|

SUMMER PUBLISHING SCHEDULE: This is our only issue of Hardlines to be published in August. We will resume our regular schedule with our Sept. 6 edition. But never fear—the Virtual World Headquarters remains open during this time.

IN OUR SPECIAL SUMMER READING ISSUE:

In this issue, we give you more content than usual, since we’re only publishing once this month. We also encourage you to do a deep dive into this issue, as we present not just news, but trends and ideas, to help you grow your business and your professional awareness.

News

- Value of staff, pro customers will be highlighted at 25th Hardlines Conference

- Orgill opens new distribution centre in U.S. Northeast

- High-tech production simplifies installation of Owens Corning’s newest insulation

Why it matters: Staying informed sets you apart from your competitors. This is Hardlines’ mandate every week, to raise the bar in home improvement retail through industry intelligence. Learn more about the biggest education and networking event of the season, how Orgill is expanding to serve independents, and product improvements from a legacy supplier.

Governance & Human Relations

- Home Depot, a values-based company, issues sustainability report

- Lowe’s Canada’s sustainability report supports environment, communities, staff

Why it matters: ESG is the newest way companies are being assessed—and valued. It refers to a company’s operations in three areas: environmental, social, and corporate governance. These factors are guiding how Wall Street and Bay Street evaluate companies. That includes how they treat their people. Two industry leaders raise the bar in these areas.

Trends

- Will lumber prices fall anytime soon? Opinions vary

- SPECIAL REPORT: Dealers in buying groups hold their own through COVID

- Employers get creative to find new hires in a competitive job market

Why it matters: The day-to-day keeps us busy, well, day to day. But stepping back to look at the bigger picture helps round out our understanding of the industry. Here, we examine the direction lumber pricing may take and share some cool proprietary info about buying groups while sharing some strategies companies in other sectors are using to get—and keep—workers.

PLUS: stolen pressure-treated lumber as good as gold, FCL reaches new agreement with employees at its Edmonton DC, Princess Auto opens Quebec location, Grainger reports Q2 earnings, Guillevin to acquire McLoughlan Supplies, West Fraser sees Q2 sales rise, 3M earnings, Canfor enjoys increases in the second quarter, building permits rise in June, U.S. construction remains almost flat, and more!

|

|

|

|

|

|

Value of staff, pro customers will be highlighted at 25th Hardlines Conference

Retail is, above all, about people. Customers need to be looked after, but so does the retail team. That was made more evident than ever under COVID.

That’s why this year’s Hardlines Conference, Oct. 19 and 20 in Niagara-on-the-Lake, Ont., will feature speakers to address the needs of both staff and customers.

Marc Macdonald (shown here) is the senior vice-president, human resources, at Lowe’s Canada. A Certified Human Resources Professional (CHRP), he joined the company in 2017 and leads the teams responsible for talent management and acquisition, organizational transformation, labour relations, health and safety, and total compensation.

Before joining Lowe’s Canada, he was chief human resources officer at DAVIDsTEA. Prior to that, he served as VP, human resources, for Keurig Green Mountain at its Canadian, UK, and Asia-Pacific business units, and as director, human resources, for The Home Depot Canada.

Macdonald has a lot of experience taking care of a company’s people. And he needed all that experience and learning during the past 18 months, as COVID brought companies face to face with a whole new set of challenges. These included accommodating staff who were reluctant or afraid to work, supporting workers financially during a period of high stress, and even buying lunch for thousands of workers across all Lowe’s Canada’s corporate stores.

(The importance of HR has become so acute under COVID that Hardlines launched a new publication, Hardlines HR Advisor, this year. You can check it out here. Yeow! More shameless self-promotion.—your Faithful Editor)

On the customer side, one of the fastest-growing and most important sectors for Home Depot Canada is its contractor, or pro, clientele. Jamal Hamad, senior director, contractor services sales and operations pro-rental-MRO-home services, at Home Depot Canada, will talk about this all-important customer.

Home Depot Canada has been aggressively pursuing the contractor customer with new initiatives, programs, and financing initiatives. Hamad has headed up that growth, putting independents on alert as Home Depot continues to gain acceptance—and market share—among pros.

