock markets turn volatile in first week after Trump’s “Liberation Day”

“My fellow Americans, this is Liberation Day. April 2, 2025, will forever be remembered as the day American industry was reborn.”

So said President Trump in the Rose Garden of the White House, a week last Wednesday. He went on to announce a list of 90 countries that would be hit by between 10 and 49 percent “retaliatory” tariffs, including a whopping 104 percent for China.

But Canada wasn’t on the list of countries to be hit by these retaliatory tariffs. As a result, stock markets in Canada went up, briefly, before they tumbled in a wild ride of volatility the entire first week of the new “liberated” era.

The first week of Trump’s attempt to tariff the world ended up with a bear market, at least for a day, on April 9. That happened last Wednesday afternoon, following an announcement by Trump that he would shelve the entire retaliatory tariff schtick for three months. Except for China. That country would receive punishing U.S. tariffs of 125 percent, threatening to grind to a halt the commerce between the two largest economies on earth.

The Toronto Stock Exchange registered a 4.8 percent dip in the first seven days following Liberation Day. Canadian Tire, the bellwether Canadian home improvement stock, dropped over that period from $149.78 to $144.66, down 3.4 percent. The largest market capitalization hardware distributor on the TSX, Richelieu Hardware, grew 8.0 percent (from $33.56 to $36.25) in the first week after April 2. That was on the cusp of its April 10 first-quarter results, a 5.2 percent drop in earnings on a sales hike of 8.6 percent. Doman Building Materials was up 3.7 percent over that first week, from $6.72 to $6.97.

In the U.S., stocks for home improvement companies that rely on China for a lot of their manufacturing got hammered hard. Even firms that have announced major plant closings in the country were down, like Stanley Black & Decker, which fell from $75.10 to $64.22 over the first week post-Liberation Day, representing a drop of 14.5 percent. Masco was similarly down, by 13.0 percent, from $64.42 to $56.04 during that time.

Even if companies aren’t affected directly, the home improvement sector can be expected to feel the impact of lower consumer confidence, especially if the North American economies slip into a recession. In the meantime, the world scrambles to keep up with the constant shifts in U.S. policy.

|

|

| Home Depot unveils spring and summer lines at product showcase

With warm weather looming, Home Depot Canada put on an event recently to promote its latest seasonal products. The shindig was held at a hip event space in Toronto’s downtown where the retailer played host to media and influencers—and Hardlines was there.

Featured products included Home Depot’s own lines of outdoor furniture, barbecues from Weber and Traeger, power tools by Ryobi, and the latest cleaning products to help consumers tackle spring cleaning.

“This year, our four collections target the traditional, contemporary, transitional, and eclectic,” said Natalia David, Home Depot Canada trend and design manager.

The outdoor furniture collections included one called Sunny Days, which marries “cottagecore” and “cabincore” (a rustic cabin aesthetic) with a cheerful, nature-inspired touch. Another, called Eclectic Fusion, brings a refined boho aesthetic with muted greens and taupe tones. Modern Reset features soft finishes, round accents, and sleek geometric lines; and Country Glamour blends dark, moody tones with classic patterns, white florals, and geometric lines.

In keeping with the perfect patio, Trex Honey Grove decking features, along with a 25-year warranty, resistance to mould and UV rays. “This product also has heat dissipation technology in it,” said Justin Morrin, Home Depot Canada’s divisional product merchant, deck and fence. The days of stepping on a hot deck are over.

Ryobi, which has over 300 power tools exclusively for Home Depot Canada, introduced a new 40-volt battery powered lawnmower. Also shown at the event were the USB-C chargeable tools, ideal for smaller tasks, as well as some of the new ONE+ 40-volt cordless tools.

Tool rental merchant assistant Rawan Rice showed that Home Depot Canada is moving towards offering sustainable tools. “We are moving away from a lot of gas power tools into a battery software to make it a bit more eco-friendly.” Some newer pieces of equipment, which are still gas powered, have also been added, including aerating and over-seeding machines.

Style-wise, this year’s collections, said Home Depot Canada’s trend and design leader, Cindy Jardim, “put the focus on functionality, always backed by value, so consumers can be really happy with their purchases.”

|

|

| PEOPLE ON THE MOVE

Becky Yan joins The Peak Group of Companies as vice-president, marketing effective today. Yan’s background includes stints at companies like American Standard, Dulux, and Ryobi. Her role at Peak will include collaborating on product innovation, developing multi-channel marketing strategies, and executing digital and traditional full-funnel marketing campaigns. Peak’s range of home improvement products consists of 1,000-plus SKUs in 21 categories. Its an exclusive supplier to more than 2,000 Home Depot stores across North America, as well as the Bunnings home improvement chain in Australia and New Zealand.

|

|

|

| DID YOU KNOW…?