The Hardlines Conference—Canada’s only national event that welcomes all the banners and retail groups—will be held Oct. 19 and 20 at the Queen’s Landing hotel in Niagara-on-the-Lake, Ont., a destination resort just 70 minutes from Toronto. At the end of day one of the conference, we will host the Outstanding Retailer Awards Gala, recognizing the finest retailers in the country from across all banners.

In addition to Macdonald and Hamad, the conference will feature these incredible retail leaders:

- Kevin Macnab, president and CEO, Home Hardware Stores

- Doug Anderson, president and CEO, Peavey Industries

- Doug Stephens, high-powered retail consultant with Retail Prophet

- Rob Faries, Ace dealer from Moose Factory, Ont.

- Drew Green, CEO of clothing chain Indochino

- Peter Norman, economist and VP at Altus Group

We look forward to a live event in October, as vaccination rates continue to rise in Canada. Tickets will be made available as we determine final attendance numbers. And for people who cannot join us live, the conference will feature, for the first time, a virtual component so dealers and suppliers can watch our speakers and view the Outstanding Retailer Awards Gala from the comfort of their own homes or offices.

The 25th annual Hardlines Conference will be held at the Queen’s Landing resort hotel in Niagara-on-the-Lake, Ont., Oct. 19 and 20. (Click here for more info on the conference and our amazing venue!)

|

|

Orgill opens new distribution centre in U.S. Northeast

U.S. hardware wholesaler Orgill welcomed hundreds of customers, vendors, and local dignitaries to Rome, N.Y., last week to celebrate, tour, and take part in the official ribbon-cutting ceremony marking the grand opening of its newest distribution centre.

“We enjoyed the opportunity to have so many of our customers and vendor partners on hand so they could get a first-hand look at the Rome DC, see the investments we are making in our distribution network, and have the opportunity to meet our team,” said Boyden Moore, Orgill president and CEO. “This milestone in our growth is only possible because of our customers’ continued growth and our vendor partners’ continued support.”

The 780,000-square-foot Rome site is Orgill’s eighth distribution centre, joining facilities in Tifton, Ga.; Inwood, W.Va.; Sikeston, Mo.; Kilgore, Texas; Hurricane, Utah; Post Falls, Idaho; and London, Ont. The latter two locations continue to service Orgill’s Canadian customers.

Innovations in distribution technology and design that Orgill showcased during the grand opening ceremony included the latest in voice picking systems, a space-maximizing very narrow-aisle (VNA) layout, and a new, multi-tiered conveyor system. All of these features are designed to create efficiencies for the distribution team and ultimately reduce friction in receiving, picking, and fulfilling customer orders.

|

|

| High-tech production simplifies installation of Owens Corning’s newest insulation

Owens Corning manufactures fibreglass insulation, shingles and roofing accessories, as well as mineral wool and extruded polystyrene rigid insulation.

Now the company has trademarked its latest product advancement. PINK Next Gen Fiberglas insulation features advanced fibre technology, which, says OC, enables up to 23 percent faster installation compared to its existing products, while meeting the latest building codes.

This advanced technology creates a tightly woven network of soft, fine fibres to form a resilient blanket of insulating micro-pockets. With these innovations, the new product has been designed to be safe for installers and residents.

“Contractors today have high performance expectations and extremely tight timelines,” said Joe Wagner, insulation marketing director. “This product evolution is a significant step-change in meeting the needs of contractors, as well as installers, builders, and homeowners.”

In Canada, Owens Corning has two plants that manufacture fibreglass insulation, one in Toronto and one in Edmonton. It also operates a plant in Valleyfield, Que., that manufactures extruded polystyrene rigid insulation.

|

|

|

Home Depot, a values-based company, issues sustainability report

Home Depot has published its 2021 Environmental, Social and Governance (ESG) Report. The document notes Home Depot’s goal to reach 100 percent renewable electricity for its facilities by 2030.

Its latest achievements include reducing carbon emissions by more than 127,000 metric tons in 2020—a 22 percent reduction in carbon intensity—while at the same time growing the business by nearly 20 percent. The retailer also joined the Science Based Targets initiative (SBTi) to reduce global emissions, committing to set goals for emissions by 2023.

“Our commitment to reducing our impact on the planet, taking care of our people, and building strong, sustainable communities is foundational to who we are,” said Craig Menear, chairman and CEO of The Home Depot.

But good governance does not end with sustainability efforts. In fiscal 2020, the company paid approximately $2 billion in enhanced pay and benefits to front-line, hourly associates in response to COVID-19. It also paid $616 million in record success-sharing bonus payments to non-management associates.

Home Depot Canada has been doing its part as well. Over the last 10 years, the Canadian division has reduced store electricity consumption by 43 percent. In 2020 alone, electricity use in Canadian stores fell more than eight percent due to the installation of LED lighting, building automation systems, and energy-efficient HVAC systems.

“We are committed to demonstrating leadership through action. Reducing our impact on the planet is part of our core values. These improvements and initiatives will benefit our people, our communities, and our environment,” said Michael Rowe, president, The Home Depot Canada. “Sustainable business is good business that benefits the associates and customers we engage with every day.”

|

|

|

Lowe’s Canada’s sustainability report supports environment, communities, staff

Lowe’s Canada has released its 2020 Canada Corporate Responsibility Highlights. Following the release earlier this year of the company’s 2020 Corporate Responsibility Report, this document illustrates the trajectory of Lowe’s Canada’s sustainability goals.

“In 2020, our communities dealt with the many challenges brought on by the COVID-19 pandemic, and it was more important than ever for us to be there for our fellow Canadians,” Jean-Sébastien Lamoureux, senior VP, public affairs, asset protection, and sustainable development, said in an accompanying release. “We made significant investments to support both our associates and local charities providing essential services, such as health care and food aid.”

Lowe’s Canada’s 2020 corporate responsibility highlights:

- Investing $4 million in communities, including more than $1.5 million to support associates and local charities during the first wave of the COVID-19 pandemic

- Reducing GHG emissions by more than six thousand metric tons compared to 2016

- Reaching 42 percent of the target to recycle 75 percent of all waste produced at corporate sites by 2025, which represents close to 22,000 metric tons of materials

- Recycling more than two metric tons of used paint in 2020

- Offering more than 5,000 ECO-branded products instore and online

- Helping customers identify and buy local products through the Well Made Here program

The retailer’s initiatives extended to its employees in new and creative ways under COVID. Some programs, such as its ongoing investment in local communities, have amounted to a $16 million investment since 2016. Last year alone, Lowe’s Canada invested $1.5 million into supporting its associates and their communities during the pandemic.

In April, Lowe’s Canada was recognized for its sustainability efforts as part of Mediacorp’s Canada’s Greenest Employers annual competition. The contest celebrates employers that have implemented exceptional sustainability initiatives and led the way toward creating a culture of environmental awareness within their organizations.

|

|

|

Will lumber prices fall anytime soon? Opinions vary

The easing of lockdown measures has customers returning to stores, but retailers continue to face pressures on their bottom lines, according to the Globe and Mail. Transport and input costs have shot up, driven by a dearth of shipping containers worldwide as well as hot demand for raw materials.

Some retailers are taking the hit to their margins in hopes of riding out a “temporary imbalance.” Others are raising prices, thereby stoking inflation, which in May reached its highest level in a decade.

Even as prices have seen a correction over recent weeks, some believe the correction has yet to be felt by consumers. “Lumber inventories purchased at high prices remain relatively substantial among retailers,” AQMAT president Richard Darveau told La Presse.

According to Darveau, most retailers won’t want to mark down those wares until “the rebound in orders from builders and renovators to finish their high summer housing starts season,” which he added is shaping up to be strong again this year.

“Unless lumber dealers initiate sales or even ‘loss leader’ sales, especially in seasonal products such as treated lumber, I would not expect to see retail price declines as large as those seen in the major forest products futures markets,” Darveau concluded.