…that our monthly newsletter for dealers and store managers, Hardlines Dealer News, landed in subscribers’ inboxes last week? In this issue, we explore one BMR dealer’s ag focus, an independent affiliate’s purchase of a RONA corporate store, and how one B.C. dealer is encouraging shop-local habits. Hardlines Dealer News is monthly and it’s free: click here to subscribe now!

|

|

| RETAILER NEWS

Weihong Liu, chair of Nanaimo, B.C.-based Central Walk, has stated her intention to announce on April 18 a proposal to acquire Hudson’s Bay Co.’s retail business. Central Walk owns three major mall complexes in B.C.: Mayfair Shopping Centre in Victoria, Woodgrove Centre in Nanaimo, and Tsawwassen Mills in the Tsawwassen First Nation Lands. The deadline for binding bids on HBC is at the end this month.

Call2Recycle Canada has recognized RONA inc. as a “Leader in Sustainability” for the 13th year. The award is presented to organizations that demonstrate “an outstanding commitment to the environment and to responsible battery management.” In 2024, RONA’s stores collected 121,808 kilograms of batteries.

IKEA Canada opened a Plan and Order Point in Sherbrooke, Que., this morning. Plan and Order Points offer customers support from IKEA experts to plan their home furnishings purchases. At the Sherbrooke location, customers will get design support and access to displays of relevant IKEA products. When their designs are complete, they can be ordered for home delivery or picked up at a local pick-up point location. The Sherbrooke Plan and Order Point is the fourth in Quebec and the ninth in Canada.

|

|

|

SUPPLIER NEWS

RPM International has announced an agreement to acquire the Star Brands Group, the parent company of The Pink Stuff, for its Rust-Oleum subsidiary. Star Brands will become part of RPM’s Consumer Group. The transaction is expected to close late in the fourth quarter of fiscal 2025 or early in the first quarter of fiscal 2026. Henrik Pade and Tim North, co-managing directors of Star Brands, along with the senior management team, are expected to stay with the business to ensure continuity.

|

|

| ECONOMIC INDICATORS

In February, the total value of building permits issued in Canada rose by $371.3 million, or 2.9 percent, to $13.1 billion. Residential construction intentions declined by the same percentage to $8.4 billion. Overall, the multi-family component fell by $224.8 million, while the single-family component decreased by $22.6 million. (StatCan)

|

|

|

| NOTED

Canada’s housing crisis is exacerbated by an immigration policy that favours highly educated workers over those considered “unskilled,” a real estate developer has told CBC News. “We’re really struggling with getting the right type of workers,” said Sue Wastell, president of Wastell Homes in London, Ont. In a statement to CBC, the Department of Citizenship and Immigration said it plans to convene a council of advice to “assess the needs in the industry and advise on new pathways to bring in the skilled workers we need.”

|

|

|

| OVERHEARD

“When it comes to our industry, we’re already in a pretty major recession. The tariffs have only made it worse. Because of what’s happened, people clam up. They have job uncertainty. They have future uncertainty. Watching this gong show, the last thing they want to do is go out and make major investments.”

Peter Turkstra, owner of 11-unit Turkstra Lumber in Southern Ontario, talking to Hardlines in a soon-to-be-published Hardlines podcast.

|

|

|

|

|

TERRITORY MANAGER – British Columbia, Canada

Regal ideas is the industry leader and has become the largest and most renown brand of aluminum railing in North America and around the globe. From Inspiration to Innovation to Safety and Durability, Regal Ideas spends an extensive amount of time researching, developing and evolving its product mix to bring innovative products that inspire homeowners, contractors and architects.

Regal ideas products can be seen on many of today’s home renovation shows and continues to lead the industry with its innovation, safety, and award-winning merchandising and marketing programs.

We are excited to grow our team and are looking for a Territory Manager to service the Canadian market in British Columbia.

POSITION SUMMARY

The Territory Manager will be the driving force to increase sales across British Columbia. The successful candidate will predominantly be on the road conducting retail site visits, developing relationships with key retail partners and contractors while networking with potential new customers. The role also involves working with retailers with store set up and merchandising as well as training of new stores and staff members. In addition, you will work with the executive team in finding new opportunities that align with the corporate strategy, identify sales leads, and maintain relationships with current and new customers. This role will provide you with support to obtain new leads and drive new sales. You are innovative, creative and a team player who can lead by example in a fast-paced, deadline-driven environment.