The state of the Canadian dollar, which has seen a 9.6 percent boost over the past year, is the one silver lining. “When the Canadian dollar is stronger, that gives them at least a small buffer,” said Retail Council of Canada CEO Diane Brisebois.

|

|

|

SPECIAL REPORT: Dealers in buying groups hold their own through COVID

The LBM buying groups are a unique beast in Canada. They have no direct parallel in other markets, like the U.S. And their operation and structure are quite distinct from large retail banners and big-box chains that make up such a large part of the U.S. market.

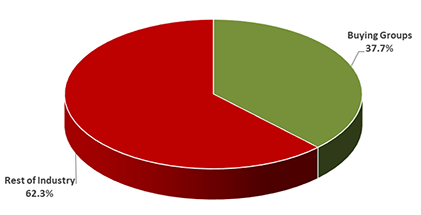

So they can be a point of puzzlement for vendors who are new to the Canadian market. But overlook them at your peril. Since 2016, buying groups have represented at least one-third of sales by the Canadian retail home improvement market—a market worth more than $50 billion in 2020. Last year, the market share of the buying groups actually grew to almost 38 percent of the overall market.

Those sales were generated by more than 2,500 independently owned outlets that are members of eight buying groups across the country.

The largest of the buying groups is Home Hardware Stores with more than $5.5 billion in retail sales (for the purposes of Hardlines’ analysis of the industry, Home Hardware’s building centre and home centre stores are treated as part of their own buying group). Next is Independent Lumber Dealers Co-operative, whose combined membership accounts for an estimated $4.4 billion. The other buying groups are, in order of size, TIMBER MART, Sexton Group, Castle Building Centres, BMR Group, Delroc Industries, and TORBSA.

These dealers were an important part of the boom that the industry enjoyed during the year of lockdowns in 2020. Many of these dealers are in smaller or secondary markets, where big box stores are not as dominant. This reflects the durability of independent dealers that make up the buying groups.

(This data is drawn from the 2021 Hardlines Retail Report. If you want to know the sales growth and market shares of all the hardware and home improvement groups in Canada, and the strategic analysis of the top players, this is the report for you. It features 190 slides and dozens of photographs and tables. For more info and to order, click here!)

|

|

|

Employers get creative to find new hires in a competitive job market

In a bid to stem the post-pandemic labour shortage, employers are offering a variety of incentives to potential workers. That can mean flexible hours, higher wages, or even signing bonuses.

This last perk is usually reserved for corporate executives or specialist workers in technology or trades. But CBC News reports that it’s becoming an increasingly common feature of want ads for positions ranging from hair stylists to call centre workers.

Marie-Hélène Budworth of York University’s School of Human Resource Management says it’s a sign that “these are desperate times” for many employers. On the other hand, some employers prefer to invest in higher overall wages rather than a one-time bonus, which Budworth says is a greater benefit to workers in the long run.

Julie Labrie, president of recruitment firm BlueSky Personnel Solutions, says salaries have gone up “drastically.” Increased paid time off, sometimes as much as four weeks of vacation is also becoming more common.

Others are thinking outside the box to lure employees. One Montreal grocer is offering bus passes and store rebates to employees. A Halifax baby boutique joined forces with neighbouring retailers to give new hires the option to combine part-time positions.

“We talked with other tenants in the mall who were also finding it really hard to attract workers,” Ivy Liu, owner of Fluffy Bottom Babies in Bedford, N.S., told the Globe and Mail. “We came up with a plan that if we find the right worker but they want full-time hours, they could work three days here and two days in another store.”

Since the pandemic’s outbreak, workers in essential services have been publicly celebrated, but material compensation has often lagged. Meanwhile, those who had worked in non-essential fields found they could earn more money staying home, thanks to programs like CERB. Now, burnout is widespread, and a looming “mass exodus” of workers has shifted the balance of power to jobseekers.

“The power swings back and forth based on market conditions and supply and demand from employer to employee,” executive recruiter Ken Stoddart told the CBC. “And right now it’s skewed towards the employee.”

Other retailers are setting their sights on younger recruits. Tristan Tremblay, 14, works at a store in Chicoutimi, Que., which includes a hardware store as well as a filling station and convenience store. “My father started working young and he wanted me to start working young too,” he explained to Le Journal de Montréal. The work, he added, is “a bit repetitive … but it’s going well.”

At the same time, some retailers are looking to the other end of the lifespan. Don Dyck is president of Kingdon TIMBER MART in Peterborough, Ont. The store used to count on Trent University students for seasonal work, but interest from that demographic has waned. Nowadays, he says, his seasonal employees are more likely to be workers later in their careers who don’t wish to work year-round.

|

|

|

Duchesne et Fils has appointed Jon Watson as Ontario sales manager. Watson has more than 10 years of experience in the building materials industry, in the window and door segment. He will oversee Dennis MacCulloch, sales representative in northern Ontario, Rob Mongraw in the east of the province, and Sean McIlravey, newly appointed in the southwest.

|

|

|

|

|

|

DID YOU KNOW…?

… that the latest episode of Hardlines’ podcast The History of Home Improvement looks at the rise and unlikely fall of Dolliver Frederick, a man who made his mark on the hardware industry in a big way before his giant hardware wholesale company went under? Click here to subscribe to the Hardlines Podcast Series for free and catch up on this and all our past episodes!

|

|

| RETAILER NEWS

A man who stole treated lumber from a Sarnia, Ont.-area TIMBER MART committed an offence akin to stealing precious metals, prosecutors told a court recently. “Some would argue that during the pandemic the theft of lumber is equivalent to the theft of gold for what they are charging for the price of wood these days,” Crown attorney David Rows submitted. Justice Deborah Austin agreed, issuing a six-month prison sentence to the 45-year-old defendant.

Federated Co-operatives Limited (FCL) reached a new four-year agreement with employees at its Edmonton distribution centre. More than 170 team members represented by Teamsters Local 987 voted 92 percent in favour of accepting FCL’s latest offer. The agreement includes improvements to benefits for all employees, expanded use of part-time employees, and increased scheduling flexibility. The agreement also includes the introduction of an alternate wage scale for new employees. This wage scale is key to sustaining FCL’s operations and the ability to serve local Co-ops across Western Canada over the long term. FCL and its union have been bargaining since the last collective bargaining agreement expired on Aug. 31, 2020.

|

|

|

Princess Auto has opened a new Quebec location, and its fourth in that province, in Lévis. It follows another opening in Saint-Hubert in May. The new store caters to tradespeople, hobbyists, home mechanics, and DIYers. Categories that set Princess Auto apart include hydraulics and surplus, in addition to an ever-expanding farm category. The privately-owned retailer now has 50 stores employing over 3,000 workers across the country.

W. W. Grainger reported its Q2 operating earnings of $334 million were up 62 percent from a year ago. Q2 earnings in 2020 had been heavily affected by losses related to Grainger’s divestment of its Fabory business. On an adjusted basis, earnings were up by six percent to $4.27 per share. Net sales of $3.2 billion represented a 13 percent increase from Q2 of 2020.

U.S. big boxes are moving to require masks for employees once again, even in states which have lifted general indoor mask mandates. Lowe’s, Home Depot, Target, and Kohls are all following the advice of the Centers for Disease Control. The agency is recommending masks indoors even for vaccinated persons, as cases of the delta variant rise. Customers are also encouraged, though not required, to mask up in-store.

|

|

| SUPPLIER NEWS

Montreal-based Guillevin, one of Canada’s largest distributors of electrical equipment, is acquiring McLoughlan Supplies Ltd. Founded in 1956, McLoughlan has branches in Newfoundland & Labrador, Nova Scotia, and Prince Edward Island. The company will continue to operate under the McLoughlan name under the leadership of Cory MacGuigan, newly appointed general manager. He was previously GM of the Charlottetown branch. All jobs will be maintained under the new ownership.

West Fraser Timber Co. saw its Q2 sales rise by 61 percent from the previous quarter to $3.78 billion. Earnings increased to $1.49 billion from $665 million in Q1. Operating earnings in the lumber segment amounted to $955 million, up from $607 million in the prior quarter.