The successful candidate has strong technical knowledge. He/she is detail oriented and can confidently support installation and client inquiries as needed. The selected candidate will report directly to the Executive Vice President and work with all facets of the company.

RESPONSIBILITIES

- Meeting quarterly and annual sales targets as set by the organization.

- Manage existing accounts, train Dealers and store staff on existing and new products.

- Weekly reporting and records updating of accounts.

- Gather competitive information and perform competitive price shops.

- Grow market share by opening up new stocking locations and converting Dealers to Regal ideas Dealers.

- Trade Show support (National and Regional), including Dealer contractor events.

- Store setup and merchandising.

- This is a remote position and requires significant travel.

- Good remuneration package.

- Participates in various departmental meetings or training as required.

- Pre-qualify potential clients with appropriate questions to establish budget, timelines, and compatibility, prepare quotations and site install meetings as required.

- Manage clients’ expectations by informing them of company processes, policies, and timelines.

- Update clients of business changes such as product offering, pricing, or inventory issues.

- Learn and promote the use of RegalONE, Regal’s internal quoting software.

- Frequent use of Regal’s internal CRM tool.

- Other duties as assigned to meet the ongoing needs of the organization.

QUALIFICATIONS AND COMPETENCIES

- 5-10 years of experience in the Home Improvement industry, preferably in the Lumber and Building Materials Category.

- Experience in territory management is preferred with strong knowledge of account management.

- Team player and self-motivated with the ability to make solid business decisions for his/her territory.

- Valid Driver’s license and have own vehicle is a must.

- Good computer skills including MS Outlook, Word, Excel, PowerPoint.

- Excellent written and oral communication skills required.

- Reliability, integrity, passion and in-person presentation skills with a strong ability to establish relationships and close deals.

- Good self-management skills.

- Exceptional, industry leading, customer service skills with a proven strength in exceeding client expectations and an ability to identify best product and fit for client needs.

- Excellent planning, coordination, and scheduling skills.

- High-energy, detail-oriented, results-driven, self-motivated individual and must be a team player.

- Must be flexible with work hours.

- Preference for this candidate to live in the territory.

Work Environment and Conditions

This is a remote position requiring majority of days out of office.

- Frequent travel required to consult with clients/dealers, conduct demonstrations, attend meetings, conferences, seminars, etc.

- Position requires set-up of displays, which involves a certain amount of physical effort.

- Frequent travel is required, often up to several hours of driving per day.

- Manual dexterity required to use desktop computer and peripherals.

- Occasional lifting of items up to 50 lbs.

- Exposure to variable weather conditions is likely.

Regal ideas support diversity, equality and a workplace free from harassment and discrimination. We are committed to providing accommodation for people with disabilities. If you require accommodation through any aspects of the selection process, please notify us and we will work with you to meet your needs.

If you wish to apply direct, please email your cover letter and resume to andrew@regalideas.com.

Thank you in advance.

Looking to post a classified ad? Email Jillian for a free quote. |

| Privacy Policy | HARDLINES.ca

The Hardlines Weekly Report is part of the Hardlines Premium Membership

Hardlines Weekly Report is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2025 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396

Steve Payne — Editor-in-Chief— steve@hardlines.ca

Geoff McLarney — Features Editor — geoff@hardlines.ca

Rebecca Dumais — Editor — rebecca@hardlines.ca

Sarah McGoldrick — Digital Editor — sarah@hardlines.ca

David Chestnut — Vice-President & Publisher — david@hardlines.ca

Shannon MacLeod — Account Manager — shannon@hardlines.ca

Michelle Porter — Sr. Marketing & Events Manager — michelle@hardlines.ca

Jillian MacLeod — Client Services Manager — jillian@hardlines.ca

Accounting — accounting@hardlines.ca

Michael McLarney — Founder & President — mike@hardlines.ca

The HARDLINES “Fair Play” Policy. Forwarding or reproduction of Hardlines content is a violation of your terms of service as a valued subscriber. Please respect our copyright! However, we DO want to reach as many people as possible at your firm or banner, so please DO enquire about our really low “extra subscriber(s)” rates. Contact jillian@hardlines.ca to get your colleagues added!

1-3 Subscribers: $545

4 -6 Subscribers: $725

7-10 Subscribers: $875

11-20 Subscribers $1,220

21-30 Subscribers $1,565

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES.

|

|

|

|