3M Co. earned net income of $1.52 billion, or $2.59 per share, in Q2. That was up from $1.306 billion, or $2.25 a share, a year ago. Adjusted earnings of $2.59 per share beat estimates of $2.28. Sales rose to $8.95 billion from $7.18 billion, topping estimates of $8.525 billion.

Canfor enjoyed increases in its second quarter as adjusted net income reached $721.2 million. Sales of $2.5 billion were up from $1.12 billion in the previous Q2. For the lumber segment, earnings increased $393.8 million quarter-over-quarter, to an all-time high of $1 billion. Lumber prices remain at record highs, helping to buoy the growth.

|

|

|

ECONOMIC INDICATORS

The total value of building permits rose 6.9 percent to $10.3 billion in June. Seven provinces contributed to the gain, led by Ontario, which jumped 22.7 percent. Construction intentions in the residential sector were up 9.1 percent to $7.2 billion, while the non-residential sector advanced 2.2 percent. Construction intentions for single-family dwellings increased 4.7 percent to $3.4 billion. Seven provinces saw gains in this component, led by Ontario and Alberta. (StatCan)

Investment in U.S. construction was almost flat in June, but residential construction was a strong spot. Construction spending rose by 0.1 percent. Private construction, however, rose by 0.4 percent, with spending on single-family homebuilding rallying by 1.8 percent. On a year-over-year basis, total construction spending was up by 8.2 percent. (U.S. Commerce Dept.)

|

|

|

NOTED

The annual Hardlines Retail Report is now available. This powerful set of research is a marketer’s dream. If you want to know the sales growth and market shares of all the hardware and home improvement groups in Canada, and the strategic analysis of the top players, this is the report for you. It features 190 slides and dozens of photographs and tables. (For more info and to order yours, click here!)

The Home Depot puts a priority on taking care of its people. That includes furthering efforts to promote diversity, equity, and inclusion. In 2020, its U.S. hires were 35 percent female and 53 percent ethnically and racially diverse. The company was recently recognized as one of Forbes’ Best Employers for Diversity.

The RCC STORE Conference, Sept. 13 to 16, brings Canada’s most influential retail leaders, world-renowned visionaries, and passionate entrepreneurs together to discuss critical topics affecting retail. (See the full agenda here!)

|

|

|

OVERHEARD…

“Technology, innovation, and capacity are all factors that drive our distribution efficiencies at a facility like Rome, but ultimately, all of these investments are designed to help us better serve our customers and help them make their businesses more successful.”

—Randy Williams, Orgill’s executive vice president of distribution, on the recent grand opening of the hardware wholesaler’s eighth DC.

|

|

|

|

|

|

|

|

|

| Classified Ads

|

|

|

Looking to post a classified ad? Email Michelle for a free quote. |

|

|

|

| Privacy Policy | HARDLINES.ca

HARDLINES is published weekly (except monthly in December and August) by

HARDLINES Inc.

© 2020 by HARDLINES Inc.

HARDLINES™ the electronic newsletter www.HARDLINES.ca

Phone: 416.489.3396; Fax: 647.259.8764

Michael McLarney — President— mike@hardlines.ca

Christina Manocchio — Editor— christina@hardlines.ca

Geoff McLarney — Assistant Editor— geoff@hardlines.ca

David Chestnut — VP & Publisher— david@hardlines.ca

Michelle Porter— Marketing & Events Manager— michelle@hardlines.ca

Accounting — accounting@hardlines.ca

The HARDLINES “Fair Play” Policy: Reproduction in whole or in part is very uncool and strictly forbidden and really and truly against the law. So please, play fair! Call for information on multiple subscriptions or a site license for your company. We do want as many people as possible to read HARDLINES each week — but let us handle your internalrouting from this end!

1-3 Subscribers: $495

4 -6 Subscribers: $660

7

-10 Subscribers: $795

11-20 Subscribers $1,110

21-30 Subscribers $1,425

We have packages for up to 100 subscribers!

For more information call 416-489-3396 or click here

You can pay online by VISA/MC/AMEX

at our secure website, by EFT, or send us money. Please make cheque payable to HARDLINES. |

|

|

|